Source: Layerzero Foundation; Compilation: Tao Zhu, Bit Chain Vision Realm

ZRO is the native asset of the Layerzero protocol.The claim will be opened at 11:00 am (UTC time) on June 20.Clicked

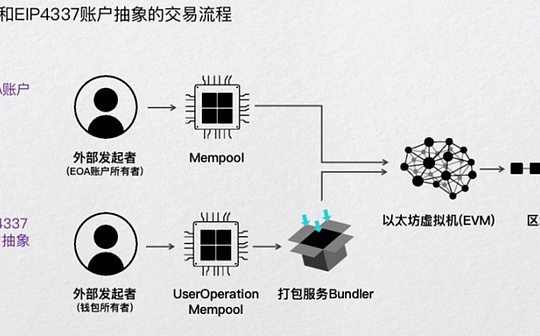

Layerzero is a full -chain interoperability protocol that supports anti -review messages and development without permission through unsusted smart contract called Endpoints.

The agreement exists permanently.Anyone can use it.No one can tamper it to move between the chain.

It is challenging to apply these principles to the production version, but the results are self -evident.Since the release of V1 in 2022 and the release of V2 in 2024, hundreds of developers have built applications, and thousands of users have interacted with the agreement. As a result, more than 200 applications have sent more than 70 blockchains.130 million news and $ 50 billion in transactions.

The launch of ZRO marks a key step in the agreement: making it a public, non -changeable infrastructure.

This article has a deep understanding of ZRO, including token economics, token mechanisms and qualifications.

Token economics

supply

ZRO supply is fixed to 1 billion tokens.

The allocation is as follows:

-

38.3% are allocated to the Layerzero community, including assigned to users, developers and communities;

-

32.2% are allocated to strategic partners with a unlocking period of 3 years, including investors and consultants;

-

25.5% are allocated to core contributions, and the unlocking period is 3 years, including existing and future team members;

-

4.0% tokens repurchase, promised to be assigned to the community.

Community allocation -383,000,000 ZRO

Layerzero’s success is mainly due to developers who build flagship crypto applications and users who actively interact with agreements.These early members have made great contributions and are very suitable for the future manager of Layerzero.

The community tokens distribution aims to reward the early, current and future durable developers and users of Layerzero, while developing the Layerzero ecosystem.

38.3% of the “383,000,000” ZRO community allocation is divided into the following subclass category classified by time:

-

Retanement plan:Eligible participants can receive 8.5% ZRO supply on June 20.(I will introduce the qualifications in detail later.)

-

Future plan:15.3% of ZRO supply will be directly distributed to users, protocols, infrastructure builders and community members through snapshots and RFP.At the time of release, the 11.5% ZRO supply will be unlocked from this storage pool. The allocation will start from the new Discord community plan. The plan will use 5,000,000 ZRO.

-

Ecological system and growth:The 14.5% ZRO supply will be managed by the Layerzero Foundation.At the time of release, the 5% ZRO supply will be unlocked from this storage pool to be used for ecosystem growth, gift planning and liquidity configuration.

Strategic Partner -322,000,000 ZRO

Strategic partners (including investors and advisers) must abide by the three -year lock period, of which one year is fully locked, and the next two years are unlocked.

Core contribution -255,000,000 ZRO

Core contributors, including the current and future Layerzero Labs employees, need to abide by the three -year lock period, including one year’s lock -up period and the monthly unlocking period of the next two years.

Buy tokens -40,000,000 ZRO

4.0% of ZRO supply has been repurchased by Layerzero Labs and promised to invest in the community pool.

Token mechanism

ZRO holders will always control the accumulation of protocol costs.

The unsatisfactory voting contract executes a public chain referendum every six months, allowing ZRO holders to vote for the cost switch to activate or deactivate the agreement.

The cost that the Layerzero protocol may be charged is equal to the total cost of cross -chain message verification and execution.For example, if the DVN and actuator configuration selected by the application charges $ 0.01 between the transactions between Arbitrum and Optimism, Layerzero can also charge $ 0.01.

If the cost switch is activated, the referendum financial contract will charge and destroy the local chain.This mechanism is similar to the EIP-1559, which can effectively distribute costs to ZRO holders.

