Author: Kyle Samani, founder of Multicoin Capital; compiled by: Bitchain Vision

DoubleZero (DZ) officially launched the main network beta version today.Earlier this year, Multicoin Capital jointly led a $28 million round of DoubleZero financing.

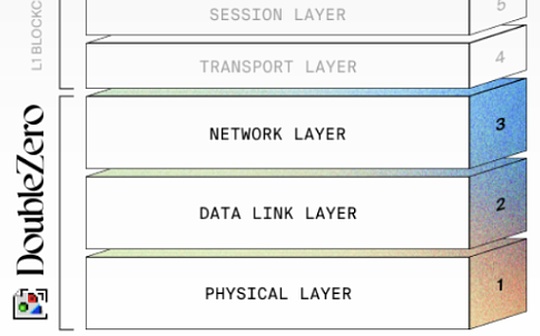

Blockchain is a global distributed system.Over the past decade, the core L1 team has invested more than $1 billion in optimizing network protocols, consensus, execution and storage.butThere is another layer in the stack that they have not tried to solve: the physical network layer.Intuitively, this seems to be beyond the scope of the L1 team.However, in global distributed systems, the physical network layer is obviously crucial to overall network performance.

DoubleZero aims to accelerate the transmission of data packets in the physical network layer around the world.How to do it specifically?By creating a license-free high-performance network link market (also known as dedicated fiber).In the OSI protocol stack,DoubleZero is located below L1 floor.

What is private fiber?

Broadly speaking, there are two types of Internet lines around the world: public lines and dedicated lines.The vast majority of Internet traffic is transmitted through public lines connecting cities, states, and even continents.

Between about 2008 and 2010, trading companies began to realize that the public Internet was too slow and unreliable to meet their latency requirements.So they began investing in dedicated network infrastructure to ensure reliable and low latency packet transmission.

Today, the world’s largest trading companies—Jump, Citadel, HRT, Two Sigma, DRW, and more—have billions of dollars in customized network equipment, covering a variety of modes, from submarine optical cables to custom microwave towers that emit radio waves across Lake Michigan.Many of the largest tech companies—Google, Facebook, Microsoft, Amazon, etc.—also have globally dedicated fibers that connect their global data centers.

DoubleZero is a license-free network that allows owners of any dedicated network infrastructure (from submarine cables to microwave towers) to contribute access to their underutilized or underutilized infrastructure.Previously, only the world’s largest and most technologically advanced customers (such as high-frequency trading companies, Google, Meta) could access dedicated fiber.DoubleZero makes this service accessible to anyone.

DoubleZero’s first bandwidth provider is Jump Trading, while DoubleZero’s first customer is Solana Network itself.Galaxy, Distributed Global Technologies, Rockaway X, Cherry Servers, Latitude, South 3rd Ventures, Teraswitch and many others have also recently announced that it will provide fiber optic links for DoubleZero.DoubleZero has been integrated into Solana’s three main clients: Agave, Firedancer and Jito.Jito’s block engine has also been integrated with DoubleZero.

With DoubleZero providing support for the Solana Beta mainnet, validators will reach consensus faster, data will flow more freely and quickly, and users and market makers will complete transactions faster.We believe this is a win-win situation for all parties.

However, DoubleZero is not only available for Solana.We expect it to be adopted by all major L1 networks in the coming years, as we believe other networks will not be able to compete with DoubleZero enhanced networks.Additionally, the network can even serve the centralized sorter L2 network, helping them distribute data to various localized RPC servers around the world to meet the needs of latency-sensitive applications such as transactions.

Looking ahead, we expect DoubleZero’s application scope to go beyond the core blockchain infrastructure.Any latency-sensitive Internet application can become a customer of DoubleZero, and we expect video calls, real-time global augmented reality and competitive gaming services to use DoubleZero.

On September 29, 2025, DoubleZero cleared a key obstacle in the process of achieving large-scale applications.The Securities and Exchange Commission (SEC) Corporate Finance Department issued a “Non-action Letter” (NAL) to it.Regulatory waivers were granted for some planned programmatic transfers of the protocol’s native token 2Z.This cleared a major obstacle for the large-scale application of DoubleZero.Users use 2Z to pay fees to transmit communications over the network, part of which will be rewarded to the network provider in a programmatic way as compensation for providing fiber links and running network hardware.In addition, resource providers will obtain newly minted 2Z in a programmatic way as compensation for tracking user interactions and payments, calculating network provider fees, and other work on managing protocols.

NAL confirmed that the U.S. SEC’s Department of Finance will not recommend enforcement actions for such 2Z programmatic transfers, thereby confirming that such transactions do not require registration as securities transactions under the U.S. Federal Securities Act.By reducing legal uncertainty, NAL provides DoubleZero with clear pathways to launch and operate its network and reinforces the U.S. SEC’s ongoing recognition of responsible innovation in the digital asset space.

Austin Federa and Mari Tomunen, general counsel for the DoubleZero Foundation, worked with the Securities and Exchange Commission (SEC) to achieve this for the network.We knew Austin for years and we were so excited when he told us that he would team up with Andrew McConnell and Mateo Ward.Andrew McConnell and Mateo Ward have decades of experience building high-performance dedicated fiber networks for Jump.We believe that the DoubleZero team has the best network engineers, an in-depth understanding of high-performance blockchains and an excellent marketing team.