Author: Sankalp Shanghairi, Source: Hashtalk, Compiled by: Shaw Bitchain Vision

Create an atmosphere

If you’ve spent a few minutes on crypto Twitter recently, you’ve probably noticed:The season for perpetual contract trading (perps) is here.Perpetual contract decentralized exchanges (DEXs) dominate the discussion, with trading volumes hitting new highs and providing users with points, rebates and airdrops.Hyperliquid opened the door to market with a $3 billion airdrop and a speed close to centralized exchanges, and now every new entrant is scrambling to emulate its strategy.It is an inspirational feast for traders; it is an opportunity for developers to win liquidity and market share in the most profitable areas of DeFi.

MaelstromFund speaks out in a recent article: Currently,The top Perp DEXs account for about half of on-chain derivative transactions.This concentration forms gravity, and once liquidity and traders pour into a certain platform, the moat will become deeper and more difficult to cross.That’s why competition is so intense: Every new DEX must provide some aggressive strategy (zero fees, faster engines, or crazy incentives) to steal users from existing platforms.

Hyperliquid: Industry benchmark

Hyperliquid remains the lead.Its custom Layer-1 and HyperCore engines achieve sub-second execution speeds, while its fee model makes transactions nearly free.The pending order can actually get a rebate, while the trader only needs to pay 5 basis points.In addition, 99% of the fees will be used to repurchase $HYPE tokens, creating a direct virtuous cycle between transaction volume and token value.

The data itself is very telling:Hyperliquid 30-day liquidation trading volume exceeds $300 billion, open contracts hover in billions.It has been able to easily cope with slippage in orders over $10 million, but competitors are struggling to cope with it.Even after the points plan ends, total locked value (TVL) and trading volume continue to climb – a testament to the depth of liquidity and user stickiness that can go beyond pure incentives.

Lighter: Zero Fee Challenger

If Hyperliquid is a veteran heavyweight player, then Lighter is a contender who is eyeing him.It is built by former high-frequency trading (HFT) traders based on zk-rollup technology and promises to provide traders with an absolutely fair and zero-fee trading environment.This is not a gimmick:The handling fee for both purchasing orders (maker) and taking orders (taker) is actually set to 0%, and the liquidity provider (LP) incentive mechanism is the key..

Lighter is developing very fast.Its monthly trading volume has exceeded US$140 billion, second only to Hyperliquid.Large orders have weak liquidity, but for most retail and medium-sized traders, trading volume is tight.The question is whether Lighter can continue to scale once the beta version of invited users is limited to expansion, and whether its zero-knowledge proof engine can withstand the continuous institutional-level traffic pressure.

Admissions for Avantis and SunPerp

Avantis quickly became one of the most eye-catching Perp DEXs, not only because of its huge trading volume, but also becauseIt integrates real-world assets (RWAs) such as forex, commodities and stocks into Base’s trading portfolio, this is rare in today’s DeFi field.Over the past 30 days, it has processed about $6.9 billion in perpetual contract transactions (about $520 million in 24 hours), but its total locked value (TVL) remains around $22 million, indicating a high turnover rate under limited collateral.With Avantis’ market capitalization of about $600 million, and a full dilution valuation (FDV) of about $2.1 billion, and with heavyweight investors like Pantera, Founders Fund, Galaxy and Base Ecosystem Fund, Avantis is well positioned, but the challenge is whether its incentive-driven growth and high leverage options can translate into sticky, sustainable liquidity once the earnings farming and airdrop boom cools down.

This means:

-

Advantages

-

RWA gives Avantis a unique advantage: you can not only conduct long/short transactions in cryptocurrencies, but also participate in index, commodities and forex trading.This expands the appeal of Avantis.

-

The incentive mechanism is strong: traders’ fees are zero or very low, and LPs are getting rich.This attracts both profit-seeking investors and speculators.

-

Weak

-

TVL is still low relative to trading volume: this means liquidity may be unstable under pressure (large retracement, large orders).Slip points may cause losses.

-

The higher FDV relative to the flow rate means that expectations have been digested.If growth or quantity stagnates, a significant decline may occur.

-

Once rewards are received, airdrops and reward cycles often cause selling pressure.

