Author: Polygon Ventures, Translation: Bit Chain Vision Xiaozou

Bitcoin accelerate evolution.Digital gold is just prelude.The hardest asset created by human civilization is to extend its huge arm to smart contracts.

>

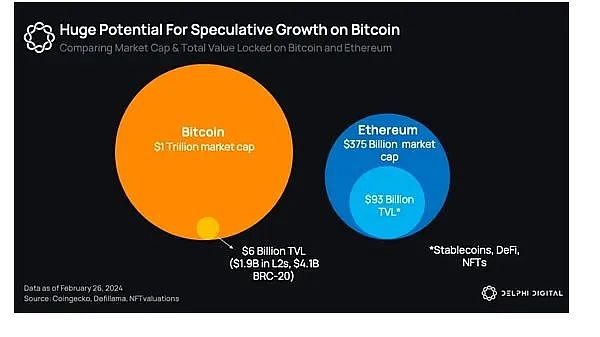

1. The potential of not fully utilization

Due to the lack of programming, coupled with low transaction throughput, slow speed and high cost, Bitcoin is largely classified as a value storage method.Most of the Bitcoin held by more than 300 million users is in a dormant state and is not used in a wallet.

The reason for the lack of programming is because its script language is not complete, and the core development team has set strict restrictions on the executable operation type.This kind of non -flexibility gives it a sense of security, but the price is very slow.

Although Bitcoin can be used as a mortgage or income for real estate, gold, and stocks, it has not been fully used to a large extent.The previous Bitcoin lending attempt left the user a bad impression on the user, because users had to give the Bitcoin’s custody rights to entities with too high leverage, and these entities later went bankrupt.

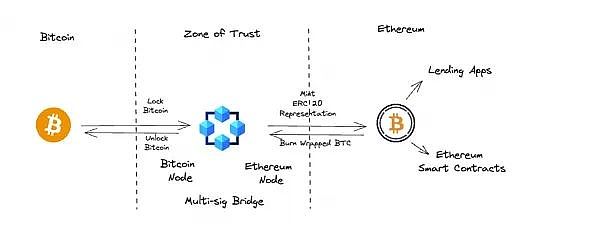

It is not successful to try to send Bitcoin to the EVM chain to copy DEFI borrowing, because the two have completely different environments, Bridge needs to provide a trusted area for this exchange.

>

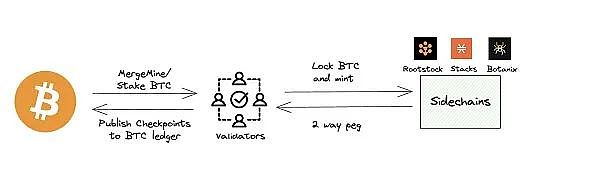

Bridges locks Bitcoin and create a replaceivity on the EVM chain.This introduces the dependence of centralized entities or a set of multiple -signed verifications, and has low security guarantee.The most popular bridge represents WBTC, with a market value of only $ 10 billion and less than 1%of BTC.

So why do people have a re -interested in programming Bitcoin?There are three aspects of catalytic factors that have people’s attention, that is, Ordinals, Bitvm, and Babylon.

2As well asOrdinals

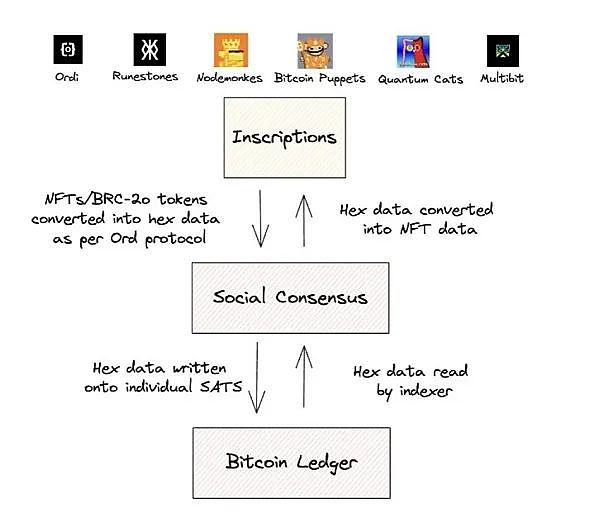

Although the inflow of ETF has brought financial attention, Ordinals has also attracted many developers’ attention to the Bitcoin ecosystem.Ordinals and BRC-20 tokes “engraved” the data to the Bitcoin ledger, but a social consensus layer is required to convert this specific data coding.

