Author: Helen Partz, Cointelegraph; Compilation: White Water, Bit Chain Vision Realm

The cryptocurrencies have achieved great success in 2024. In December, the circulation reached the highest level of history, exceeding 200 billion US dollars.

Stable coins -cryptocurrency designed to imitate currency value, the most common is the US dollar -an indispensable part of the encrypted ecosystem, accounting for 5%of its market value.

With the approach of 2025, this article summarizes the industry’s prediction and prediction of the main trend of stable currency next year.

The next stop is 300 billion US dollars: USDT and USDC will remain dominant

A number of industry executives and founders said that Tether’s USDT and Circle’s USD Coin (two maximum stablecoins calculated based on market value) are likely to maintain a dominant position in 2025.

Guy Young, the founder of the decentralized stabilization coin protocol Ethena, predicts that USDT will continue to become the largest stablecoin next year, and the total market value of the stablecoin will rise to $ 300 billion.

“I expect our circulation to exceed 300 billion US dollars, and Tether will continue to dominate with its existing moat, and the rest of the market will be challenged by the new fintech and web2 enters and its own products,” Young pointed out.

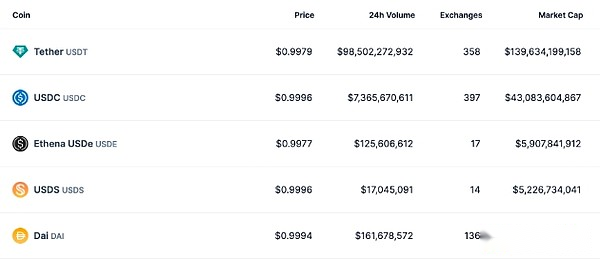

As of December 24, the top five stablecoins ranked by the market value.Source: Coingecko

Ailona Tsik, chief marketing officer of Alchemy Pay, said that stablecoins such as USDT and USDC “have become an important tool for global transactions, and their adoption in emerging markets and decentralized applications may accelerate.”

“Stable coins supported by legal currencies such as USDT and USDC may maintain their dominant position because they have established reputation, liquidity, and extensive users and corporate ecosystems that rely on them.”

USDC’s partner Coinbase stated in its 2025 outlook that the stablecoin “has just started”,Some analysts predict that these tokens may increase to a $ 3 trillion market in the next five years.

Stable currency payment: VISA expects stable currency card demand will surge

CUY SHEFFIELD, director of VISA cryptocurrency, pointed out that the adoption of stablecoins can achieve modernization and simplification of global payment, but the existing stable currency consumption opportunities are still limited.

“If 2024 is a year when the demand for stable currency is rebounded, then 2025 will bring the next key opportunity: the rise of stable currency hook cards,”Sheffield said.

“By 2025, as the wallet hopes to use the stable currency to use and issue a stable coin linked card, this demand will only increase.”

He said that VISA will expand its function so that the issuer can use stablecoin to directly linked to the stable coin card with the payment giant.

Simon MCloughlin, CEO of the encrypted platform UPHOLD, also increased optimistic about the adoption rate of the coming year.

“2025 will be a year when stabilization currency enters the mainstream as an international payment tool,” Mcloughlin said.He focused on the new type of stablecoin for cross -border settlement, such as Ripple USD (RLUSD) of Ripple Labs, which started trading on December 17.

Ripple began to transfer RLUSD on the exchange on December 17.Source: Ripple

Bill Zielke, Chief Marketing Officer of BitPay, said that although the stablecoin accounted for only 5%of all transactions, by 2024, it accounted for at least a quarter of the transaction volume of the encrypted payment platform.

“Although the average BTC’s average BTC transaction value is slightly higher than $ 1,000, the average USDC transaction exceeds $ 5,000,” he said.

“We predict that as stable coins further consolidate its role in global business and enterprises in enterprise payment, this trend will continue until 2025,” Zielke added.