ZRO voting is simple: autonomy, chain, and immutable -to make the holder only send a signal from the chain of ZRO to turn on or turn off the protocol fee switch.

Qualification requirements

Layerzero is one of the most widely used and most harvested agreements in history: nearly 6 million unique wallet addresses interacted with the agreement, and developers have deployed more than 54,000 OAPP contracts.This makes it difficult for the initial tokens to distribute correctly.

Although all transaction volume contributes to the agreement, it is necessary to ensure that long -term users are rewarded and the maximum is consistent with the agreement.Long -term users are defined as users who are most likely to continue to use protocols or repeat the past operation in the future.Identification and adjustment of these users need to implement multiple processes before claims.This includes Sybil filtering, protocol RFP and qualification standards.

The main problem of the distribution of “perfect” is the gap between expectations and reality, which often leads to the dissatisfaction of participants.A large number of users interact with Layerzero, with different degrees of activity.For example, 957,640 users conducted more than 50 transactions, and 227,410 users conducted more than 100 transactions, and 1,075,590 users interacted with more than 15 chains.In addition, Layerzero approved 211 agreement RFP.Each protocol has unique distribution needs, so the one -size -fits -cut distribution method is not feasible.

All these requirements are very challenging on Layerzero’s network scale.Although ZRO distribution is not perfect, we think it is correct: to reward long -term users in a consistent way to keep users and Layerzero agreements to the greatest extent.

The following is an overview of the qualification process of our first ZRO token distribution activity.

Sybil filter

In the first stage, Sybil users had a self -report for 14 days and received 15%of its expected allocation.After this period, any Sybil users who have not reported and have been recognized in the initial Sybil reports made by Layerzero Foundation, Chaos Labs and NANSEN will not receive any rewards.In the second stage, bounty hunters can report SYBIL activities and get 10% rewards that are expected to be allocated at the recognition address.After the bounty hunting, Chaos Labs and NANSEN continued to cooperate with Layerzero Foundation to further filter Sybil from the token distribution.

Through bounty hunting, self -reporting, and cooperation with NANSSEN and Chaos Labs, about 10,000,000 ZRO (about 1%of the total supply) is avoided to the Sybil address.

Soliciting suggestions (RFP)

Agreement RFP is suitable for deployment of OAPP, OFT or onFT contracts on the main network before the snapshot #1.This process allows the team to allocate their Zro to their respective communities in the most value -added way.

Overall, 230 unique proposals were submitted, and each proposal summarized its end users and developers allocated.In the end, the 1111 proposal was approved, and a total of 3%of the total ZRO supply was obtained, and it was allocated in the way it thought.

standard

The ultimate qualification depends on many factors in the agreement RFP and Layerzero Core.

Protocol RFP (3%)

The wallet listed in the approved agreement RFP is qualified. The minimum ZRO is distributed to 5 ZRO and a maximum of 10,000 ZRO.Any remaining part will return to its respective RFP groups.

Specific protocol distribution is based on several factors, including the number of messages sent before and after snapshot, the number of days since the first message sent on Layerzero, and the application category (OAPP, OFT, Onft).The goal of the developer’s allocation is the distribution of 90/10. Each development team is up to 100,000 ZRO, and any extra ZRO will be assigned to other developers.

Core (5.5%)

The distribution of Layerzero Core part is designed to trace the activity of users on the agreement.Allocate payment -based agreement fees.All users who trades before the snapshot are qualified, the minimum is 25 ZRO, and the maximum distribution is 5,000 ZRO.Any amounts that exceed these restrictions will be re -assigned in the Layerzero Core group.

The specific standards are as follows:

The weight of transactions below 1.00 US dollars and worthless NFT transactions (very low market value) decreased by 80%to give priority to real participation.

Provide multiplications for early and snapshots to recognize the continuous participation of the agreement.

Inspector

You can

Summarize

The ZRO distribution process aims to be fair and transparent, while supporting contributors and future growth.

Thanks to the developers, users and community members who have contributed to the agreement so far.

Next: Receive ZRO at 11:00 am (UTC time) on June 20.