Author: danny; Source: X, @agintender

MYX used the exaggerated increase as a gimmick to capture the traffic C position of various media and data platforms, allowing all the warriors who were eager to try to invest their real money and contributed a fireworks to the bankruptcy.MYX is like a powder barrel, and the trigger is in the hands of big players. No matter how long or short it is, it will make you go without going back.The market is not short of opportunities, but only the “survivor bias” that is willing to take risks.

Statement: This article strongly does not recommend you to participate in this abnormal transaction.This article is not aimed at anyone or the project party. It is just for the purpose of academic analysis, so that more people can know the truth, know why, and understand the mechanism behind it.

Part 1: MYX Price Explosion: Quantitative Overview

1.1 Delineate the Parabola Trajectory

The price trend of MYX tokens shows a typical parabolic pattern, and its rising speed and amplitude have reached extreme levels in the short term.A review of the timeline of this process can reveal its amazing growth trajectory:

-

The token price started from its all-time low of approximately $0.047 in June 2025.

-

In the first round of significant gains in August 2025, the price reached a phased high of $2.49 on August 8.

-

Subsequently, in September 2025, a more explosive rise began.In just seven days, prices soared over 1132%, hitting an all-time high of more than $17.On September 9 alone, the price increase exceeded 291% in one day.

1.2 Trading volume and market value dynamics

With the surge in prices, there have also been explosive growth in trading volume and market capital, reflecting the rapid influx of market attention and speculative capital.

-

Trading volume surge: Driven by the upgrade narrative of MYX Finance V2 (this may be a rationalization “protect”), spot trading volume increased sharply from September 7 to 8, with an increase of more than 710%, reaching US$354 million.At the subsequent peak of prices, this number climbed to an astonishing $880 million.Such a huge trading volume shows that the market sentiment is extremely excited and a large amount of speculative funds are involved.

-

Market capitalization inflation: During the rise in August, MYX’s market value has exceeded US$300 million.On September 8/9, its market value expanded to more than US$3.5 billion, once ranked among the top 35 cryptocurrencies in the world.

1.3 Technical indicators of market overheating

Technical indicators clearly show that the market has entered an extremely overbought and irrational state, which is a signal that the price pullback is extremely risky.

-

Relative Strength Index (RSI): RSI is a key indicator for measuring market momentum and overbought/oversold conditions.During this rise, MYX’s 14-day RSI reached 96.21, while the 7-day RSI reached an unprecedented 98.06.Normally, an RSI value exceeding 70 is considered an overbought area; while a value exceeding 95 indicates that the market has entered a statistically unsustainable speculative fanatic state, which almost without exception indicates an upcoming sharp pullback.

The interaction between price and trading volume forms a strong positive feedback loop.The initial price increase, likely driven by concentrated and collaborative buying, has successfully attracted initial market attention.As prices climbed, the percentage of transaction volume displayed on major exchanges and data aggregation platforms increased dramatically, providing material for cryptocurrency news media and social media influencers.

The reporting and dissemination of these amazing data by the media, KOLs, data platforms, etc. (this article is also one of them) quickly created a social consensus of “popular tokens” and triggered a FOMO of retail investors (similar to the transactions of giant whale traders on HL, a promotional effect from “large orders”).This process strengthens itself, forming a parabolic upward trajectory.More importantly, this retail-driven inflow of funds provides early insiders and controllers with the huge liquidity necessary to distribute their tokens at high levels.

Part 2: Under the appearance: on-chain evidence collection and market manipulation indicators

The soaring price of MYX is not simply a market enthusiasm, but a comprehensive result of a series of carefully planned events.

2.1 The soaring engine: violent derivative short squeeze

The derivatives market is the main battlefield and core engine of this price explosion.

-

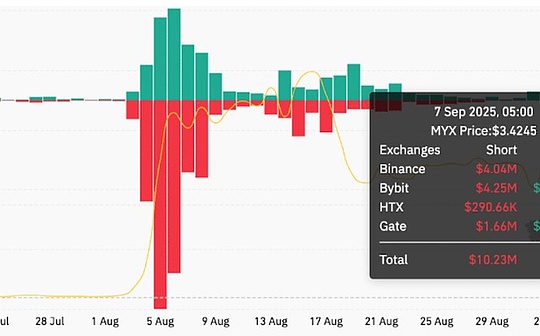

Key data: According to Coinglass data, a large-scale liquidation incident occurred in the market on September 8.The total liquidation amount reached US$14.63 million, of which as high as US$11 million came from short positions.

