Source: LD Capital

1. Fundamental overview

In June 2019, Facebook (now Meta) announced the plan to build a license blockchain and a digital wallet for supporting the global payment network, and to establish the LIBRA association (later renamed DIEM)The subsidiary Calibra (later renamed Novi Finance) is responsible for developing digital wallets.But both of them were not fully realized in the end, and the DIEM and Novi ended in 2022.Later, two independent blockchains were born based on DIEM and Novi research: APTOS and SUI, Aptos inherited DIEM’s heritage, iterated on the basis of the project development technology, and Mysten Labs created a new SUI.

SUI is a new public chain. It is the first Layer1 blockchain and smart contract platform designed from the bottom up. It aims to make digital asset ownership quickly, private and secure, and everyone can access it.SUI’s name is inspired by the water element of Japanese philosophy, and the power of water comes from its liquidity -it can easily adapt and change any environment.

1. The characteristics and advantages of SUI

(1) The possibility of implementation of large -scale web3 use is strong, fast, fast, fast, and the possibility of large -scale web3:

Sui Move programming language: Under the design of the mainstream Solidity language today, assets are a numerical value, and the asset transfer is completed by adding or reduced asset transfer instead of the real movement of assets.MOVE is regarded as a resource, stored in a module. This module is similar to a smart contract. Among themIt is opaque.To put it simply, MOVE changes ownership by making assets independent and through its movement, which is also the origin of the MOVE name.

SUI has made new improvements on the basis of MOVE to form the SUI MOVE language. The main difference is that it is an object -centered global storage, address represents object ID, and object has the uniqueness of the global ID, which constitutes the underlying foundation of other SUI technology innovation.

(2) Data model centered on objects:

On the SUI, assets are type objects, all objects have the characteristics of stable, global only ID. Each object can be transferred to other objects without interaction with smart contracts, or even with your assetsDifferent smart contracts run interaction.In the SUI, all the transactions use the objects as input, and generate new or modified objects as output. By observing all activity objects, the global state can be determined.

The object is variable assets, and the object can have other objects. Developers can change, combine, and create hierarchical structures, which makes SUI have a strong combination.The combination of assets is essential for expansion. For example, you have assets such as stones, wood, cement, etc. in the game. The contract allows these assets to combine houses.The data model of most blockchain is poorly modeling for asset ownership.They are restricted, making it difficult for the state (such as games, social) applications to use them. SUI’s object -centered data model solves these availability and programming problems.

(3) Double consensus mechanism:

SUI’s system design breaks through a key bottleneck in many blockchain: it needs to reach a global consensus on the total orderly trading list.Given that many transactions do not fight the same resources as other affairs, this calculation is wasted.The SUI uses parallel protocols on causal independence affairs to divide transactions into two types: complex transactions and simple transactions to deal with, and make breakthroughs in terms of scalability.

Complex transactions: Complex transactions involving shared objects are sorted and consensus through Narwhal and Bullshark protocols of SUI.The Narwhal memory pool maintains the availability of the transaction data submitted, and provides a structured path with a loop -free diagram to traverse (selection sequence).Bullshark consensus through a specific sequence of these structured data through a specific sequence of structured data through a specific sequence of structured data.

Complex transactions need to go through five steps before reaching the final confirmation.

1. The transaction is broadcast from their respective users / client to nodes.

2. After receiving the message, the verified that the node receives the effectiveness of the message according to their equity scale.

3. After the user / client collects a majority of anti -Bybiazhan votes, a record certificate is generated and the certificate is broadcast back to the verified person.

4. The transaction certificate is sorted by Narwhal and Bullshark, so that most of the verificationrs who fight against Byzantine reached an agreement on the sorting of transaction data.

5. The verified person performs the last response, and the user collects a “influence” certificate, which is a proof of state changes and ensure the final nature of the transaction.

Simple transactions: Only simple transactions involved in non -shared objects do not need to be sorted through Narwhal and Bullshark.In other words, simple transactions can skip step 4 in the above transaction processing process.Simple transactions are only subject to the lightweight algorithm of Byzantine’s unanimously broadcast. This algorithm is lower than the consensus of Byzantine and has stronger scalability.The broadcast ensures that all nodes receive the same message from the user / client; it does not require the node to reach an agreement on the network status.Therefore, if there is no association between multiple transactions (the same object involves the same object), then these transactions can be handled in parallel in arbitrary order, and all simple transactions bypass complex consensus.

