Author: Jacob Zhao, Mirror

The crypto market has been lackluster recently, and conservative and steady returns have once again become market demand. Therefore, based on my investment experience in recent years and the concentrated research results of the stablecoin field at the end of last year, let’s talk about the ancient but evergreen topic of stablecoin returns.

The current stablecoin categories in the crypto market are mainly the following categories:

-

USDT, which is conditionally compliant but has the highest market share: the application scenarios are wide enough (exchange currency trading pairs, crypto industry company salary payments, real international trade and offline payment scenarios), users rely on big hopes and cannot fail and Tether has the ability to provide a guarantee.

-

Compliant stablecoins anchored with fiat currency 1:1: USDC has the most chain and application scenario support, which is the real on-chain USD, and other compliant stablecoins such as PayPal USD, BackRock USD, have certain limitations.

-

Over-collateralized stablecoins: Mainly made of MakerDAO’s DAI and its USDS after being upgraded to Sky Protocol; Liquity’s LUSD has become one of its competitors with a 0-collateralized loan interest rate and a low pledge rate of 110%.

-

Synthetic Asset Stablecoins: This cycle is most representative of the phenomenal Ethena USDe.The model of obtaining profits by capital rate arbitrage is also one of the stablecoin income models that will be analyzed later in this article.

-

The underlying assets are US Treasury stablecoins: Usual’s USD0 and Ondo’s USDY are the most representative in this cycle.Usual’s **USD0++** provides liquidity for US bonds, similar to Lido, which is innovative to ETH Staking.

-

Algorithm stablecoin: After Terra’s UST collapse, the track was basically falsified. Luna lacks real value support. The token price fluctuates violently. After the death spiral of plunging sell-off and plummeting, it finally collapsed.There are still some application scenarios for FRAX collective algorithm stablecoins and over-collateralization models, while the rest of the algorithm stablecoins no longer have market influence.

-

Non-USD stablecoins: Euro stablecoins (Circle’s EURC, Tether’s EURT, etc.) and other fiat stablecoins (BRZ, ZCHF, round coin HKDR, etc.) currently have little impact on the stablecoin market dominated by the US dollar. The only way for non-USD stablecoins is to pay services under the compliance regulatory framework rather than to be applied to the native crypto community.

Currently, the types of models that obtain profits through stablecoins are mainly the following categories. This article will further analyze each category of profits in detail:

1. Stablecoin lending (Lending & Borrowing):

As the most traditional financial income model, lending essentially comes from the interest paid by the borrower. It needs to consider the security of the platform or agreement, the probability of default of the borrower and the stability of the income.Stablecoin lending products currently on the market:

-

Cefi platform mainly focuses on current financial products from leading exchanges (Binance, Coinbase, OKX, Bybit)

-

The top Defi protocols are mainly Aave, Sky Protocol (MakerDAO upgraded brand), Morpho Blue, etc.

The platform security and top Defi protocols of top exchanges that have experienced the test of cycles are relatively high. During the rising market period, U current returns can easily soar to more than 20%, due to the strong demand for lending, but the general returns during the market period are low and maintained at 2%-4%. Therefore, the current lending rate (Flexible Interest) is also a very intuitive market activity indicator.Fixed Interest lending has earned more than current returns due to liquidity sacrifice, but it cannot capture the surge in current returns during market active periods.

In addition, there are some micro-innovations in the overall stablecoin lending market, including:

-

Fixed-interest rate lending Defi Agreement: The Pendle Agreement, which is a representative cycle, started with fixed-interest rate lending and was formed in income tokenization. This article will be introduced in detail later; although early fixed-interest rate Defi projects such as Notional Finance and Element Finance have not successfully emerged, their design concepts are worth referring to.

-

Introduce the Rate Tranching and Subordination mechanism in lending;

-

Provide the Defi protocol that is Leveraged Lending;

-

Defi lending agreements for institutional clients, such as Maple Finance’s Syrup earnings are derived from institutional lending.

-

RWA puts the benefits of real-world lending businesses on the chain, such as Huma Finance’s on-chain supply chain financial products.