>

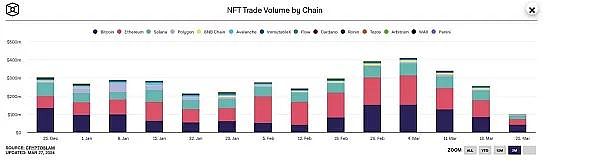

Ordinals makes Bitcoin NFT a runner -up of the transaction volume dimension, second only to Ethereum.This success has triggered a key issue: Can we create a Bitcoin L1 guarantee instead of the EVM paradigm that is not trusting by the social layer?

>

This seems impossible due to the low -level restrictions.SideChains is the only alternative that uses Bitcoin miners to ensure the security of the new chain of the EVM environment.However, this kind of security depends on a set of external coorders.

>

3As well asBitvm

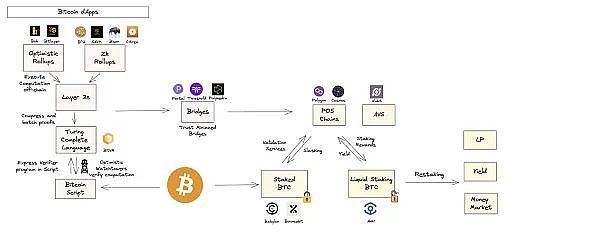

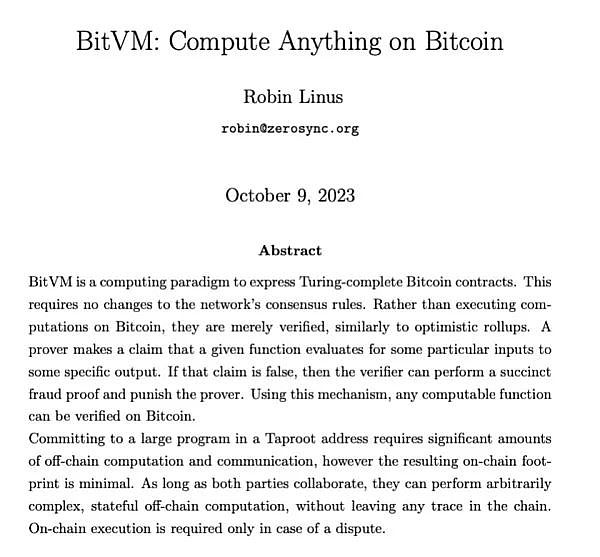

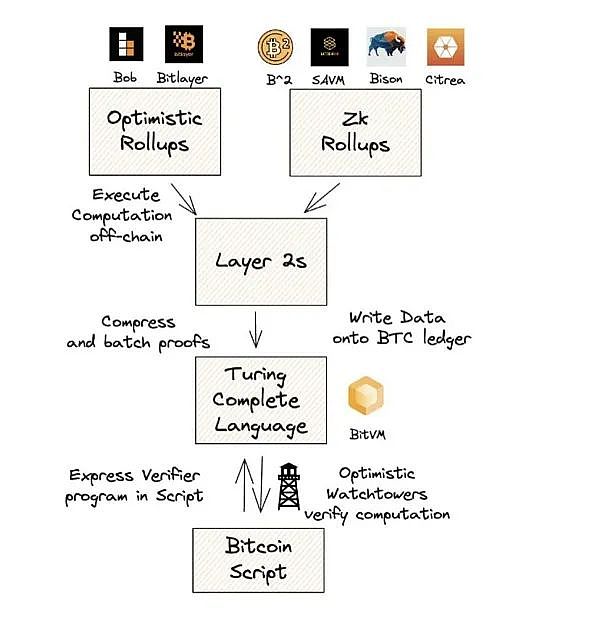

A member of the ZEROSYNC team came up with a way to achieve verification logic on the Bitcoin script without changing the protocol or performing a soft fork.Bitvm uses optimistic proof-verified model to express the complete smart contract of Turing.

>

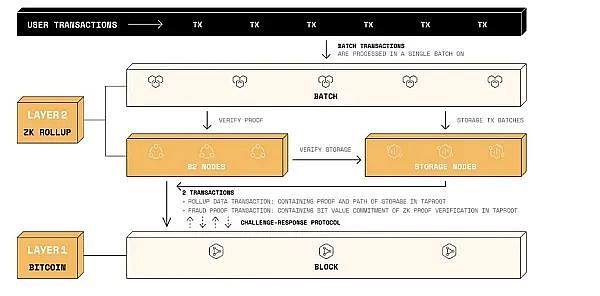

The calculation is executed under the chain, and the results are settled on the Bitcoin chain, which is very similar to the modular Rollup ecosystem.Any Watcher can verify the execution results. If fraudulent behaviors are found, they have the right to punish Prover through funds.

