This old man Trump is too unruly playing cards~

It was announced that it would suspend the tariffs on the world for only one day.

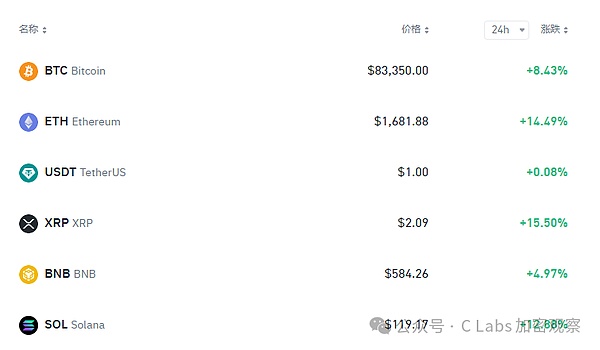

The market regards this as a major easing signal, with the Nasdaq and S&P rebounding strongly.The crypto market has also begun to surge!

It has to be said that cryptocurrencies are now considered US dollar assets, and US policies can almost completely control the rise and fall of the market.

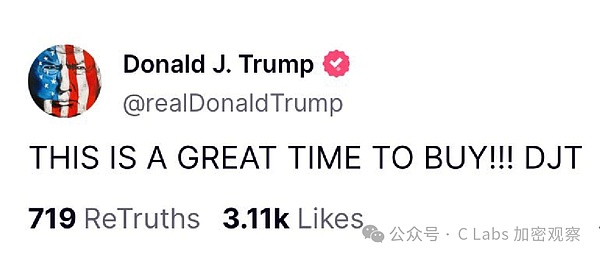

What’s even more sarcastic is that Trump publicly called for orders to buy at the bottom four hours before announcing the suspension of tariffs!

With his own strength, Trump has turned the US stock market into something like a cryptocurrency, and can control the rise and fall by calling orders.

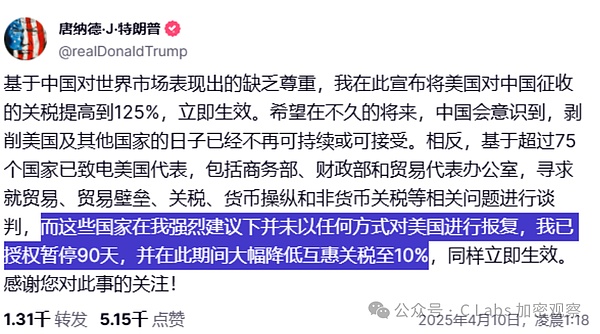

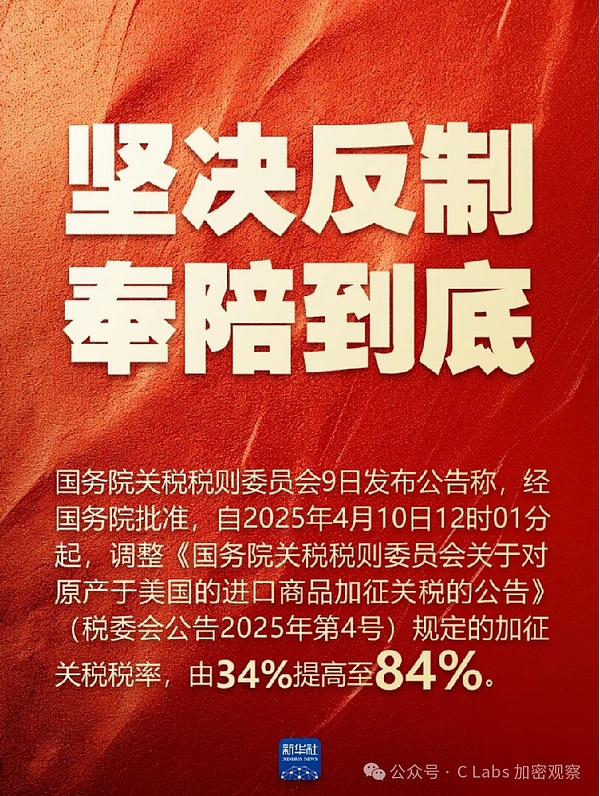

China, which just announced yesterday that it would impose a retaliatory tariff of 84% on the United States, has been increased to 125%!

Now Trump stopped pretending and showed up!

The so-called tariff trade war is purely for China. Other countries are doing things, and they are targeting China!

The friends who had made an appointment to fight the United States admitted defeat.

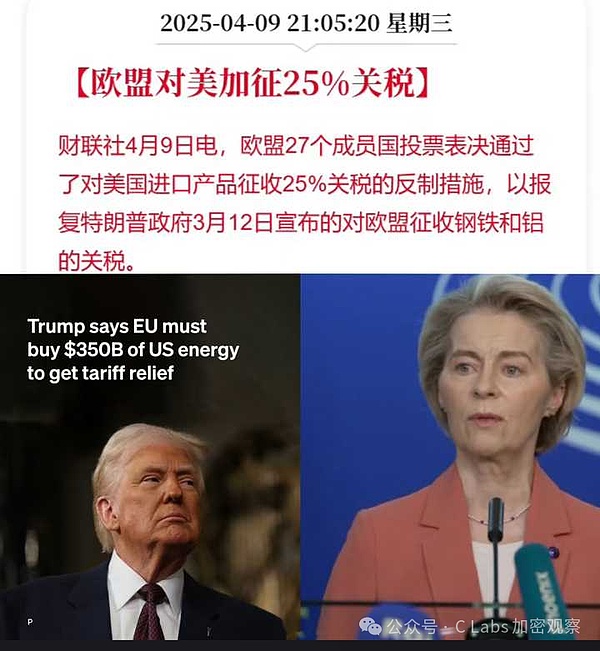

Although the EU also announced yesterday that it would vote to impose a 25% counter-tariff on U.S. products, it only involved US$23.2 billion of goods, accounting for 6% of U.S. exports to the EU.

Moreover, the EU has made it clear that this retaliation of imposing a 25% tariff on EU steel and aluminum exports will not target global reciprocal tariffs in April.

The current situation may have three possible impacts on the future trend of the crypto industry:

First, although the reciprocal tariffs are suspended, the United States still imposes a 10% basic tariff on the world, and the 125% tariff imposed on China will also seriously affect US prices.

The Federal ReserveAs long as inflation remains high, there will be no interest rate cuts, and it is believed that tariffs will be one of the reasons for inflation to rise. Unless it is a deterioration of the labor market or weakening of economic activity (recession expectations), the Fed has no intention of preparing to cut interest rates.

To speak human words means not to expect the Fed to cut interest rates in the short term.

The second point is that the spring of crypto payment may come!

A hundred years ago, the United States implemented a ban on alcohol, and the situation was much higher than it is now!

However, the prohibition not only failed to effectively reduce alcohol consumption, but instead became the most violent commodity in the gangsters, and finally promoted the professionalization and organization of American gangsters.

Now the scope of goods affected by tariffs is wider. Do you think if a large number of goods are smuggled into the US market through gangs, how will they pay and settle?

That must be paid in cryptocurrency!

As for this third point, if the tariff trade war against China becomes a protracted war, the RMB exchange rate will definitely be affected, and may also affect RMB assets.