In short, lending business is the most traditional financial income model, and the largest amount of funds will continue to be the most important stablecoin income model.

2. Yield Farming income:

Represented by Curve, its income comes from the handling fees and token rewards distributed to LP by AMM transactions.As the holy grail of the stablecoin DEX platform, Curve has become a stablecoin supported in Curve Pools and has become an important indicator to measure the adoption of new stablecoins in the industry.The advantage of Curve mining is that it has extremely high security but insufficient returns are too low and lacks attractiveness (0-2%). If non-large and long-term funds participate in Curve’s liquidity mining, the returns may not even cover the transaction Gas Fee.

Uniswap’s stablecoin pool trading pairs face the same problem. Uniswap’s non-stablecoin trading pairs have the possibility of liquidity mining losses, while other stablecoin pool trading pairs with smaller scale DEXs still have Rug Pull concerns even if the returns are high, which do not conform to the principle of prudent and stable financial management of stablecoin.We can see that the Defi stablecoin pool is still mainly based on the lending model, and Curve’s most classic 3Pool (DAI USDT USDC) is only in the top 20 TVL.

3. Market neutral arbitrage returns:

Market-neutral arbitrage strategies have been widely used in professional trading institutions for a long time. By holding long and short positions at the same time, the net market exposure of the investment portfolio is close to zero.The main ones in Crypto are:

-

Funding Rate Arbitrage: Perpetual Futures has no expiration date, and its price is consistent with the spot price through the Funding Rate mechanism.Funding rates need to be paid regularly to shorten the short-term price difference between spot and perpetual contracts.

-

When the price of a perpetual contract is higher than the spot price (premium), long pay shorts and the capital fee rate is positive.

-

When the price of a perpetual contract is lower than the spot price (discount), the short pays the long and the capital fee rate is negative.

-

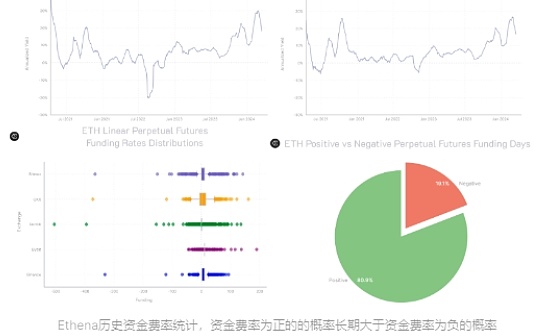

According to historical retracement data, the probability of a positive capital rate being greater than the probability of a negative capital rate being long-term.Therefore, the source of income is mainly spot buying in positive capital rate scenarios, short selling of perpetual contracts, and long-paid fees.

-

Spot and futures arbitrage: Spot and futures arbitrage takes advantage of the price difference between the spot market (Spot) and the futures market (Futures) to lock in profits by hedging positions.The core concept is **”Basis”**, that is, the difference between the futures price and the spot price.Usually operates in a premium (Contango, futures price is higher than spot) or discount (Backwardation, futures price is lower than spot) market.Futures and Spot arbitrage is suitable for investors with large amounts of funds, can accept lock-in periods and are optimistic about the convergence of the basis, and is commonly found in traders with traditional financial thinking.

-

Cross-exchange brick-moving arbitrage: Using price differences between different exchanges to build neutral positions is the early mainstream arbitrage method in the Crypto industry. However, the current price difference between mainstream trading pairs is already extremely low, and they need to rely on automated brick-moving scripts and are more suitable for high-volatility markets and small-cap coins. The threshold for retail investors to participate is high, so you can refer to the Hummingbot platform.

-

In addition, there are arbitrage models such as triangular arbitrage, cross-chain arbitrage, and cross-pool arbitrage in the market. This article will not provide additional extensions.

The market-neutral arbitrage strategy is extremely professional, and most of the audience is limited to professional investors.The emergence of this cycle of Ethena will move the mature model of “Funding Rate Arbitrage” to the chain, and ordinary retail users can participate.