Differential supervision and the needs of the consistent system will continue to exist

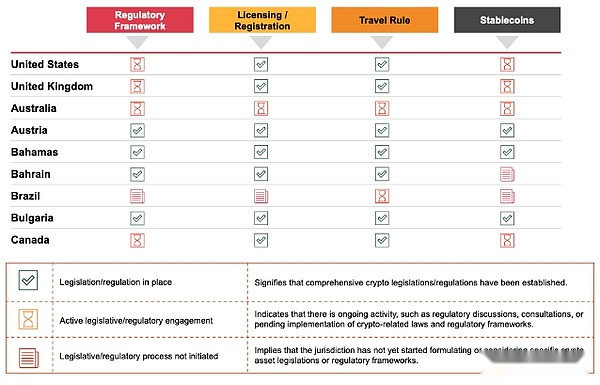

Although many people are optimistic about the growth of stable currency in 2025, the supervision of stablecoin globally is still inconsistent.

Alchemy Pay’s TSIK said:“We foresee that one of the main challenges facing stablecoin in 2025 is to deal with the changing regulatory environment.”

Ben Reynolds, the person in charge of Bitgo stabilized currency, said,Before the legislators provide clear guidance, the demand for regulatory uncertainty and improving transparency will still be a major challenge in 2025.

The “List of Encryption Supervision” in Pwa Yongdao 2023.Source: PricewaterhouseCoopers

True Markets founder Vishal Gupta pointed out,The legal environment of stable currency “will still face the problem of low efficiency and fragmentation, because the regulatory system will be inconsistent.”

He mentioned the European Union’s introduction of global regulatory differences caused by the introduction of specific stable currency rules, especially the encrypted asset market supervision (MICA).

“Regulatory differences may bring opportunities in areas with clear and balanced rules, but are also challenged in areas with too complex or strict regulations,” GUPTA said.

As the United States elected President Donald Trump in January, companies such as Bitpay hope that the supervision methods of stable coins and encryption markets will be clearer and consistent.

2025 Stablecoin Trends: L2, benefits and interoperability

Many industry executive forecasts,Next year, stable coins will be further developed in the second floor (L2), income and interoperability.

BitPay’s Zielke said that the use of L2 stable coins on the Internet such as Arbitrum, Optimism, and Base will become one of the largest development areas of the 2025s.

Tether CEO Paolo Ardoino said“Stabilization will become the most important currency technology in the next decades, and blockchain and L2 will be integrated.”

Bitgo’s Reynolds predicts that next year will promote greater interoperability between blockchain, so that stable currency can be seamlessly transferred in the cryptocurrency field. TRUE Markets Gupta pointed out that this will unlock the new “new retail and institutional market markets new in the institutional market market.Use case “.

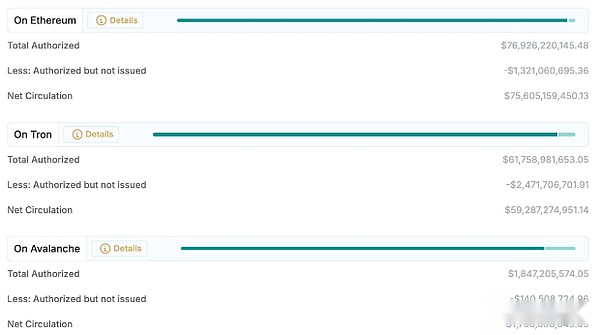

Ethereum, TRON and Avalanche are the three major networks of USDT.Source: testher

As L2 and interoperability are becoming more and more widely used, the stabilization currency industry may also see more stablecoin solutions that generate income in 2025.

Azeem Khan, chief operating officer of Ethereum L2 platform Morph, emphasized that stable coins such as PayPal USD only need to hold stable coins to provide revenue rewards.Bitgo and other companies also launched a stablecoin of income in 2024.

“There will be other stablecoins that generate income to enter the market, seek to get more holders, and find the way to add them as the payment option,” Khan said.

The risk of “Exotic” stable currency

True Markets GupTa said that as the demand for stable currency income increases, the “Exotic” stablecoin (that is, a stable currency designed to provide higher returns) will increase.

“The pursuit of higher returns may lead to the generation of‘ Exotic ’stabilizer. These stablecoins actually act as structured financial products and hide risks that retail users may not be fully understood,” he added.

GUPTA warned that retail investors may be seduced by the promise of higher returns without fully grasping relevant risks, which may lead to major losses.

“Industry participants must give priority to transparency, detailed risk disclosure and education of retail users. Regulatory agencies should formulate clear standards to protect consumers while maintaining room for innovation.”