-

Mechanism Analysis: When the MYX price is pushed up and breaks through the key technical resistance level (such as $3.69), a forced closing of a large number of short positions is triggered.These short traders who were forced to close their positions had to buy MYX in the market to cover their positions, which instantly created huge, involuntary buying pressure.This cascading forced buying has formed a vicious cycle, further pushing up prices, thereby liquidating more short sellers at higher prices.The leverage of up to 50 times provided by the MYX perpetual contract amplifies this effect, making the price extremely sensitive to small fluctuations.

-

Fueling factors: Binance’s adjustment to the settlement frequency of MYX perpetual contract fund rate (changed to once every 1 hour) further exacerbates the short-selling dilemma.More frequent settlement of capital rates means increased costs and uncertainty in holding short positions, which effectively traps short traders in losses and makes them more vulnerable to rising prices.

2.2 Question: Accurate and timed token unlocking and VC selling

If short squeeze is the engine of rise, then the timing of the token unlock event reveals the “time” of this rise.(A good move to “take a plan” is based on the market’s impression of the decline if unlocked)

-

Event coincidence: The peak of the price coincides perfectly with a major token unlock event in time.The unlocking released 39 million MYX tokens to the market, accounting for 3.9% of the total supply.This is a huge supply shock for a token with a relatively small circulation disk.

-

On-chain evidence: After the token is unlocked, on-chain data tracking shows that the well-known venture capital institution Hack VC transferred 835,000 MYX to the MEXC exchange, which is a clear signal to prepare for a large-scale sale.

-

History repeats itself: This is not an isolated incident.In August, MYX’s price plummeted 58% after a similar token unlocking incident.This shows that the market has formed a clear pattern: token unlocking is a window period for early investors and insiders to take profits and put huge selling pressure on the market, and it is also the market’s consensus on the token’s “high probability of falling.”

2.3 Accusations of collaborative manipulation and wash trading

-

Analyst Red Signs: Dominic, an analyst on X, provided a detailed analysis that points to multiple red flags that point to market manipulation.

-

Disproportionate trading volume: MYX’s daily perpetual contract trading volume suddenly surged to $6 billion to $9 billion, a figure that is completely illogical for a token whose market capitalization and liquidity scale is much smaller, suggesting a large amount of non-real trading activity.

-

Synergistic trading model: Exactly the same, programmatic trading model was observed on multiple exchanges such as Bitget, PancakeSwap and Binance.This cross-platform synchronous behavior is highly unlikely to be spontaneously formed by a large number of independent market participants, but more like controlled by a single entity or a collaborative group through a trading robot.

-

On-chain funds collection: On-chain data shows that a large amount of funds that pay small amounts are eventually collected into a centralized wallet address.This is a typical manipulation technique to mask the true intentions and size of funds of a single big player.

-

Wash Trading creates false trading activity.The purpose is to artificially exaggerate trading volume and attract retail investors who regard high trading volume as signals of market health and good liquidity.Once retail investors are attracted to the market, the manipulator can sell the tokens in their hands to them at a high price to complete the harvest.The various signs observed in the MYX event are highly consistent with the typical characteristics of washing transactions.

Part 3: Analysis of “The Killing Scene”: A Strategic Review

The core logic of this incident: “The winning situation under high control of the spot market”.This is not a simple market fanaticism, but a carefully planned and interlocking capital operation.Its strategy can be broken down into the following steps:

3.1 Step 1: Laying the foundation – highly concentrated spot control (high control)

-

Low circulation volume and high internal holding: The total supply of MYX is 1 billion pieces, but during the peak price period, the circulation supply was only about 197 million pieces, less than 20% of the total.According to the token allocation plan, core contributors (20%) and investors (17.5%) collectively hold 37.5% of the total supply.Most of these tokens are in a long-term lockdown, which means that at any given point in time there are very few “floating chips” that can be truly freely traded in the market.

-

Advantages of disk control: This low circulation and high concentration structure creates perfect conditions for price manipulation.When the vast majority of tokens are controlled by a few entities, they only need relatively little capital to create huge price fluctuations in the spot market, paving the way for subsequent contract market operations.

3.2 Step 2: Start the engine – leverage the contract with spot (manipulate the price)

Big players use their control over spot stocks to turn the derivatives market into the core battlefield for harvesting opponents.

