author:Anthony Pompliano, Founder and CEO of Professional Capital Management

Nothing feels better than a bull market.

Your portfolio is rising day after day.The media was so excited that they danced.There was a boiling moment on social media, and people took screenshots and shared their net worth.The call for a bear market is rising, and a big collapse is right in front of you.Your barbers, taxi drivers and neighbors are all selling you their latest stock recommendations.

There was chaos.The bull market is really interesting.

This is exactly what we are in now.Stocks, Bitcoin, gold and almost all other assets will continue to soar to record highs in 2025.But how good is this bull market?How compared to the previous market?

Warren Pies of 3Fourteen wrote:

Compared with the historical bull market, how is this round of rebound?Compared with all other bull markets, this round of rebound is the fourth quarter.Only 1982, 2009 and 2020 were stronger than this rebound.Excluding recession factors, this round of rebound is the strongest.This round of rebound has not seen a 6% correction for 116 consecutive days, with an increase exceeding all bull markets except for the two early bull markets (1966 and 1957).

These data confirm what we all feel… The current bull market is very rare.Tariff concerns earlier this year artificially curbed stocks, laying the foundation for the historic market recovery we are currently witnessing.

Many people believe that the recent rise in stock prices is unsustainable.They will point out that a lot of data indicates that the stock market is overvalued.You will hear them say that regressing the mean is essentially inevitable.

But what if they were wrong?What if the facts are exactly the opposite?

I want to challenge each of you and ask yourself: If the bull market has just begun, what will the future look like?What happens to investors if everything goes well?

However, these problems do not stem from fantasy.Ryan Detrick of Carson Group noted:“The fourth quarter was the best quarter in history, unmatched.”

The average return rate in the last quarter of the year is almost twice as high as in any other quarter.Ryan further explained that in the last 15 times the S&P 500 rose 10% or more as it entered its last three months, there were 14 positive returns in the fourth quarter.

Or don’t believe it?Well, we can see that 2025 is going to be similar to 1999.Revere Asset Management’s Connor Bates perfectly demonstrates this in this chart, which compares the time frame from 1996 to 2001 with the situation from 2023 to the present:

I doubt my vision is normal, but in my opinion, the two markets look similar.Taking into account the current trend, this comparison shows that in the 1999 market repeats itself, there is still significant room for appreciation in this bull market.

Please remember,All of these analyses and stock market performance are amid the recent Fed rate cut.The Fed is reducing capital costs, while stocks hit record highs.This development is not a bad news, but rather indicates that the stock market will continue to hit new highs by the end of the year.

This is undoubtedly good news for stock investors, but another asset also sounds the alarm that cannot be ignored.That’s gold.

Mike Zaccardi said central banks around the world are buying gold in large quantities:

The demand for this precious metal is simply crazy.Analyst Marko Papici stressed that the central bank’s moveWill help gold replace U.S. Treasury bonds to become the world’s most popular reserve asset.

This milestone seems out of reach for 25 years.Until 1971, a sound monetary system had dominated.We have witnessed the explosive growth of fiat currencies after the United States left the gold standard, and it seems that sound currency is about to be forgotten.But now,We see gold and Bitcoin returning to the properties of sound currency.

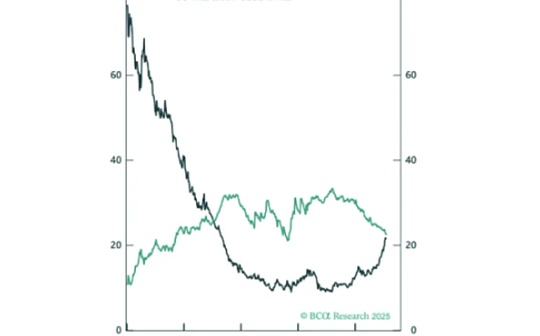

The Blokland team demonstrated gold’s dominance in pricing U.S. Treasury bonds.The trend is clear and the truth is obvious.

In short, central banks abuse the opportunities that citizens give them.They printed too much money and destroyed the purchasing power of the people.Citizens chose to vote in the US dollar and switch from fiat currency assets to stable monetary assets.These citizens also use stocks to profit from the crazy currency devaluation in the market.

Stocks, gold and Bitcoin.These three assets can make you profit from the ridiculous and undisciplined behavior of central banks.Buy them and calm down.

They are all rising.The bull market has not ended yet becauseCheap funds are pouring in, the world needs new technologies to lead the next twenty years.I hope each of you can ignore those bear market speculators.Don’t be fooled by their nonsense.They were wrong.They don’t understand the market or the economy.These people are still stuck in the past.

Optimists will win.It’s no exaggeration to say that I bet on all my investment portfolios.