Author: Ryan Selkis, founder and CEO of MESSARI; Translation: Bitchain Vision Xiaozou

Recently MESSARI published MESSARI CRYPTO TheSis 2024 report.The following is the main point of the report.

1. When you have questions, focus on the overall situation.

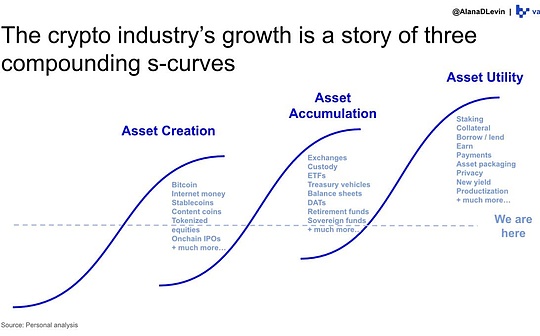

Cryptocurrencies are inevitable. When you question the long -term development of cryptocurrencies, pull the lens far away to see how far we are gone, it will be very helpful.

The figure below shows the performance of cryptocurrencies in the past five years:

>

2. Although it has recently risen, BTC is still Coses in the financial field.

ETF is coming soon, and the institutional adoption, coupled with geopolitical influence, is far from overheating compared with the historical cycle.Looking at the ratio of market value to realized value, it is now 1.3.After reaching 2.0 or above, make an evaluation.

>

3. I wrote “ETH in stagnation” in late November.Bitcoin is a better digital gold. Solan et al. There are better, faster, faster, and lower cost performance on the “integration” network.This seems very reasonable, but because the average return (without other factors) theory, ETH should now rise.

>

4. Private equity funds will follow the trend of public tokens.In terms of encrypted venture capital activities, in 2024, it will be crushed in 2023, and growth companies will continue to attract investment.

The biggest beneficiary:

+DEPIN (storage, calculation, wireless)

+Rollup & amp; integrated network ecosystem

+ Any encryption X AI project

>

5. DEPIN will explode in 2024.

>

6. The following 10 objects are worthy of attention:

ETF team (Cathie Wood, Larry Fink, Sonnenshein, the Circle team (the most likely IPO candidate), Kristin Smith, Mike Carcaise, our dead enemy Satan (Elizabeth Warren), RWA leaders, and Desoc and DESOC and DESOC and DESOC and.DEFI supporter.

7. Category 10 is worthy of attention to encryption projects:

(1) USDT on TRON

(2) Application on Base

(3) Celestia

(4) Jupiter & amp; solana defi

(5) Farcaster/Lens

(6) GBTC

(7) lido & amp; lsts

(8) CCIP vs. Pyth

(9) blur & amp; black

(10) Project Guardian

8. Bitcoin’s security model depends on Ordinals.Bitcoin network needs to ensure safety through the following ways:

(1) Toll application.

(2) Introduce permanent low inflation.

(3) Migration of proof of equity.

Otherwise, Bitcoin will eventually fail (slowly) failure.

9. The privacy protection project I am most interested in is Privacy Pools, Silent Protocol, and ZCASH.

We need privacy on the chain, which is a comprehensive war that protects the privacy of our chain.

>

10. Worries about Tether are insignificant

The US government likes USDT (monitoring European dollar), although they pretend to hate it in private.Continuous hostility to USDC will continue to cause damage to us unless the White House changes a new president.

>

11. If the Democrats control the Senate and the White House at the same time, cryptocurrencies have no future in the United States.

We need to get rid of Sherrod Brown, Jon Tester, Katie Porter, and several other hostile senators candidates, otherwise you should transfer to overseas and choose another industry.

>

12. What our political opponent said about us is almost a lie.

The use of illegal cryptocurrencies accounted for the transaction volume and market value close to the lowest point of history. Half of our “illegal financing” was because half of the world (India+China+other countries) in the world did not even realize sanctions.

>

13. Coinbase is a big giant and will continue.

The team’s outstanding performance in all aspects will promote the development of the encryption field.I expect they will grow through mergers and acquisitions in 2024.Their profitable ways are deposits, trading volume and chain activities.

>

14. You haven’t seen the potential of Bitcoin ETF.

+Wall Street is now interested in cryptocurrencies.

+They all have to smash a large amount of marketing funds to compete with each other.

+Eth first, then others.

This is a tsunami (earthquake, tiny correction, and then ruthless capital barriers).

>

15. DCG and Gemini and other companies are liquidated with their customers, SECs (US Securities Regulatory Commission) and Nyag (New York General Prosecutor’s Office).

+The lowest civil penalty.

+Most creditors settle in US dollars, not cryptocurrencies.

+No need to go to jail.

If you have any objections, sorry, everything is over.

16. Our quarterly report contains dozens of L0/L1/L2 networks.However, the “Fat Protocol” view still exists and will continue to exist in 2024, even in the long run, it is still ridiculous.Don’t fight against trends or memes.

>

17. Ethereum will still be centered on Rollup in the future. Most of the economic values that rebound this year will be attributed to the tokens and ETH of those Rollup chains.The price spread transaction is easy.

>

18. Solana is the return player of the encrypted industry this year. It still has space against ETH as the top integrated network.If Bitcoin is Godzla, then Solana is eating beans, and you can eat all killer encrypted applications at a time.

>

19. Encryption payment is booming on Ethereum, TRON and Solana.It is not on the Lightning Lightning Network that is not Bitcoin.Solana will continue to get market share, TRON will go with Tether or die, Ethereum will rely on Rollup on it to pay and settle.Lightning will sit quietly in the corner.

>

20. At present, the spot DEX transaction volume is about 15-20%of the spot CEX transaction volume, but the market share of PERP DEX transaction volume is lower.This gap will be greatly reduced in 2024.

The following is a potential DEFI leader:

>

21. Bridge will continue to be the root of our survival.Today, most illegal cryptocurrencies come from hacking and bad security on the chain.The attackers use different degrees of complex operations, but the unsafe bridge is the main source of attack.

>

22. Elon has won time for us, but we need a parallel social media ecosystem.The leaders in the club are Lens, Farcaster, and Friend.tech.These protocols are large and involve a lot of funds.

>

23. With the arrival of the US presidential election, the prediction of the encryption market may rise 50 times this year, but the most sustainable high -encrypted betting opportunity is in the field of gaming.Cryptocurrencies perform well in an environment where the gray market and are not clear, and the global demand for gaming betting is huge.

>

24. The battle of wallets is the most interesting, most risk, but at least mentioned war in the field of cryptocurrencies.The competing competition will upgrade cryptocurrencies from a speculative asset to a safer and easier mainstream consumer technology in 2024.

>