Author: Stacy Muur Source: Stacy in Dataland Translation: Shan Oppa, Bitchain Vision

Over the years, no new blockchain has been able to challenge Ethereum’s dominance as the second largest asset in cryptocurrency.But, as users migrate to L2 and ETH has inflation, is it still a powerful blockchain now?

In 2020, Ethereum turns to an L2-centric roadmap.Now, after Dencun,rollups account for 87% of all daily transactions.

However, this expansion solution has also been criticized because Ethereum’s gas fees are at its lowest level in years, causing inflation in the ETH economy.Furthermore, Ethereum’s recent underperformance against BTC and SOL also confirms critics’ views.

Is Ethereum still a competitive and viable blockchain?Let’s find out.

The current situation of Ethereum

Ethereum’s deflationary narrative seems to be in danger.

In the second quarter of 2024, Ethereum experienced its highest quarterly inflation rate since its transition to the Proof of Stake Consensus through The Merge in September 2022.

The reason for the surge in inflation is the sharp drop in Gas consumption rate and the price of Gas is unusually low.According to Ultra Sound Money, the network currently charges only a typical transaction1 gwei .

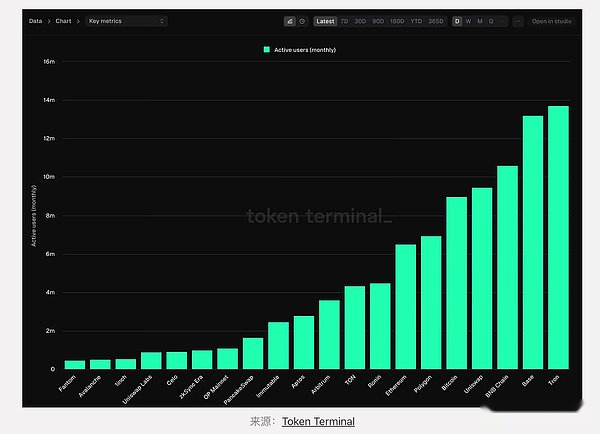

Token Termial data reveals the following information about Ethereum:

-

Ranked number one in revenue, but Tron and Tether are catching up quickly.

-

Total lock value (TVL) ranked first at $50 billion.

-

Ranked third in the number of token holders, BNB Chain and Tron have surpassed Ethereum.

-

Calculated by monthly active users (MAU), it is the seventh largest agreement with 6.5 million users.

-

Ranked 11th in the number of transactions.

-

Trading times per second (TPS) ranks 12th.

-

By daily active users (DAU), it ranked 12th at 371,000, behind Bitcoin L1’s 410,000.

-

Disadvantages of Rollup strategy

-

As mentioned above, the economy of reduced user activity, inflation and poor performance have sparked criticism of Ethereum.Is there anything else?

-

Some analysts discussed the impact of Ethereum’s rollup-centric strategy on ETH value and highlighted potential risks and uncertainties.rollup strategy assumption L2 willcontinueUsing Ethereum’s block space, bringing more users and fees back to Ethereum in the long run.

-

However, Ethereum cannot ensure that L2 is consistent with its underlying layer.There is a risk that L2 may develop its own ecosystem and split it into separate chains and no longer pay Ethereum.

-

If this happens, Ethereum’s trading activity value may be reduced and its revenue is at long-term risk as L2 stops contributing fees.

on the other hand…

Despite ETH’s recent underperformance and challenges such as reduced fees and user migration to L2, Ethereum remains a powerful platform with a strong community.

The widespread use of ETH in DeFi on L2 shows the prospects for this assetoptimism, because L2 may become an important economic hub with ETH as its core.

-

On Arbitrum, assets related to ETH account for the total valueMore than 50%, worth nearly $590 million.

-

On Base, ETH and its derivatives account for the supply assetsMore than 80%, totaling nearly US$140 million.

-

According to Optimism, ETH-based assets account for nearly the total value50%, worth about $110 million.

In addition, Ethereum is the oldest and most successful smart contract platform, with a strong and resilient community that has withstood various challenges, including major upgrades such as “mergers”.

The power of the Ethereum community isA key difference factor, because it cannot be built quickly and is crucial to the long-term success of the platform.

L2 gained great value from its alliance with Ethereum and is unlikely to leave.

Finally, the Ethereum community rekinds its enthusiasm and plans to proceedBasic layer extension, and even launch more efficient L2s (such as MegaETH).