Author: Vince Quill, Cointelegraph; Compilation: Five baht, Bit Chain Vision Realm

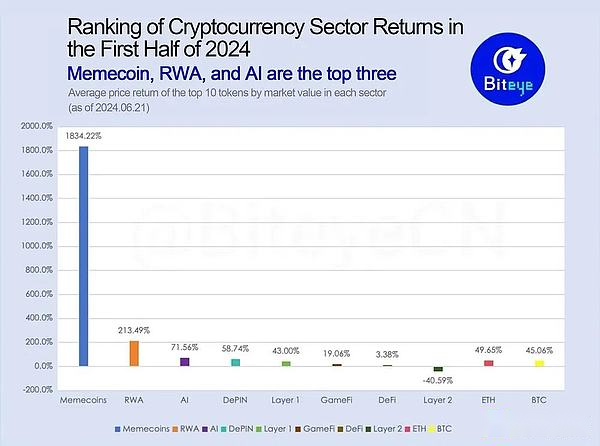

In the first half of 2024, the most profitable areas of the cryptocurrency industry have been revealed, of which Memecoin and emerging industries occupy the largest profit share.

According to data from Biteye, Coingecko and Wu Blockchain,Since the beginning of 2024, Memecoin’s return rate is as high as 1,834%, which is a leading position in competition.The second one is the field of asset -oriented in the real world, bringing 214% of the return on investors.The return rate of artificial intelligence blockchain projects is 72%, while the return rate of decentralized physical infrastructure network (DEPIN) is 59%.

The main digital assets Bitcoin and Ethereum continue to perform well. Among them, Ethereum has increased by 50%so far this year, and the return rate of Bitcoin is about 45%.

In addition, the average return of Layer 1 platform is 43%, while industries such as games and decentralized finance lag behind competitors, but they still achieve moderate returns of 19% and 3% respectively.However, the Layer 2 industry has fallen significantly, with an average loss of about 41%.

The profitability divided by the department is detailed.Source: Biteye, Wu Blockchain

Meme fanatic

The rapid rise of Meme is attributed to the Solana network.In May, 541,000 new token projects were cast on the Solana blockchain alone.Celebrities and network influencers such as Andrew Tate, rapper Lil Pump, and Iggy Azalea poured into the Internet to launch their Meme.Many of these projects have been accused of insider trading activities, and in some cases, they are also accused of raising selling plans.

The architecture of Solana and the attention of user -friendly functions deployed simplified tokens and smart contracts won the reputation of the blockchain MacOS for the network, which is the title of Pantera Capital awarded Solana.

Assets of real -world assets

If it does not solve the booming asset token industry in the real world, any industry analysis is incomplete, and the industry has become the favorite topic of institutional investors and banks.

With the migration of global investment funds, stocks, bonds, common funds and even real estate, the real -world asset tokenization is widely regarded as the next cutting -edge of digital assets, which may eventually cover $ 87.4 trillion in wealth.

Projects like ChainLink continued to make progress in introducing world assets into blockchain, and established new partnerships, and preferentially realized the digitalization of wealth through distributed ledger technology.