Author: Justin Baba, Research Manager, Messari

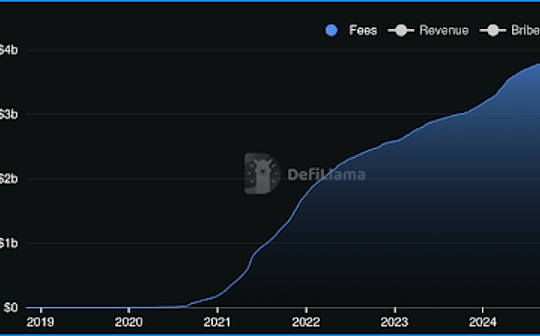

Since its establishment in 2018, Uniswap has become one of the main pillars of DeFi in the Ethereum ecosystem and is also a top DEX.During this period, it processed $2.4 trillion in transaction volume, incurring $3.8 billion in fees for the agreement.

On October 9, Uniswap Labs launched Unichain, an L2 built on Optimism’s Superchain, designed to help expand DeFi.

Its main design aims to solve the key challenges of DeFi: high costs, slow transaction speeds and diversified liquidity.

-

Reduce costs:Compared with Ethereum Layer 1, Unichain will reduce transaction fees by 95%, and costs are expected to be further reduced as Ethereum rollup-centric roadmap evolves.

-

Increase the speed:Unichain’s one-second block time and 250 millisecond sub-blocks will provide near-instant transaction speeds and enable transparency and efficiency through a Trusted Execution Environment (TEE).

-

Native interoperability:Since Unichain is part of the Optimism hyperchain, its cross-chain messaging capability facilitates transactions between Unichain and any other hyperchain L2.In the future, chains outside the superchain ecosystem will passERC-7683 enables interoperability, This creates a standard API for cross-chain transaction execution systems.

Unichain will also launch the Unichain Verification Network (UVN), which will allow UNI stakeholders to earn some sorting fees incurred by the chain.

-

UVN is a decentralized network composed of node operators that can independently verify the latest status of the network.

-

This helps reduce the risk that the sorter proposes both invalid blocks and conflict blocks, which are related to a single-sorter network.

-

To become a validator, users must stake UNI on Ethereum.The validator with the highest pledge weight will be considered as the active validator set.

By combining its DEX products with the interoperability provided by traditional universal chains, Unichain will open the door to the development of new applications, especially in the DeFi space.

The value generated by Unichain will directly benefit UNI token holders, as they will now be able to obtain some of the revenue generated by the protocol, which has been a major discussion point within the DeFi community.

-

Currently, Unichain is online on the test network, and the main network is expected to be deployed later this year.