Author: Marcel Pechman, Cointelegraph; Compilation: Deng Tong, Bitchain Vision Realm

Since falling to $ 2,396 on August 27, ETH has risen 7.5%, but 22% of the past 30 days indicates that investors still feel uneasy about their own positions.Although Ethereum’s network activities are increasing, the price of Ethereum has not yet shown signs of recovering the level of $ 3,800 in early June.

Ethereum ETF spot demand explains the weakness of ETH

Given that the market value of Congzhong has decreased by 13%in the past 30 days, this means that Ethereum’s performance is not as good as similar currencies, and this situation is even more worrying.This trend partly attributed to people’s expectations for the launch of the spot trading fund (ETF) in the United States on July 24.However, there are more reasons, because the recent transaction price of Ethereum is $ 3,200 on April 24.

The Ethereum Multi -headed hopes to pin on the average transaction fee of Ethereum recently declined, which is the first time in four years to fall below $ 1.Coupled with the successful dependence on the second -level solution for projects that require higher throughput, the dominant position of Ethereum in the decentralized application (DAPPS) is still no one to shake.

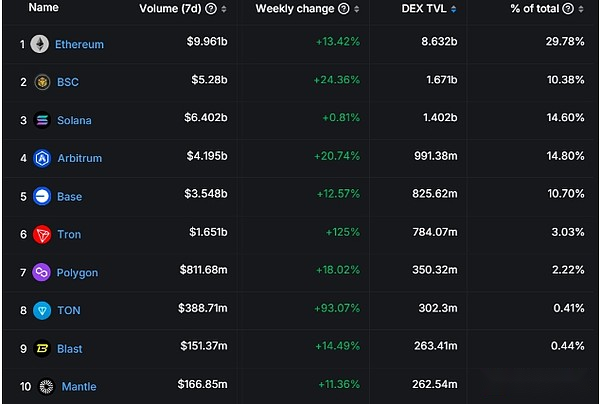

7 -day transaction volume of decentralized exchanges, US dollars.Data source: Defillama

Ethereum’s loser believes that the competitive chain provides lower costs on the basic layer, providing novices with a simpler user experience.In fact, most users are not worried about the high centralization of TRON or BNB Chain or the excessive cost of running a Solana verification device.The success of Ethereum’s own second -level solution Base shows that users pay more attention to directly accessing Coinbase, not self -sovereignty.

Ethereum network TVL and transaction volume continues to rise

Regardless of whether Ether’s price benefits from its second -level ecosystem, the total lock value (TVL) on the Ethereum network has been rising.According to the data of Defillama, the total deposits in the DAPPS of Taifang increased to 18.9 million ETH, an increase of 4%over two weeks ago.In contrast, TRON’s TVL decreased by 10%in the same period, while the deposit on Avalanche fell 4%.

Symbiotic, which was launched on the Ethereum network recently, has shown the most significant TVL growth in the past two weeks, an increase of 83%to 640,310 ETH.Similarly, the total deposit on the Ether.Fi mobile pledge agreement increased by 15%.However, it is misleading by analyzing its TVL that Ethereum ’s network activities have increased, because most DAPP does not require a large amount of deposit foundation.

According to DAPPRADAR data, in terms of network activities,The DAPP transaction volume of Ethereum increased by 36%from July 22 to July 29. It was mainly driven by the decentralized exchange UNISWAP and automatic as the city merchant BALANCER. The former transaction volume increased by 35%to $ 30.8 billionThe latter’s transaction volume increased by 46%to $ 18.1 billion.In contrast, the DAPP transaction volume on the Solana network is about $ 6.3 billion per week.

Ethereum DAPP ranking at the forefront (calculated by 7 days of transaction volume, USD).Source: dappradar

Active address and transaction number decreased

However, since August 22, Ethereum network activities are not all positive.For example, the number of active addresses interacting with DAPP remains unchanged, and the total number of transactions has dropped by 8%.In contrast, the active address of BNB Chain increased by 7%, while Solana’s users in the same period increased by 10%.

According to the data of Farside Investors, Ethereum’s performance has also been dragged down by the weak inflow of the Ethereum Etf Fund in the spot.These data highlighted that although similar Bitcoin spot ETF tools were strong, the net inflow of 523 million US dollars at the same time, institutional investors lack interest.

final,There is no obvious excitement in the Ethereum network, which cannot prove that the price of Ethereum rises sharply is reasonable.Critics may think that the average transaction fee of Ethereum is not enough to fall below $ 1, especially considering that the cost provided by competitors such as BNB Chain and Solana is much lower.at last,Data show that the price of Ethereum is not directly related to the event on the chain.