2. Team background

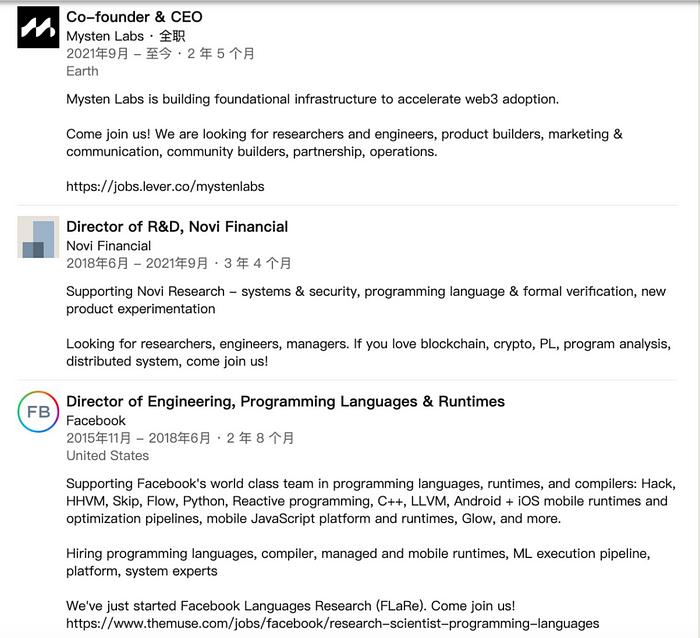

The SUI team has rich industry experience and strong technical strength. EVAN Cheng is the co -founder and CEO of SUI/MYSTEN LABS. It was once the general development of Novi Financial.With 10 years of development experience at Apple, he served as Mysten Labs in September 2021 at Facebook and Novi Financial, respectively.

SAM Blackshear is the co -founder and CTO of SUI/Mysten Labs. He was the chief engineer of Novi Financial.He has 6 years of work experience in Meta’s Libra/Diem, and deeply participate in the creation of MOVE language.

3. Financing situation

The investment background of SUI is excellent. It raised 36 million US dollars in 2021–12–06 and Series A financing. Investors include star investment institutions including A16Z, Coinbase Ventrues.2022–09–08, a round B financing raised 300 million US dollars. Investment institutions include Jump Crypto, Binance Labs, Circle Ventrues, etc.

2. Recent ecological development

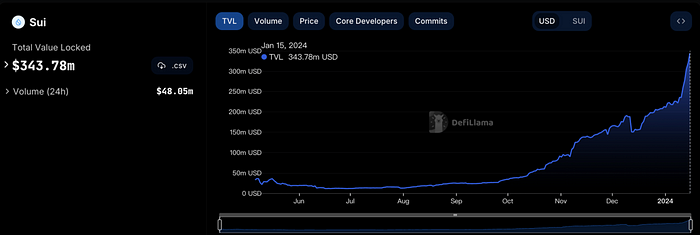

SUI is one of the fastest -growing public chains in TVL. For the past month, TVL has nearly doubled. According to data on Defillama, it exceeded US $ 175 million on December 7th. On December 26th, it exceeded US $ 200 million.September exceeded US $ 300 million, currently close to $ 350 million.

The SUI ecology has become booming from the initial lack of goodness, and it has continuously emerged with popular tracks and hot spots. It has good ecological development potential:

(1) Karrier One (DEPIN): On January 11, 2024, SUI FOUNDATION established a strategic partnership and invested in Karrier One.Karrier One是一个Depin项目,旨在构建一个去中心化的移动网络和电信服务,目标是创建一个社区拥有的运营商级 5G 网络,提供更高的可访问性、速度、成本效益和安全性。NFT Mint is currently undergoing NFT Mint.

(2) E4C (Gamefi): On January 4, 2024, E4C announced that it landed on SUI to provide mobile native MOBA games, sustainable in -game asset ownership, and seamless asset trading experience.The founder of E4C is Johnson Yeh, known as the godfather of Asian e -sports. Since 2015, he has served as the head of the E -sports business of Riot Games China.Later he became the general manager of Riot Games (China, Japan, and Southeast Asia).He also hatched “League of Legends Mobile Games”, “League of Legends War Tactical Mobile Games”, “LPL E -sports Manager”, etc. He brought MOBA games into Web3 and gave birth to E4C: Final Salvation.

