Author: Christopher Tepedino, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

According to Argentine newspaper Clarin,An Argentine law firm filed a criminal lawsuit against the U.S. Department of Justice (DOJ) and the FBI on February 17, pointing out the mastermind behind the LIBRA token collapse.The lawsuit also calls for investigation into the role played by Argentina President Javier Milei in it.

On another legal side, the Citizens Alliance ARI filed a criminal lawsuit on February 17, asking the Justice Department to investigate allegations of bribery and fraud that President Milei was suspected of pushing, adding that “the government cannot be both a judge and a jury.”

LIBRA tokens rebounded after President Mile posted a post on X on February 14.The post has now been removed, highlighting that the project will be used to fund “Argentine small businesses and startups” with a contract address, which caused the token’s market value to rise to $4.56 billion before plunging to a few hours later$257 million.

These latest legal challenges build on criminal charges filed earlier in Argentina, accusing Mile of participating in fraud by supporting tokens.

in turn,The government has been trying to draw a line between the Argentine president and the scandal, saying Mile was “good-intentioned” by traders who launched LIBRA and that he didn’t know the financing mechanism.

After the country’s fintech chamber acknowledged that LIBRA could be a scam,President Mile may eventually face impeachment charges.

“This scandal has brought shame to us internationally and we need to make a request for impeachment against the president,” opposition lawmaker Leandro Santoro told Reuters on Feb. 16.

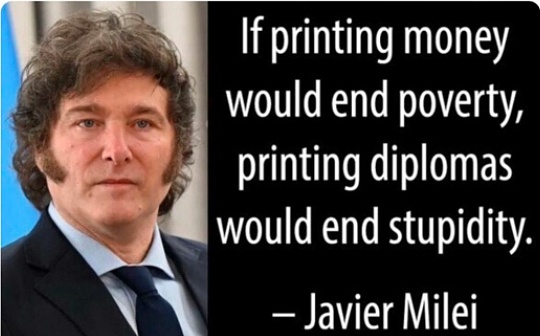

February 17,US President Donald Trump posted on Truth Social, sharing a photo of Mile, with the caption: “If printing money can eliminate poverty, printing a diploma can eliminate stupidity.”On X, Miley retweeted several screenshots of Trump’s post.

In an interview with Coffeezilla, LIBRA founder Hayden Davis defended the token’s crash, calling it a failure rather than a scam, saying: “All the complaints on social media are those that don’t have one.What the people who participate in the transaction say. If they participate in the transaction, you will never hear them complain. ”