Author: Yashu Gola, Cointelegraph Translation: Shan Ouba, Bitchain Vision

According to technical and fundamental indicators, the price of Solana may usher in a sharp rise before March.

SOL price may break through the “Niu Qi”

As of January 18, SOL’s price is testing the upper trend line of the Niu Qi form.

The bull market flag shape is a continuous mode of bullish bullish. Its feature is that the price is moved in the downward channel (flag shape) after the strong upward trend (flagpole).They usually resolve at the upper trend of the price breakthrough and rise to the height of the flagpole.

Therefore, Solana is expected to break through the trend line above the flag shape by March, reaching 194 US dollars, an increase of about 80%from the current price level.

>

On the contrary, the callback from the top trend may fall the price of SOL to the lower trend line close to $ 80.

Nevertheless, cryptocurrencies may have some accumulation and horizontal price trends at the 50 -day index moving average (50 days; 50 days EMA; red waves) near $ 87. The area has always been a long -term support area.The possibility of staying in the flag -shaped range is intact.

Hot discussion on Solana ETF

The approval of the Bitcoin spot ETF on January 11 has aroused the hope of the industry’s hope for the future of other cryptocurrencies including Solana.

Franklin Dempton is a trillion -dollar asset management company. After praising the progress of the blockchain in decentralized finance, infrastructure, irreplaceable token innovation, and MEMECOIN, it further promoted the wave of Solana ETF.The company has provided the spot Bitcoin ETF product of the same name, and the stock code is (EZBC).

The expectation of the spot Solana ETF may promote SOL prices soaring, similar to the rise of Bitcoin before its ETF was approved.

Federal Reserve interest rate cut forecast

The expectations for the Federal Pigeon may further push the price of Solana in the next few months.

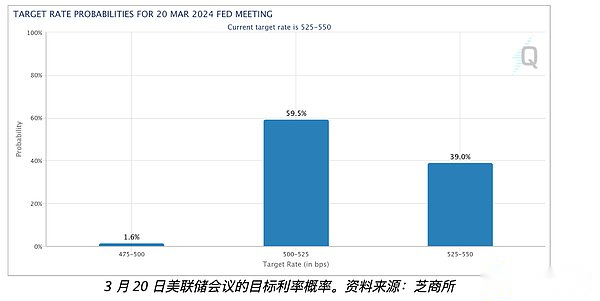

CME’s Federal Reserve Futures Fund interest rate prediction believes that by March 2024, the possibility of 25 basis points at the US interest rate cuts is 59.5%.

>

With the decline in asset yields for US dollars, lower interest rates may lead to weakening the US dollar.Cryptocurrencies like Solana are usually priced in the US dollar. As the US dollar weakens, its value may increase.

The technical settings of the US dollar index (DXY) indicate that the selling period will appear in the next few days.It is worth noting that since December 2023, it has been forming a rising wedge -shaped mode. Its downward target is between 101.50 and 102.25, depending on the breakthrough point, as shown in the figure below.

>

Therefore, the continuous correlation between Solana and the US dollar should also increase the possibility of SOL’s significant rise in March.