Zero-knowledge proofs: How transformative can they be?

Author:0xKira Preface In the ever-evolving landscape of cryptography and blockchain, few innovations have attracted as much attention as zero-knowledge (ZK) proofs.Once an obscure academic concept in computer science theoretical papers,…

New proposal reshapes UNI value. Is the forgotten Uniswap still worth investing in?

Written by: Michael Nadeau, The DeFi Report; Compiled by: Glendon, Techub News Launched in 2018, Uniswap is a breakthrough innovation that enables the organic formation of a two-sided market for…

A reversal of the Fed’s December interest rate cut?How many of the 12 voting members supported an interest rate cut?

Deng Tong, Bitcoin Vision On November 21, according to CME’s “Fed Watch”: the probability that the Federal Reserve will cut interest rates by 25 basis points in December is 39.6%,…

Interpretation of Nvidia’s earnings report from a bearish perspective: Is it an AI bubble or an AI revolution?

Author: danny; Source: X, @agintender Nvidia announced its Q3 financial report on November 19. Although it cannot be said that the results are outstanding, it can also be said that…

How Much of the Trump Family’s Wealth Was Evaporated in the Cryptocurrency Crash?

Author: Tom Maloney, Annie Massa, Source: Bloomberg, Compiler: Luffy Cryptoassets have transformed President Donald Trump’s family’s fortune during his second term.Today, the Trump family and their followers are experiencing firsthand…

Powell’s allies set the tone, is an interest rate cut in December a high probability event again?

Author: Wu Yu, Jin Shi Data Over the past month, Fed officials have had sharp public disagreements over the likely direction of the economy and the appropriate level of interest…

Interpret the real reason why Bitcoin Core v30 relaxed the OP_RETURN restriction

Author: Aaron Zhang; Source: X, @zzmjxy Bitcoin Core v30 relaxes the OP_RETURN restriction. Everyone is saying that it is because “Ordinals inscription restriction is invalid”. Over the past three months,…

“Currency Circle-AI-US Stocks” Tiesuo Lianjiang is all watching when the currency circle stabilizes

Author: Ye Zhen, Wall Street News As this quote on social media puts it: “We are all long Bitcoin, some of us just don’t know it yet.” On November 24,…

What is the future of Bitcoin treasury companies and the DAT model?

Author: Yue Xiaoyu; Source: X, @yuexiaoyu111 There have been rumors in the market recently that MicroStrategy, the largest Bitcoin treasury company, will be kicked out of the global index fund.…

Peter Schiff blasts “digital gold” as a lie and where will retail investors go?

Author: Divine Grace Bitcoin fell below the US$90,000 mark, while gold sat firmly above US$4,000. This battle between digital assets and traditional precious metals is evolving into a bloody capital…

Looking at the crypto industry from the first principles of money: great differentiation led by BTC

Looking at the crypto industry from the first principles of money: great differentiation led by BTC 2025 Year in Review: The Current State and Trend of Ethereum

2025 Year in Review: The Current State and Trend of Ethereum Will the policy differences between the U.S. and Japanese central banks reshape global liquidity?

Will the policy differences between the U.S. and Japanese central banks reshape global liquidity? Faith Capital Market: The Essence and Core Value of Cryptocurrency

Faith Capital Market: The Essence and Core Value of Cryptocurrency The golden stage of the crypto field is coming to an end and is heading towards new financial innovation

The golden stage of the crypto field is coming to an end and is heading towards new financial innovation Magic Eden: From NFT market to crypto entertainment

Magic Eden: From NFT market to crypto entertainment AI infrastructure debt surge, miner leverage and disappearing “liquidation liquidity”

AI infrastructure debt surge, miner leverage and disappearing “liquidation liquidity” Cryptocurrency: The shift from asset class to technology sector

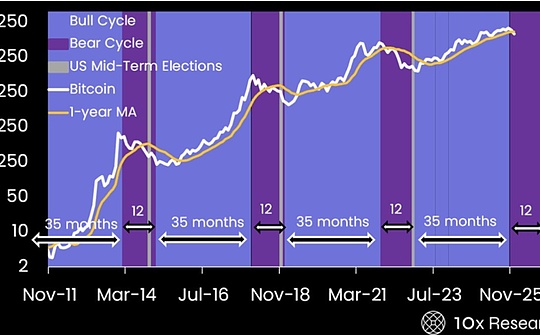

Cryptocurrency: The shift from asset class to technology sector Tom Lee’s speech in Dubai: The crypto super cycle is solid and why I still persist

Tom Lee’s speech in Dubai: The crypto super cycle is solid and why I still persist The truth behind the current cryptocurrency market

The truth behind the current cryptocurrency market