A new report by Bitcoin technology and financial services company River predicts that some U.S. companies will increase their investment in Bitcoin (BTC) in the next 18 months.

American company entry

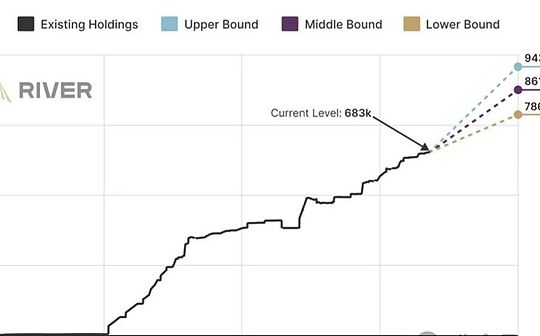

It is reported that about 10% of U.S. companies are expected to convert 1.5% of their treasury reserves (about $10.35 billion) into bitcoin within the next year and a half.

River analysts also noted that traditional corporate financial strategies rely on cash and other short-term cash equivalents, and these assets have poor storage capacity.For this reason, River’s analysis believes that:

“These investments can produce modest returns close to the federal funds rate (currently over 5%). However, even these short-term investments often fail to outperform inflation, reducing the value of Treasury bonds.”

The report notes that inflation erosion also caused Apple (currently a trillion-dollar market capitalization) to lose $15 billion in bond holdings over the past 10 years.

MicroStrategy’s Corporate Financial Strategy

The analyst’s forecast suggests that corporate financial strategies promoted by Michael Saylor, founder of MicroStrategy, will be adopted by more and more people.

2024 年 6 月,MicroStrategy 以 2.25% 的利率完成了额外8 亿美元的优先可转换票据债务出售,到期日为 2032 年。MicroStrategy 使用公司债务资金额外购买了 11,931 个 BTC。

Sailer defines Bitcoin as an asset that guarantees “economic immortality” for businesses and companies because the supply of Bitcoin is limited and there is no counterparty risk inherent in other means of value storage such as real estate or stocks.

MicroStrategy’s second-quarter earnings report showed it currently holds 226,500 BTC, which was worth about $14.7 billion at the time.

Banks in the United States enter the market

Earlier, U.S. banking giant Wells Fargo disclosed investments in multiple Bitcoin ETFs, making it the latest big financial institution to join the cryptocurrency space.

The bank has purchased shares in Grayscale’s GBTC Spot Bitcoin Exchange Trading Fund (ETF) and also holds shares in Bitcoin ATM provider Bitcoin Depot Inc., according to filings with the U.S. Securities and Exchange Commission (SEC).

But the exposure is small, with Wells Fargo investing $141,817 in GBTC, while its investment in ProShares is less than $1,200.Bitcoin Depot has an exposure of only $99.

Not only that, BNP Paribas and Bank of New York Mellon have also invested heavily in Bitcoin ETFs.This shows that despite the small exposure, investment trends in traditional financial institutions are still growing.

Beyond Warren Buffett – a new era of corporate finance?

Saylor’s BTC financial strategy allowed MicroStrategy to outperform Warren Buffett’s investment firm Berkshire Hathaway.MicroStrategy has risen by more than 1,000% since adopting the Bitcoin financial strategy.By comparison, Berkshire Hathaway’s share price rose 104.75% over the same period.

Buffett refuses to add Bitcoin to his portfolio or recommends Bitcoin as a means of preserving value against fiat inflation.