Author: 0xloki, ABCDE researcher source:@Loki_zng

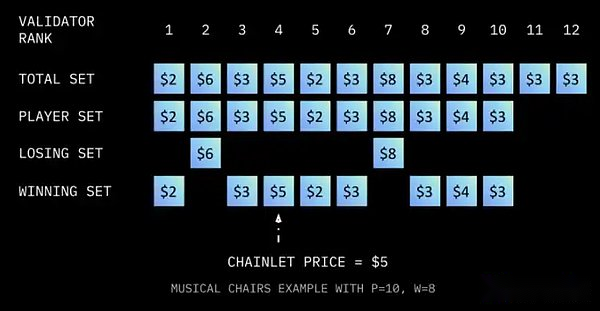

The essence of the SAGA business model is to distribute block space for downstream demanders. A key issue involved is how to pricing. SAGA uses a unique “music chair pricing” for:

(1) Assuming that there are A = 12 verifications in the initial state, SAGA hopes to choose 8 from it for commission verification;

(2) First of all, SAGA selected a certain number of verifications from the pledge rate ranking to enter the bidding link, such as P = 10, then the authentication of the 11th and 12th ranking will be eliminated;

(3) In the next 10 verificationrs, the quotation is quoted, and the quotation is sorted according to the quotation from low to high. 8 of them are selected as the commissioned verification.Verifications on No. 2 and 7 were eliminated, and the remaining eight verifications were shortlisted, and they agreed to pricing at $ 5.

>

This mechanism looks very complicated, but it can achieve a goal: provides as cheaper block space (or effective pricing) as possible through the internal volume.

The above case is an example. If the verifications want to get a reward, they must ensure that they enter the top 8.The first step needs to ensure that your pledge is sufficient, which is a bit similar to the past super nodes of EOS. There are significant differences in rewards 21 and 22.

The second step is to be shortlisted by quotation.Instead of the perspective of a single node, the quotation is 0.01 and the offer is $ 5, the final order price is 5 US dollars, but the $ 5 needs to be eliminated at the risk of being eliminated, so it is as low as possible.

But gradually, most of the verificationrs will find that this is an endless inner roll, and the price is gradually cheaper to 0. So if you consider the cost of the verification (including the opportunity cost of the tokens), a more secure way is to report a slightly slightly a little bit of a slightly stable way to report a slightly slightly slightly sterile way.The price higher than your own cost.Therefore, in the actual process, the pricing will be close to [cost + a small amount of profit], and it will be in a very low range for a long time. In this process, high -cost verifications will be constantly eliminated.

It can be seen below that after the upgrade of Cancun, ETH L2 is much cheaper, but it is still not cheap enough, especially for Solana.From a technical perspective, we need security such as BTC/ ETH, but from a business perspective, large -scale applications can indeed unable to bear the transaction cost of 0.1U/ pen, so “extremely low and stable costs” are very meaningful.

In addition, SAGA’s charging model is also different from other public chains. Users do not need to pay the network fee directly. The application can determine the charging method by themselves (such as subscription system, buyout, advertising charges and even completely free).The business model is more flexible.

>

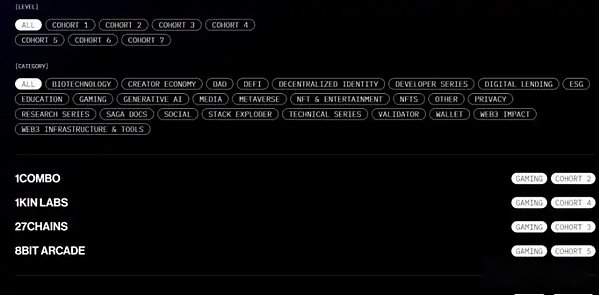

Another interesting thing is that Saga’s incentive test network SAGA PEGASUS currently has hundreds of agreements. As of April 1, 2024, the plan includes 350 projects.80% of these projects are games.About 10% of the projects are NFT and Entertainment, and 10% are DEFI.This data also reflects consistency with the economic model -SAGA is more suitable for light assets, high users, and high users.

>

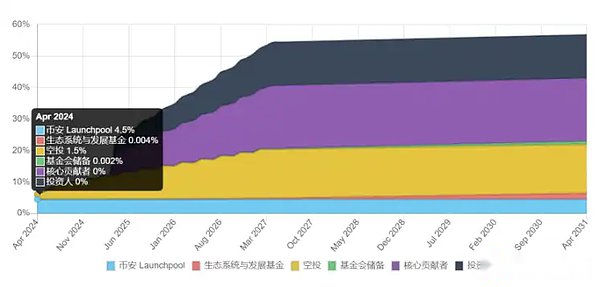

Finally, it is necessary to pay attention to tokens allocation. According to the information released by Binance, the initial circulation is only 4.5% of Launchpool and 1.5% of the airdrops, and the ecosystem and foundation share can be basically ignored:

(1) 75% chip Binance Launchpool, the throwing pressure is very limited;

(2) A total of 15.5% airdrops were only issued by 1.5%, which is likely that there are many wheels in the back. Considering that there are hundreds of items on the incentive test network (may be issued).(Especially pledge)

>

Saga details: https://binance.com/zh-cn/research/projects/saga