Author: addy, MESSARI researcher; Translation: Bit chain vision Xiaozou

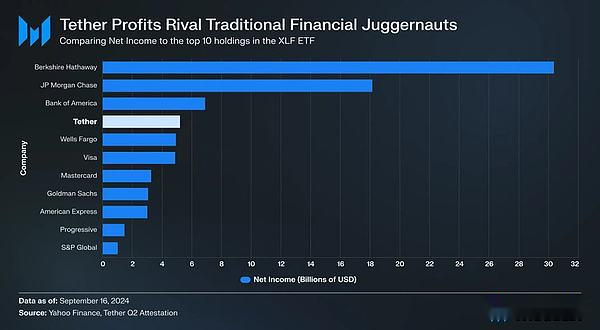

Tether’s recorded profitability last quarter made it among the TRADFI giants.But the huge profit of $ 5.2 billion has also made it the goal of new competitors who want to get a share.

In this article, we will have to go deeply and rapidly developing the world of stabilization, which involves centralized and decentralized areas.

Stable currency full view

We will make the following types of vertical subdivision:

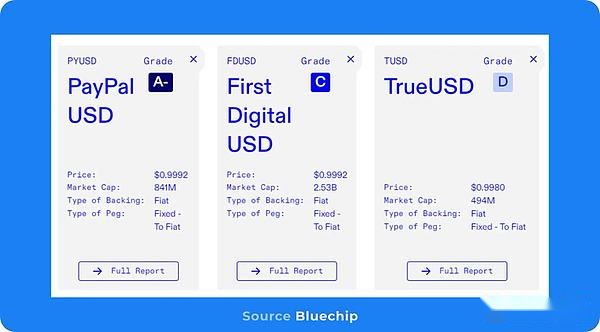

Pyusd

Centralized stabilization currency often lacks transparency, and often occurs only under the conditions of clear incentives.Pyusd is one of the few centralized stable currencies with a market value of US $ 1 billion in a small market value.

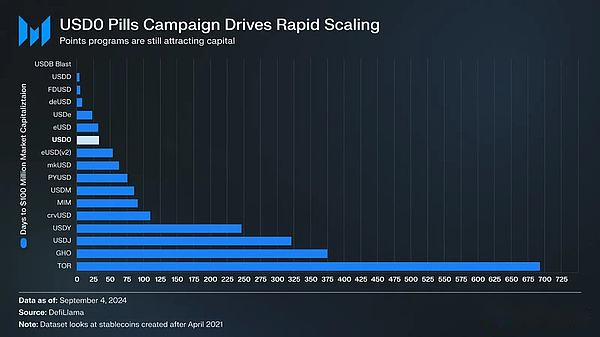

USD0

Through the integration of airdrop incentives and cooperation with the DEFI platforms such as Morpho, more decentralized vaults such as USD0 support stable currency grow rapidly.The USD0 market value is about $ 250 million, and this goal soon achieves this goal.

Elixir’s DEUSD

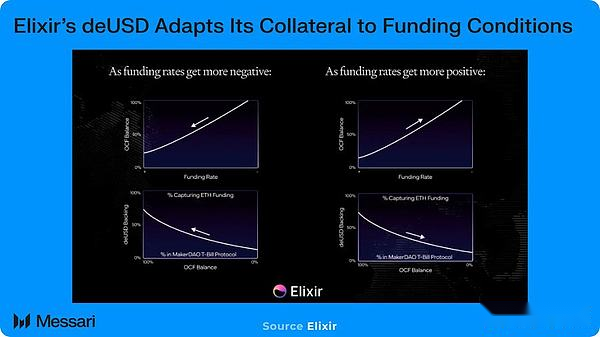

Synthetic stable coins like USDE use “multi -spot spot+short futures position” to maintain their hooks.Because the foundation is compressed, the USDE loses market share.But new protocols like Elixir are designed to improve the Ethena model by adjusting their mortgage support.

GHO

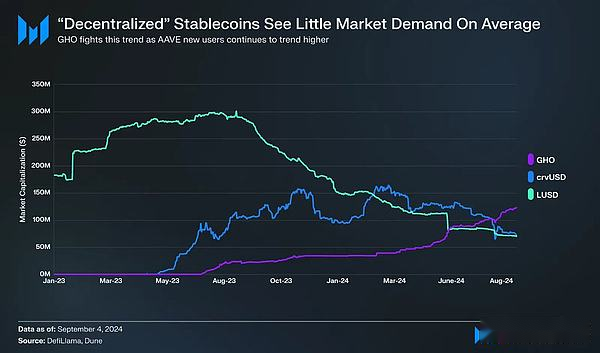

Focusing on the maximum decentralization and minimizing the stable currency of human intervention has not showed much demand.GHO may be an exception because it uses an active user base on AAVE.

Dyad

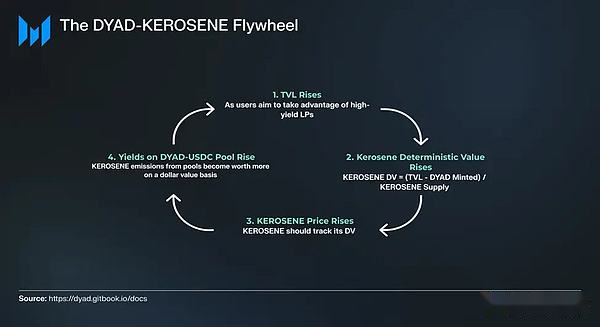

Innovative design usually tries to achieve a certain mechanism to improve typical mortgage debts.

Bar inch mode.Dyad is such a stable currency. Its goal is to use the excess mortgage in the system through another tokens called Kerosene.Kerosene allows users to mortgage their own exogenous assets to cast more DYAD.Moreover, the more KEROSENE of NFT (Note) holders, the more benefits they get from the liquidity pool.

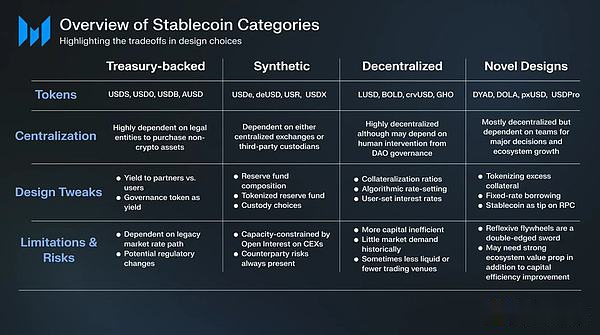

These categories of new stabilization coins are competing in terms of yields, accessibility, liquidity, stability, and capital efficiency.The adjustment of the new design or the adjustment of the old design involves all kinds of pros and cons:

New stablecoins enter the market every week, and the structure of the stabilization currency is also developing and changing.