Deng Tong, Bitchain Vision

On May 29, US time, the Bitcoin 2025 Conference came to a successful conclusion. Many industry leaders delivered important speeches. Bitcoin Chain Vision selected 21 golden sentences to take you to relive the highlights of the Bitcoin 2025 Conference.

-

US Vice President Vance:“Bitcoin will become a strategic asset in the United States over the next decade.”

-

Eric Trump:“We are introducing Bitcoin into the United States, and the United States will win this cryptocurrency revolution. Cryptocurrency is the antidote to corruption. It makes everything cheaper, faster, safer, more transparent, and makes the entire system more efficient.”

-

Donald Trump Jr.:“Financial democratization is the fundamental principle of the goals that we hope to achieve in this administration after world peace.”

-

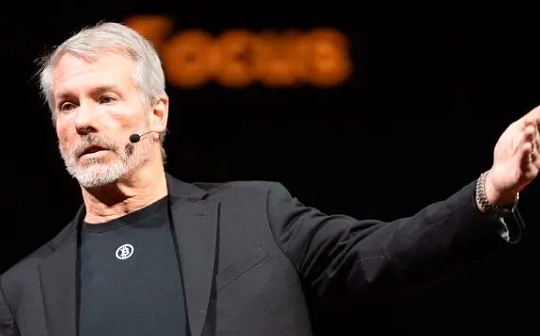

Michael Saylor, founder of Strategy:“The 21 paths to wealth are: transparency, firm belief, courage, cooperation, ability, portfolio, citizenship, civility, politeness, company, concentration, equity, credit, compliance, capitalization, communication, commitment, ability, adaptation, evolution, advocacy, generosity.”

-

SEC Commissioner Hester Pierce:“When people are free to use something, it will eventually be incorporated into traditional financial products. We need to think about how it interacts with our regulatory framework – but the key is to uphold people’s ability to transfer value as they wish.”

-

White House Executive Director Bo Hines:“We are steadily moving toward becoming a world’s Bitcoin superpower. It’s not about the party, but a revolution in the financial system.”

-

Former U.S. Treasury Secretary Rosie Rios:“The eyes of the whole world are watching us. We should not only set the tone for our history, but also for the future. For all of us, this is the American dream. It is about the values of our nation’s founding.”

-

Tyler Williams, Treasury Department:“We are vigorously developing digital assets, and you will surely see the United States becoming the world’s Bitcoin superpower.

-

U.S. Rep. Byron Donalds:“Bitcoin is a key asset because it has proven to be a value holder outside fiat currencies and central banks. President Trump is looking at the long term – strategically recognizing the role of Bitcoin in national reserves.”

-

Wyoming Senator Loomis:“The problem in the past four years is that regulators are very hostile to digital assets. We have $37 trillion in debt, and if we buy and hold 1 million bitcoin for 20 years, we can cut our debt by half, and we have some underperforming assets that can be converted into bitcoin without additional borrowing.”

-

New York Mayor Eric Adams:“For the first time in history, this city should have a financial instrument built specifically for Bitcoin holders. I believe we need a ‘bitcoin bond’ and I will work hard to push and strive to launch ‘bitcoin bonds’ in New York.”

-

Chris LaCivita, co-manager of President Trump’s 2024 campaign:“This country is built on the entrepreneurship of Americans and we are at the forefront of building and planning the future of currency.”

-

Tether CEO Paolo Ardoino:“We promise to reinvest a lot of money in Bitcoin. Our company currently holds more than 100,000 Bitcoins. By the end of this year, Tether will become the world’s largest Bitcoin miner, even surpassing all publicly traded companies, which is very realistic.”

-

Mike Belshe, CEO of BitGo:“Whether you mean USD or Bitcoin, the key to a good stablecoin is the liquidity it has in the global market.”

-

Fayal Hirzade, Chief Policy Officer of Coinbase:“Lawmakers now recognize the need to support innovation, not kill it.”

-

Hunter Horsley, CEO of Bitwise Asset Management:“In the U.S., wealth management companies manage $30 to $60 trillion in assets, and if they can eventually distribute 1% of their funds into this area on behalf of their clients, helping them seize the opportunity of hundreds of billions of dollars.”

-

Blockstream Co-founder and CEO Adam Back:“BTC can reach $1 million. But it’s too early for retail investors.”

-

Strike Founder and CEO Jack Malles:“As Bitcoin matures, its volatility will decline. Bitcoin has reached a level that is equal to the risk of Tesla stock. We should not pay double-digit interest rates for loans.”

-

Economist and writer Saifedean Ammous:“Tether is a “transitional monetary system”, the US dollar is falling into a downward spiral, and Bitcoin, with its “digital upward technology”, will continue to rise.”

-

VanEck Digital Assets Director Siegel:“Building a permanent U.S. strategic bitcoin reserve may require targeted legislation rather than executive action. The most effective way to increase U.S. strategic bitcoin reserves is through targeted revisions to Congressional budget legislation.”

-

Miles Jennings:“The connection between the traditional financial system and Bitcoin, stablecoins and everything else will be truly paved by stablecoin legislation.”