SunPerp is Tron’s entry product.Justin Sun announced SunPerp on Space, positioning it as the first native Perp DEX on Tron, with the lowest handling fee and extremely low friction, and is committed to converting Tron’s huge USDT trading volume into Perp DEX trading volume.SunPerp is still in its early stages, but has had about 3,000 users without any marketing or paid promotion.

Additionally, it promises to use 100% of the protocol revenue to $SUN token repurchase to support holders.

Repurchase = good story, but it needs to look at the actual revenue data.If the income is low (because the handling fee is low), then the repo may be only token rather than strong value acquisition.

SunPerp is now more speculative.As users migrate for low fees and low friction, it may shine in the short term.But maintaining this advantage will be more difficult (once other platforms also match the costs, or the cost of expansion increases).

Aster and Bullet: The ready-to-go machine

Aster’s release is like watching fireworks:Based on BNB Chain, and supported by key ecological participants like Binance founder CZ.

On the first day of TGE’s launch, its transaction volume reached about $371 million, with about 330,000 new wallet addresses added, and the total lock value (TVL) soared to about $1.005 billion..The $ASTER token itself rose by about 1,650% at its first release, which was both popular in the market and gained actual attention.

But the indicators after the first day show a more subtle story.Although TVL has fallen back from a peak of more than $2 billion to hundreds of millions of dollars, daily trading volume is still high.DefiLlama shows that its 24-hour transaction volume reaches hundreds of millions of dollars (many snapshots show that it is more than $400 million to $500 million).

Aster’s open interest volume is rising, but still lags behind the heavyweight product: Aster’s futures open interest ranged between $840 million and $900 million in some periods, which is very strong for the recently launched products, but still far behind Hyperliquid’s data.

On Solana, Bullet is building what is probably the fastest Perp DEX to date.It is still in the testnet phase, claiming a delay of about 2 milliseconds — several orders of magnitude faster than Hyperliquid’s hundreds of milliseconds.Bullet is powered by Zeta Markets and aims to integrate perpetual contracts, spot and lending into a single Solana native experience.

Bullet is also conducting testnet “Trading Cup” and airdrop-like airdrop-guided activities so early traders/participants can join before the mainnet goes online.Currently, the test network does not include all features, so there is risk, but the potential is huge for traders who focus on low latency and low slippage.

Key data

Here is the current competition situation:

Risk and reality

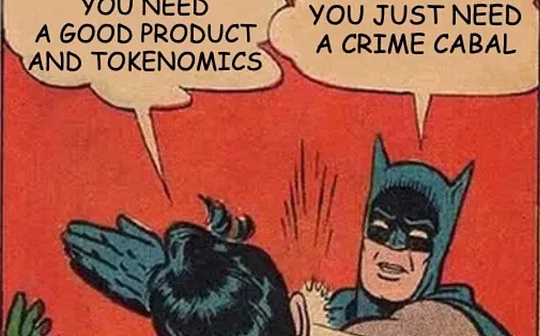

Traders are earning handling fees, market makers are increasing trading volume, and exchanges are issuing high rewards.If the user comes just for airdrops and leaves once the reward is exhausted, the transaction volume will drop as quickly as it rises..

Liquidity risk is another key issue.For smaller exchanges, orders above $10 million can distort the order book and cause slippage.The capital rate soared, and Aster showed an annualized long premium of 117% the next day.This highlights how fragile new perpetual contracts are when hot money pours in.Of course, the focus of regulation is also imminent: the larger these DEXs, the higher their exposure.

The next step in competition

The conclusion is simple: we are in an arms race.Hyperliquid sets the standard; Lighter, Aster and Bullet are all trying to outperform their opponents with fees, speeds or incentives.For users, this means a golden age of giveaways and near-free trading.For developers, this means finding a balance between growth hackers and a sustainable economy.

I expect integration.A handful of winners will seize stable liquidity and grow into real “DeFi exchanges”, while dozens of smaller Perp DEXs will gradually decline or merge.The sign of success is simple:Large in-depth order book, sustainable income from LPs, and communities that still exist after airdrops.

The final thought

Now, perpetual contract trading is a bit like a nightclub carnival: everyone is giving away free drinks at the door, and Hyperliquid’s music is the loudest.But when the carnival is over, the only ones that can survive will be those “night clubs” with real business models.