Author:Dankrad Feist, former researcher at the Ethereum Foundation and current researcher at Tempo; compiled by: Bitchain Vision

I’m not a trader.This article only represents a summary of my personal views and does not constitute investment advice.

Something interesting is happening with L1 token valuations right now: while on-chain activity continues to grow, many tokens are struggling to maintain their previous price levels.This disconnect suggests that the underlying value proposition of these tokens may have shifted.Here is my take on the current situation.

ETH used to be currency

There has been a lot of debate about whether ETH is a currency or not, but if we look at the facts,The reality is that ETH used to be money.

In 2017, the first major product market fit (PMF) for the Ethereum public chain was the ICO.It was a crazy year, full of optimism, but most importantly, the investment raised by ICOs was in the form of ETH.Since ETH seemed to be only going up at the time, individuals and institutions alike kept the majority of their investments in ETH, even using it as the primary way to measure the value of their asset reserves.

2020/2021 brought another wave of adoption centered around DeFi and NFTs.ETH is central again – remember when Christie’s and Sotheby’s started pricing in ETH?

Looking back, this was the peak of ETH adoption as a currency.In some respects, it has realized the “three elements of currency”:

-

Unit of account (mainly for NFTs)

-

store of value

-

medium of exchange

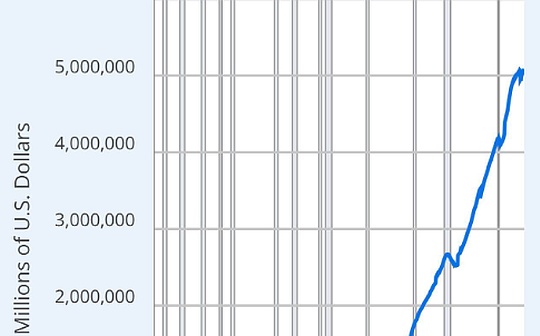

According to the currency velocity equation (MV = PQ, where M is the money supply, V is the circulation velocity, P is the price level, and Q is the total volume of goods/services), we can know that when ETH is used as a currency, its market value (proportional to M) should be proportional to the on-chain GDP (PQ) (assuming that the circulation velocity V remains relatively constant).In other words, as economic activity on Ethereum grows, if ETH continues to be the primary medium of exchange, its valuation should grow with it.

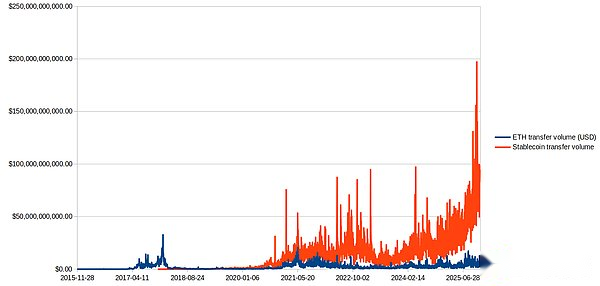

ETH is replaced by stablecoins

Time has not been kind to ETH since 2021: NFTs have lost a lot of value, and their status as a medium of exchange has mostly been replaced by stablecoins.

Ethereum is now rarely used as a medium of exchange or unit of account compared to the 2017-2021 period.This may explain why ETH’s value appreciation appears to have stalled, although adoption is still growing.

The road ahead

ETH can get out of the woods in the following ways:

-

Transform into a “meme-like store of value” that mimics gold (and now Bitcoin).However, this largely decouples it from the success of the Ethereum chain itself, and it’s unclear whether it will be considered superior to Bitcoin; the value of a meme-style store of value is primarily driven by brand, rather than technical attributes.

-

Promote large-scale activity to re-establish ETH’s monetary function in areas where it has lost ground.

-

Focus on capturing revenue and burning fees, with the goal of reaching at least tens of billions of dollars in revenue.This will require transforming the Ethereum Foundation (EF) into an efficient research and development (R&D) and business development (BD) organization and finding ways to continue funding these efforts.

Many L1s will face the same problem.While their tokens have no history as currencies, much of their valuation stems from being viewed as a potential alternative to Ethereum, with the implicit assumption that their tokens will similarly be used as a medium of exchange.Solana had brief success during the meme coin craze in early 2025, but that success was more short-lived than Ethereum’s past drivers.

Conclusion

The challenge with L1 tokens is this: their historically high valuations are largely determined by their use as currencies, specifically as a medium of exchange.The velocity of money equation states that when a currency performs this function, its valuation will track on-chain economic activity.However, the shift to stablecoins has broken this link for most L1 tokens.

This creates a valuation problem:If a token is no longer used as currency, what drives its value?There are only three options: either recapture the currency function, pivot to a store-of-value narrative (competing with Bitcoin), or fundamentally change the value proposition by generating significant revenue through fee income and destruction.The latter requires a different kind of organization: one focused on business development and sustainable revenue generation, not just protocol development.