(3) MRC20-Move (Intelligent Intelligence): When the inscription market is hot, MRC20-MOVE is released on January 1, 2024. The concept of intelligent inscriptions that are easy to combustion and combustion refund suddenly burst into fire.The $ Move was all finished, the locking volume exceeded 1 million SUI, and the casting address was nearly 50,000.

(4) Solend Protocol-Suilend Protocol: A few weeks ago SUI announced that the largest borrowing agreement on Solana Solend Protocol will land on SUI (also supports Solana and Sui), called Suilend Protocol.The founder of Solend Protocol believes that SUI’s technical foundation is very friendly to developers, and the developer experience around MOVE has increased by 10 times compared to Solan.

Third, the actual currency situation

1. Distribution and unlock

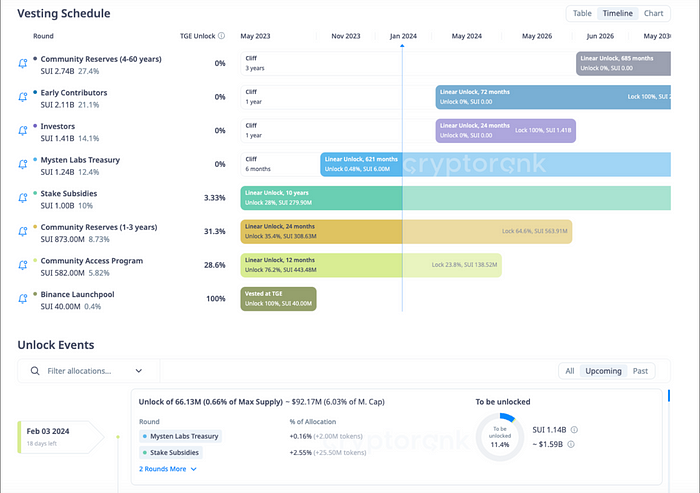

The total supply of SUI is 10 billion pieces, 48%are ecosystem reserves, 20%of private investors, 20%teams, 9%foundation, and Launchpool, Binance, accounting for 3%.The current circulation is mainly an ecosystem. Foundation and Launchpool, the circulation rate is 11%.

The current market value is 1.515 billion US dollars, FDV is US $ 13.759 billion, and the 24 -hour transaction volume is US $ 745 million.In the “Accelerating Development of SEI: Accelerating the Development of SEI: Parallel EVM New narrative” released by LD Capital Research on January 12, the data has been compared between the new public chain.Above, SUI is higher than APTOS, much higher than SEI.

SUI recently unlocked 66 million ($ 92.17 million) per month. The first large investor unlock was unlocked on May 3, 2024. There will be more than 800 million token unlocked.Token of about 100 million pieces.

There are five main categories of SUI token:

(1) Native assets of the SUI platform

(2) GAS fee: GAS fees are charged for all network operations, and participants who are used to reward the mechanism of the rights and interests and prevent spam and refuse to serve

(3) Storage Fund: SUI storage funds are used to transfer equity rewards across time, and compensate for the storage costs of data on the chain data previously stored by future verifications.

(4) Certificate of equity: The entrusted equity certification mechanism is used for the integrity of the owner of the Equipment for selection, incentives and rewarding the SUI verification, and the SUI owner related to its rights and interests.

(5) Voting on the voting chain for governance and agreement upgrade.

2. Period spot data

The price of SUI has been in a decline from May 1, 2023 (closing price of 1.2431) to October. From November to the tokens, the price began to rise slowly.Rate to 1.2506 and return to the price of 23 years.From the recent 15 minutes line, the price was consolidated in the 1.35–1.45 interval. It was supported by EMA on the 30th. Each technical indicator was good, or it rose further after consolidation.

In one hour’s spot hanging order, there are relatively many buying orders around 1.35, with a certain short -term support. The densely sold orders above are 1.42 and 1.5.

In terms of futures data, the 30 -minute contract holding the position has decreased from a certain height. The number of long -term positioning ratio is 1.06, and the large number of large positions holds a long and short ratio of 1.33.Conquest in the state of market savings.

Fourth, summary

1. The MOVE language used by SUI is highly expanding, good programming, low speed and low cost, etc. The ecological development is booming and the emergence of hot spots.The team has a solid technical ability, a good investment background, and a good fundamental foundation.

2. The tokens have no large unlocking for nearly 3 months. The first investor unlock in May. The new public chain data has advantages.

3. The price of tokens has just returned to the price level of the 23rd year. The current spot transaction volume is active. It is currently in the trend of consolidation or further breakthrough.