-

Manufacture short squeeze: This is the core mechanism of this manipulation.By pulling up prices in the spot market, the operator can accurately push up the marking price of the perpetual contract, allowing it to break through key technical positions (such as $3.69).This move triggered a chain reaction: a large number of short positions were forced to close due to insufficient margin.These forced short positions must buy MYX in the market to cover positions, thus forming a huge, involuntary buying, further pushing the price to a higher level.

-

Amazing clearing data: On September 8, liquidation of up to US$14.63 million occurred across the network, of which more than US$11 million came from short positions that were exposed.This clearly shows that one of the main purposes of raising spot prices is to accurately “hunter” short sellers in the contract market.

3.3 Step 3: Expand the results of the battle – as a “trading” for marketing (attracting opponents)

The crazy and skyrocketing “marketing effects” are a crucial part of this strategy.Pulling the price of the currency to the sky is itself the most effective marketing method.

-

Create FOMO emotions: In just 8 days (September 1-8), it increased by more than 1132%, and once entered the top 35 CMC’s global market value on September 9, quickly attracted the attention of the entire market.This parabolic rise has been spread through major media and social platforms, creating a strong FOMO for retail investors.

-

Attract new opponents: This extreme market sentiment has successfully attracted a large number of new traders to enter the market.Traders attracted by price increases will open long positions to chase the rise, while traders attracted by high capital rates and pullback expectations will open short positions.Regardless of direction, they have become the “opponent plate” that the operator needs, providing depth and liquidity for the market, and preparing for the next stage of harvest.

3.4 Step 4: The ultimate goal – shipment and harvesting at high levels (short and short positions)

The ultimate goal of this carefully planned pull-up clearly points to creating exit opportunities for those who are interested and harvesting the market in both directions.

-

Perfect synchronization with token unlock: The highest point of the price matches the unlocking event of 39 million MYX tokens in a surprisingly timely manner.The pull-up behavior creates a perfect window with abundant liquidity and consistent “bearish” direction.

-

On-chain evidence: Hack VC, a well-known venture capital firm, immediately transferred the MYX token worth about $2.15 million to the exchange after the token was unlocked.This shows that retail investors have become insiders’ “exit liquidity”.Or is this a “bearish” drama for retail investors and analysts to see?

-

Two-way harvest: The goal of this game is to take both long and short sides.

-

In the process of pulling up, by detonating the short sellers, harvesting the shorted opponents.vice versa.

-

After the price peak is completed spot distribution, the operator can short it with the backhand.As they stop protecting the market and start selling, prices will inevitably plummet (so the previous eight months of unlocking caused the price to fall by 58%), when the long positions chasing the rise at the top will be completely liquidated.Regardless of long and short, the trigger button of the explosion (spot) is controlled by others. Whether the position is broken or the profit will depend on the kindness of others.

To sum up, MYX’s surge is not a natural reaction of the market to its technology or fundamentals, but a “must-kill” situation in the derivatives market using highly concentrated spot control and using spot prices as leverage.Its core purpose is to attract a large number of traders to become competitors by creating a sensational marketing effect, thereby achieving accurate liquidity in short positions, and creating an ideal liquidity environment for those who are interested to sell newly unlocked tokens at high prices, and ultimately completing a two-way harvest of the market.

Part 4: Summary

These seemingly independent events—V2 new product narrative, short squeeze, token unlocking and wash trading allegations—are actually an interlocking, well-planned overall strategy.First of all, those who are interested predicted the date when the 39 million tokens are unlocked.In order to sell at the highest price during this period, they must create huge market demand ahead of time.Therefore, they vigorously promoted the narrative of V2 upgrade through or using official channels and social media, providing a reasonable explanation of the upcoming rise.Then, people who are interested may use trading robots to wash trading on major exchanges, creating the illusion of active trading volume and starting to slowly push up prices.When the price rise attracts the first shorts, the trap is set.

The operator then invested a key sum of money to push the price sharply above the critical liquidation line, triggering a large-scale short squeeze.At this time, the buying caused by forced short positions has become the main fuel to drive the parabolic price rise, and the operator itself no longer needs to invest a large amount of money.Finally, on the day when the price peaked, the market FOMO sentiment was strongest, and the tokens were unlocked, they obtained the exit window they had always dreamed of: a very high selling price and a huge group of buyers composed of a large number of retail investors.The newly unlocked 39 million tokens poured into the market, and retail investors unfortunately became their “exit liquidity”.