When financial security meets the speed of innovation, who should define the future of stablecoins?

Hong Kong vs. United States

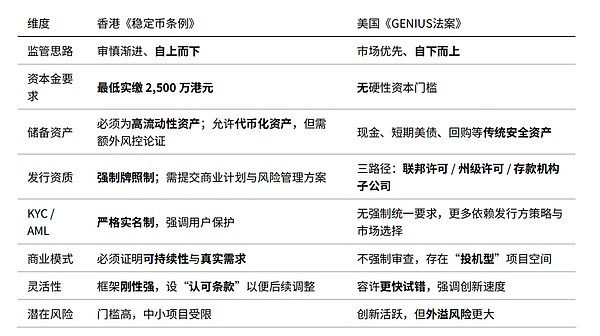

On August 1, 2025, the Hong Kong “Stablecoin Ordinance” officially came into effect, establishing the world’s first regulatory framework specifically targeting fiat-anchored stablecoins, reflecting the “prudent and gradual” regulatory style: high capital threshold, strict reserve requirements, KYC real-name system, and review of the sustainability of business models.The GENIUS Act, the US “GENIUS Act”, adopts the idea of ”market first”, does not set rigid capital requirements, has diversified issuance paths, and relies more on market screening and user selection.

Understand one picture: Comparison of core terms

Regulatory portrait: the underlying logic of two paradigms

Hong Kong: Construction of a system that takes “trust” first

Objective: Investor protection, systematic stability, and mutual recognition of cross-border compliance.

Means: high capital threshold, reserve authenticity and liquidity, strong KYC, and business model sustainability review.

The results are expected: the number of issuances is smaller but the quality is higher, and the license becomes a “trust endorsement”.

United States: A competitive experiment that takes “market” first

Goal: Encourage competition and diversity, and the survival of the fittest is achieved by the market.

Means: diversified issuance path, fewer hard indicators, and mainly disclosure and market discipline.

Results are expected: projects are richer and iterate faster, but risk governance depends more on issuers and markets.

Who is more suitable for which model?

Compliance funds / Financial institutions / Large Internet: Positive to Hong Kong – Compliance costs are high but institutional trust dividends can be obtained.

Early entrepreneurial teams / Exploration of new mechanisms (such as RWA+ programmatic currency): leaning towards the United States – with large trial and error radius and fast new launch speed.

Cross-border payment and e-commerce: The Hong Kong route is conducive to cooperation between banks and payment license institutions; the US route is conducive to the developer ecosystem and the spread of the C-end.

Specific impact on the industrial chain

To the issuer

Hong Kong: Funding and audit deployment are required; compliance demonstration and on-chain disclosure mechanisms for tokenized reserves are considered.

United States: Pay attention to liquidity management and transparency disclosure, and optimize compliance costs between different state/federal paths.

For exchanges/wallets/payment institutions

Hong Kong: Strong KYC and list screening have become standard; cooperation with local licensed institutions is more critical.

United States: Multi-asset access, on-chain risk engines and user education are moats.

Reserve management and audit

Hong Kong: Daily reconciliation + regular audit + stress test.

United States: Disclosure-driven, audit frequency and scope are more determined by issuer and market standards.

Risk and opportunity coexist

Threshold vs Vitality: Hong Kong’s high thresholds raise the industry’s average quality and may also curb long-tail innovation; the US’s vitality brings higher spillovers and compliance uncertainty.

Cross-border mutual recognition: Whoever can first establish compliance mutual recognition with major jurisdictions will gain the global settlement network effect.

Trust Engineering: The “product power” of stablecoins is not only minting and redemption, but also transparency, auditability and risk control automation.

Conclusion: Finding the optimal solution between “trust” and “openness”

Hong Kong and the United States have shown two completely different regulatory paths: Hong Kong focuses on compliance, safety and sustainability, emphasizing the stability of licenses and reserves; the United States is guided by market-driven and competitive experiments, encouraging diversification and rapid iteration.The two models have their own advantages and risks – the former guarantees the stability of the system, but may inhibit innovation; the latter stimulates vitality, but is also accompanied by spillover and regulatory uncertainty.

Ultimately, the global stablecoin landscape depends on who can find the balance first: it can not only win the trust of users and institutions, but also maintain the openness and vitality of the market.This not only concerns the future of financial innovation, but also determines the direction of cross-border payments, digital assets and global financial infrastructure.