Author: Mike Kremer, Messari data engineer; compile: 0xjs@Bit chain vision world

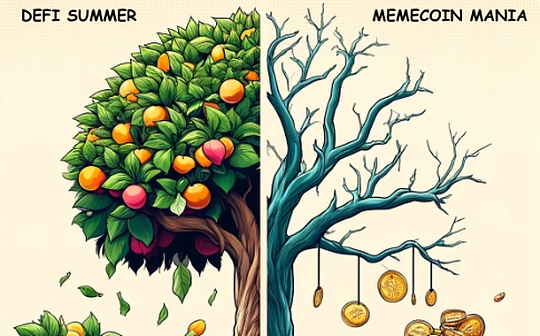

Since the ICO boom, the MEME currency wave may be the most plundered encryption phenomenon.Different from the past cycle, the past cycle is usually supported by real projects with tangible value, and the rise of the model MEME currency marks to a more destructive dynamic transformation.To understand this, let’s compare the value flow during the DEFI SUMMER period with the situation we see today.

During the DEFI Summer, UNISWAP Labs and other projects launched an agreement to provide real utility for the encryption economy.

-

Users participating in these platforms usually get tokens awards -these tokens represent part of the value created by the agreement.When speculative frenzy fades, these tokens still have potential value because they are linked to a fully functional and valuable service.

Compare this with the trend of Meme currency.

-

Here, internal personnel or Carter will create tokens like SuperCumrocket69 to speculate on it and seduce retail investors to bid for these “revolutionary” new assets.Once the price rises, internal personnel will sell their assets, which will effectively squeeze wealth from the scattered participants, leaving tokens without actual value or utility.The entire process is a zero -sum game, which is not only re -assigned, but also destroyed.

The impact on retail investors is obvious.Take a look at projects like Friend.tech and Ore SUPPLY.

-

Despite the implementation of the distribution mechanism that is conducive to retail investors -Friend is fully swapped to its community, ORE is a fair use of CPU -based algorithms -but the prices of these two tokens have depreciated sharply.

-

This shows that retail buyers are ruthlessly squeezed out by meme currencyThere is no longer capital to support the market value of those more real projects.at the same time,Memecoin can only be maintained by suspicious market activities and the innocence of retail investors.

The sad fact is that although speculative bubbles have always been part of the cryptocurrency field, they have left some surplus value in the form of legal projects.However, the MEME coin bubble is purely speculative, and the value of the ecosystem is exhausted, making the situation of retail investors worse than before.

Information disclosure: The author of this article suffers huge losses on Friend, and now holds and mining ORE has also suffered huge losses.The inspiration of this article comes from the losses of wealth and the general depression of the Memecoin seller and buyer.