>

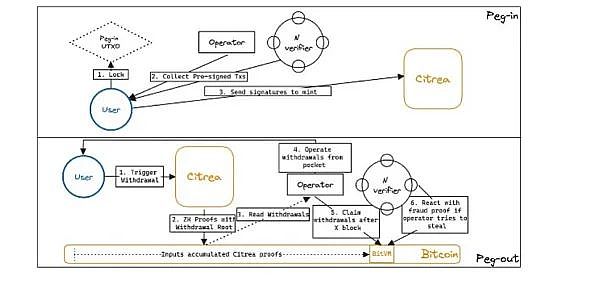

This became the catalyst that L2S took off on Bitcoin.The BTC L2 team such as B² Network is using BITVM to build Rollups with different proof mechanisms and virtual machines.Citrea has designed a zero -knowledge verification circuit that can run directly on the Bitcoin script.

>

Rollups on Bitcoin uses modular technology to greatly improve scalability and efficiency.This progress not only attracts people who are proficient in EVM tools, but also attract millions of users who are eager to obtain such user experience.

>

Bitvm also introduces Bridges with a minimum trust to receive the Bitcoin Bridge to the POS chain.Citrea gathers from other chains to be proved by a light client that can be proven natively on Bitcoin.This reduces the required trust. As long as a verifier can maintain honesty, it can ensure integrity.

>

4As well asBabylon

When L2S is busy expanding, Babylon has triggered a revolution in the capital efficiency of Bitcoin ecosystem.Simply put, babylon is the Eigenlayer of Bitcoin.

EIGENLAYER is a re -pledge protocol that allows ETH pledges to extend the verification service to the POS chain, Bridges and sorters and earn income.It has no mechanism to ensure integrity through the automatic penalty in the basic chain smart contract -this is a function that is impossible to achieve on Bitcoin.

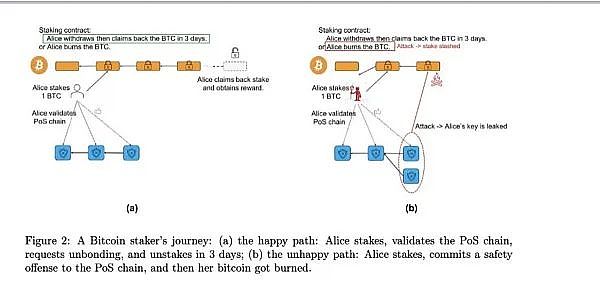

So the Babylon team came up with a clever solution.Bitcoin is locked in multiple signatures, allowing holders to pledge and retrieve their funds after waiting for a period of time.If any attack is observed, the protocol leaks the gold library key, and the automatic penalty mechanism will be started.

>

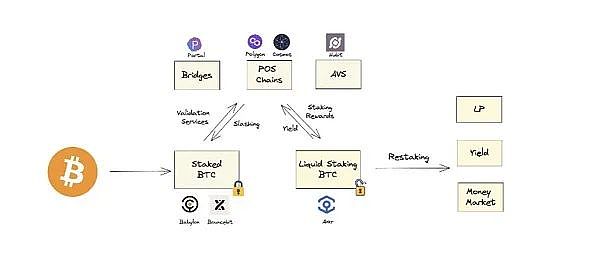

Users can provide verification services for POS chains, data availability layers, Oracles, AVS, etc. by pledged their Bitcoin.This has spawned a model that can get rich returns without sacrificing self -hosting.

>

The POS chain and other verification services can use the economic security of BTC to guide their agreements and build a security layer.

Portal is ensuring the security of a Bitcoin Bridge. Nubit is using Bitcoin as the data availability layer. Avail plans to use the QUORUM supported by BTC.

>

LSTS expands liquidity by creating such lock -up pledges on the POS chain that locks the pledged free transaction. Babylon cooperates with ANKR STAKING to pledge these tokens to earn more benefits and create a stable currency supported by BTC,etc.

5. Conclusion

In short, Bitcoin does make progress in two aspects:

-The programmable vertical expansion of L2S that supports millions of transactions.

-The as a reliable mortgage in a large number of applications to improve capital efficiency.

I really responded: “Bitcoin is an isolated island, and it is not connected with a wider web3 ecosystem.”

We are about to see a brand new Bitcoin application world, which will be seamlessly integrated with EVM to open up unlimited possibilities.

>