Users deposit stETH in the Ethena protocol and receive USDe tokens of equivalent value. At the same time, they open equal value short orders on centralized exchanges to earn positive capital rates. According to historical statistics, more than 80% of the time is positive capital rates and negative capital rates, Ethena will make up for losses through reserves; Ethena protocol **held capital rates of more than 65% of the revenue hedging capital rates in addition to some Ethereum staking, on-chain or exchange lending income (35%) as supplementary income; in addition, user assets are entrusted to third-party custodian OES (Off Exchange Settlement)** and regularly issue audit reports, effectively isolating the exchange platform risks.

Regarding Ethena’s risk thinking, apart from the uncontrollable factors of the project party such as accidents between the exchange platform and the custodial institution, smart contract security issues or anchored asset decoupling, the more important core point is “losses in the long-term negative capital rate scenario and the reserved funds of the agreement cannot be covered”. According to the historical data drawdown, we can understand that the probability is low. Even if it occurs, it means that the “fund rate arbitrage” trading strategy that is generally applicable in the industry has failed.Therefore, under the premise that the team does not do evil, the Ethena protocol will not have a death spiral pattern of Terra algorithm stablecoins, but it is possible that the high yield of token subsidies will gradually decline and return to the normal arbitrage yield range.

At the same time, we have to admit that Ethena has made the greatest data transparency, and can clearly query historical returns, capital rates, positions on different exchanges and monthly custodial audit reports on the official website, which is better than other capital rate arbitrage products on the market.

In addition to Ethena’s “fund rate arbitrage” model, Pionex Exchange also has stablecoin financial products with the “term arbitrage” model.Unfortunately, apart from Ethena, there are currently not many market-neutral arbitrage products that retail customers can participate in at a low threshold.

4. US Treasury Bills

The Fed’s interest rate hike cycle from 2022 to 2023 pushes the US dollar interest rate to more than 5%. Even though it has turned to a gradual reduction in interest rates, the US dollar interest rate of more than 4% is still a rare asset target in the traditional financial industry that takes into account high security and high returns.RWA business has high compliance requirements and heavy operation model. US bonds, as a standardized target of high transaction volume, are among the few RWA products with business logic.

Ondo, which has US bonds as its underlying asset, has USDY for non-US general retail customers and OUSG for US institutions with US institutions with USDY returns of 4.25%. It is the number one in the RWA track in multi-chain support and ecological applications, but in terms of regulatory compliance, it is slightly insufficient compared to the FOBXX and BlackRock BUIDL launched by Franklin Templeton; while the Usual agreement, which emerged in this round of cycles, has added liquidity tokens USD0++ on a basket of US bonds as underlying assets, similar to Lido’s pledge to Ethereum, providing liquidity for 4-year locked US bonds, and can participate in stablecoin liquidity mining or lending pool to obtain additional returns.

It should be noted that the returns of most US Treasury RWA projects are stable at around 4%, while the higher returns of the Usual stablecoin pool are mainly due to speculative additional returns such as Usual token subsidies, Pills (Point) incentives, liquidity mining, etc., are not sustainable. As the most complete US Treasury RWA projects with the Defi ecosystem, they will still face the risk of slow decline in returns but not storm in the future.

Although the price decoupling and selling incidents caused by the adjustment of the redemption mechanism of USD0++ in early 2025 are the root cause of its bond attributes and misalignment of market expectations and governance mistakes, its liquidity design mechanism is still worthy of reference for other US bond RWA projects as an innovation in the industry.

5. Option structured product (Structured Product)

The structured products and dual currency strategies currently popular in most centralized exchanges originate from the Sell Put or Sell Call strategy of “selling options to earn premiums” in option trading.The U-standard stablecoins are mainly Sell Put strategies, and the returns come from the option bonus paid by the option buyer, that is, earning stable USDT option bonus or buying BTC or ETH at a lower target price.

