Author: James Butterfill, CoinShares Research; Translation: 0xjs@作 作 作 作 作 作 作 作

In the field of commodities, the impact of demand refers to the sudden major changes in the demand for basic products or raw materials caused by unforeseen events.The impact of demand is from increased demand, which may be due to technological innovation, policy changes, or changes in consumer preferences, which leads to rising prices.

In the early 21st century, the Chinese economy was prosperous. With the acceleration of real estate development, the demand for commodities had impacted, resulting in 793%of steel prices from 2000 to 2008.The reaction was made in the form of increasing production, resulting in 80%of the price of steel in the next ten years.

We think Bitcoin is currently undergoing a positive demand shock.The US Securities and Exchange Commission (SEC) approves the spot -based EFT, allowing Bitcoin to reach more than $ 14 trillion in assetsAlthough this is well -known, the timing is not clear, and the scale of funds generated by this has not reached a wide consensus.

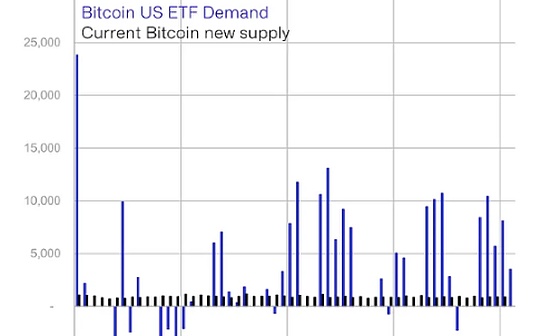

so far,January 11Bitcoin ETFAfter the launch, itThe average daily demand is 4,500 Bitcoin (only trading day), while the Bitcoin network is only dug 921 new Bitcoin per dayEssence

This has led to the sharp rise in the BTC we saw in recent weeks, because the newly issued BTC supply cannot keep up with the demand, resulting in ETF issuers who have to purchase mainly from the secondary market.We can see this from the data. The tokens of the OTC counter have decreased by 74%since the peak of 2020, which is likely to be due to the demand of ETF in recent years.

In the first two months, the amount of capital inflows in the US ETF exceeded the record of US $ 10 billion, which made Ishares’s first two -month capital inflow of the first two months of funds launched by Ishares in 2005.By 2020, before halving, ETP flowed into $ 436 million, accounting for 11%of the total management assets, which was very similar to today. The recent inflows accounted for 11%.The amount is 23 times higher than 2020.

We also see that the exchange holds a significant decrease than BTC, since 2020,As investors use ETP more and self -custody Bitcoin, the BTC held by the exchange has fallen by 29%Because they are increasingly regarded Bitcoin as a means of value storage.

According to the current buying rate of about 4500 BTC per day, it takes 573 days to reduce the balance of the exchange Bitcoin to zero—— So there is still a long way to goEssence

After the commodity market has a demand shock, there will be a supply response.Over time, the supplier will adjust the production level to respond to new needs.In the case of positive demand impact, manufacturers may increase production capacity or seek efficiency to meet higher demand.However,This is the difference between the Bitcoin and the commodity market, because Bitcoin has a fixed supply, and its programming design is half of the supply volume issued by about every 210,000 blocks or about every 4 years.

final,The market seeks a new balance at the intersection of supply and demand.This adjustment process can be fast or slow, depending on the degree of impact, and in view of the lack of flexibility of Bitcoin supply, only the price increase can seek new balance.This is why we have seen the price of Bitcoin so sharply in the past two months.The release needs of ETFs and the upcoming halves have exacerbated this problem.

Half is a well -known information, at least in theory that should be included in the price.Some people may say that the rise in prices after 2020 is more of the result of the new crown epidemic stimulus measures, rather than halving itself.Statistics, there are only 3 samples of previous events for reference, so it is dangerous to draw any conclusions.However, it may have a factor to become a prediction of self -realization, especially if a large number of transactions are related to the incident, although the current futures market traders are lower around the incident.

anyway,There are several other price support factors in BTC prices this year. The most important development is that the US registered investment consultant (RIA) can include Bitcoin ETF into the customer investment portfolio.However, we believe that the inflow of these funds will eventually decrease, thereby reducing its impact on prices.If these inflows began to decrease later this year, we expect Bitcoin prices to be re -adjusted according to interest rate expectations.As the Fed is expected to cut interest rates later this year, this may become an additional support for Bitcoin prices.