Author: Zhao Hao, Cailianshe

Nasdaq Inc. is applying to regulators to allow investors to buy and sell tokenized versions of stocks on their exchanges.

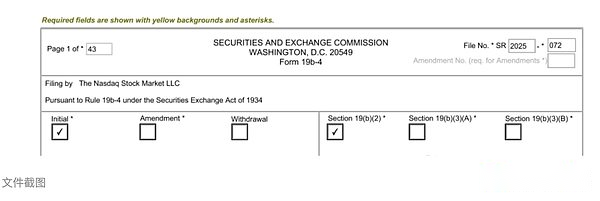

Nasdaq is seeking approval from the U.S. Securities and Exchange Commission (SEC) to modify some of the rules, including the definition of “securities” to enable stocks to be tokenized and traded in regulated venues such as the Nasdaq, according to a filing filed on Monday (September 8).

This move may be a major test for blockchain technology to enter the core stock market system of the United States for the first time.But it should be noted that any rule modification must be approved by the SEC and can only be implemented after a solicitation period.

According to documents seen by the outside world, Nasdaq elaborated on the way to trade tokenized securities in detail.The Company recommends that if a tokenized securities are deemed to be equivalent to the underlying securities and enjoy equal shareholder rights, their transactions shall be subject to the same execution and record rules as the original securities.

Nasdaq also proposed that tokenized assets must be clearly identified so that transaction clearing and settlement parties (including US depositary trusts) can correctly execute relevant instructions.The company said that the priority of tokenized assets in order execution will be consistent with traditional assets.

This request is not only a technical rule change, but also a fundamental issue of stock definition, issuance and settlement—these issues that may determine whether tokenization will continue to stay on the edge of cryptocurrency or be integrated into the core infrastructure of Wall Street.

“This solution is already detailed in the proposal and it is simple and leverages existing infrastructure and market architecture,” Nasdaq Chief Financial Officer Sarah Youngwood said at a meeting.

If approved, regulated U.S. exchanges will be able to incorporate tokenized stocks into the system, giving blockchain technology that supports cryptocurrencies direct access to some of the most frequently traded stocks around the world.

Nasdaq’s move comes as traditional financial institutions increase their layout of digital assets and blockchain, which is also related to Washington’s increasingly open regulatory attitude.New SEC Chairman Paul Atkins is pushing for the development of clear standards for securitization of digital assets.

Last month, SEC Commissioner Hester Peirce said regulators are willing to work with tokenized companies, but stressed the need to ensure they fully disclose the nature of the tokenized assets.

The so-called tokenized securities is a type of digitization of securities, rather than directly holding the underlying asset itself.They can be traded on the blockchain network, rather than through traditional brokerage accounts.Tokenization is seen as enabling market liquidity, supporting fragmented holdings, and expanding access to the U.S. stock market for overseas investors.

Supporters pointed out that tokenized securities on blockchain can achieve 24-hour uninterrupted trading, which is different from the restrictions on traditional exchanges closing at night and holidays.In theory, tokenization can also achieve nearly instant clearing and settlement, reducing dependence on traditional intermediaries.

Tokenization has always been promoted as one of the most feasible application scenarios for blockchain.BlackRock, Franklin Templeton, KKR and other institutions have announced to tokenize some fund assets, but mostly through brokerage firms as intermediaries.

Most tokenized stocks are currently issued by third parties, rather than by listed companies on traditional exchanges such as Nasdaq, which raises some problems.

Previously, Robinhood had provided transactions on OpenAI tokenized stocks, but the AI company immediately reminded that it did not recognize the product and the relevant tokens did not represent the company’s equity.

In the filing with the SEC, Nasdaq expressed concerns about the issuer: “Nasdaq believes that securities tokenization should not deprive issuers of the right to decide the venue and method of trading their stocks.” The document also pointed out that Nasdaq has limited ability to give issuers the right to choose.

In a recent report to clients, JPMorgan Chase pointed out that the tokenization of traditional assets such as bonds has not yet been popularized, and most of the current related activities are mainly driven by crypto-native companies, rather than traditional banks, securities firms and listed companies.

Other financial giants have also called for caution about tokenization.Market maker giant Citadel Securities warned that if the SEC does not set clear rules, there could be a risk of “regulatory arbitrage”.

Nasdaq president Tal Cohen said the company hopes to “build a bridge between the world of digital assets and the traditional assets.”He posted on LinkedIn: “The challenge and responsibility lies in ensuring that this transformation always takes the interests of investors as the primary principle.”