In practical practice, the option selling strategy is more suitable for range fluctuations. The target price of Sell Put is the lower limit of the fluctuations and the target price of Sell Call is the upper limit of the fluctuations. For unilateral rising markets, the return on options and funds is limited and it is more appropriate to choose Buy Call; for unilateral falling markets, Sell Put is easily a state of continuous losses after buying halfway up the mountain.For newbies who sell options, they are prone to fall into the trap of pursuing short-term “high option bonus returns” and ignoring the risk exposure caused by the sharp decline in the currency price. However, setting the target price too low, and the option bonus returns lack sufficient attractiveness.Combined with the author’s years of options trading, Sell Put strategy mainly sets a lower buying target price operation when the market is in decline and panic is spreading to earn high option bonuses, while the yield on current lending on the exchange during the market is more considerable.

As for the Shark Fin principal protection strategy popular on exchanges such as OKX recently, the Bear Call Spread strategy (Sell Call charges option funds + higher exercise price Buy Call limits the increase) + Bull Put Spread (Sell Put charges option funds + lower exercise price Buy Put limit the decline) allows the entire option combination to earn option funds within the range, and buy and sell options outside the range to compete with each other without additional returns. It is a suitable U-standard financial management solution for users who focus on principal safety but do not pursue the maximization of option funds or currency standard returns.

The maturity of on-chain options remains to be developed. Ribbon Finance once became the top option vault agreement in the last round of cycles. Top on-chain options trading platforms such as Opyn and Lyra Finance can also manually trade option funds strategies, but now it is no longer in its glory.

6. Yield Tokenization

The Pendle Agreement, which is a very representative cycle, started with fixed-rate lending in 2020 and was formed in 2024’s income tokenization. By splitting income assets into different components, users can lock in fixed income, speculate future returns or hedge income risks.

-

Standardized yield tokens SY(standardized yield tokens) can be split into main token PT and yield token YT

-

PT (Principal Token): represents the principal part of the underlying asset. The underlying asset can be redeemed at 1:1 when it expires.

-

YT (Yield Token): represents the future income part, decreasing over time, and the value returns to zero after maturity.

Pendle’s trading strategies are mainly:

-

Fixed Income: Holding PTs can get fixed income when maturing, suitable for risk aversion.

-

Earnings Speculation: Buy YT Bets for future earnings, suitable for risk-loving people.

-

Hedging risk: Sell YT to lock in current returns and avoid market decline risks.

-

Liquidity offers: Users can deposit PT and YT into the liquidity pool to earn transaction fees and PENDLE rewards.

The stablecoin pool it currently promotes, in addition to the native returns of the underlying assets, also has incentive measures such as YT speculative returns, LP returns, Pendle token incentives, and Points, which make its overall yield considerable.One of the shortcomings is that Pendle’s high-yield pool has a relatively medium- and short-term maturity, and cannot operate once and for all like Staking or liquidity mining or lending pools. It requires frequent on-chain operations to replace the revenue pool.

7. A basket of stablecoin income products:

As the leading protocol of Liquid Restaking, Ether.Fi actively embraces the transformation of product after the Restaking track enters a saturated downward trend, launches many revenue products in BTC, ETH and stablecoins, continuing to maintain its leading position in the entire Defi industry.

In its stablecoin Market-Neutral USD pool, it provides users with a basket of stablecoin income products such as ** lending interest (Syrup, Morpho, Aave), liquidity mining (Curve), capital rate arbitrage (Ethena), income tokenization (Pendle)** in the form of active management funds.For users who pursue stable chain returns, insufficient capital volume and are unwilling to operate frequently, it is a way to take into account high returns and diversify risks.

8. Stablecoin Staking Pledge Income:

Stablecoin assets are not POS public chains such as ETH that have staking attributes. However, the AO network launched by the Arweave team has accepted on-chain staking from stETH and DAI in the token Fair Launch issuance model, and DAI staking has the highest AO income fund efficiency.We can classify this stablecoin pledge model as an alternative stablecoin income model, that is, earn additional AO token rewards on the premise of ensuring the security of DAI assets, and its core risks lie in the development of the AO network and the uncertainty of token prices.

To sum up, we summarize the mainstream stablecoin income model in the current crypto market as shown in the above table.Stablecoin assets are the most familiar but easiest market for crypto market practitioners. Only by understanding the source of income of stablecoins and then allocating them reasonably can we more calmly deal with the uncertain risks of the crypto market on the basis of the stable financial cornerstone.