Author: Chen Mo CMDEFI, Source: Author Twitter @cmdefi

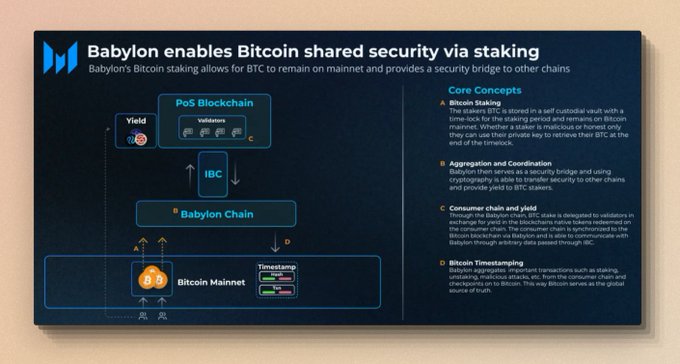

Core point: Using Bitcoin’s economic security and COSMOS IBC cross -chain communication technology, BTC holders are allowed to provide an additional pledge mechanism with a unique pledge mechanism without leaving the Bitcoin network without leaving the Bitcoin network.Safety layer, exchange for income.Use the advantages of the workload (POW) to provide security supplements to the equity certificate (POS).

-

“Remote pledge” retains the pledged BTC on the maincoin main web.

-

Create a customized pledge contract on Bitcoin. Babylon uses the Bitcoin script and restricted clauses to customize UTXO operations and create a special trading type to complete the pledge lock function.

-

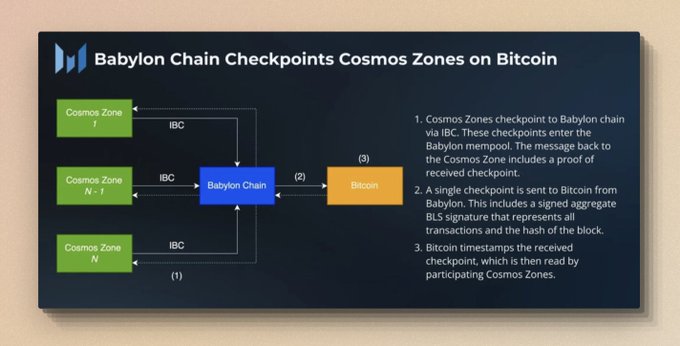

Use the COSMOS IBC cross -chain communication protocol to seamlessly aggregate, convey messages and data between Bitcoin and other blockchain.

-

Extra security layer.By recorded some key data of the POS blockchain (such as trading hash, important decision -making or status update), to the Bitcoin blockchain and set up a “checkpoint”.Babylon can provide these data that provides a time -stamp that cannot be tampered with, which is equivalent to a snapshot of the POS chain status and regularly anchor to the Bitcoin blockchain.

-

Bitcoin main network

-

BABYLON aggregation layer

-

IBC communication protocol

-

POS consumer chain (target POS blockchain)

-

Data Submission: The nodes on the POS blockchain generate some important data and convert them into hash, such as transactions or block information.

-

Send to Bitcoin Network: Babylon Chain is responsible for collecting these hash and aggregating them to pack them. Through IBC, the packaged hash collection will be submitted to the Bitcoin blockchain in a specific transaction.

-

Generating timestamps: Once these hash have been recorded on the Bitcoin blockchain, they get a timestamp from the Bitcoin blockchain.This generates the “checkpoint”, which inherits the security of the Bitcoin network, which is recognized and unchanged worldwide.This means that anyone can view this bitcoin transaction and confirm when the data are submitted according to the timestamp.

-

Use timestamp: POS blockchain can use these timestamps to verify the correctness and timeliness of its data.For example, when dealing with the authenticity of transactions or verification blocks, they can quote these timestamps.

-

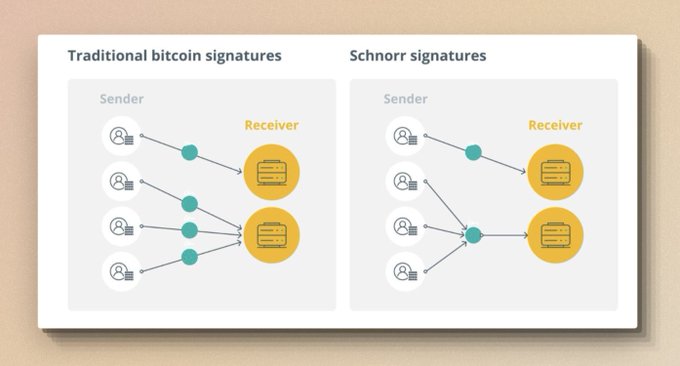

Schnorr’s signature provides an efficient (aggregation) and security way to handle the signature of the Bitcoin pledged.

-

EOTS is used to allow the pledged to attack the network with dual payment attacks, allowing automatically extract private keys from the signature generated by malicious behaviors and automatically perform SLASHING.

-

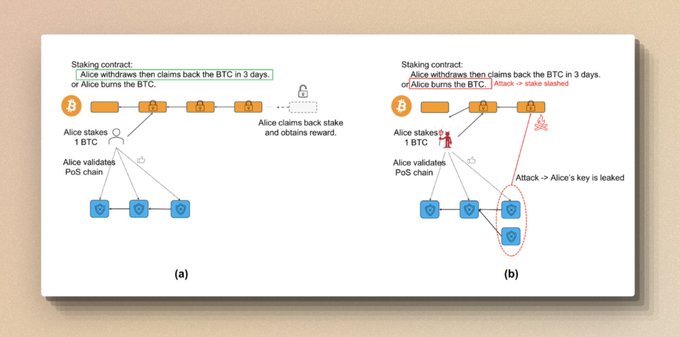

(A) The Road to Happiness: Alice pledged, verified the POS chain, requested to lift the binding, and the pledge was lifted within 3 days.

-

(b) Unfortunate road: Alice pledged, committed security crimes against the POS chain, and then her BTC was burned.

-

Most BTC holders are unwilling to let BTC leave the Bitcoin network

-

Worried about the security of packaging assets such as WBTC, TBTC

-

Excessive income

-

Some BTCs are in a state of sleep (according to

Coinshares

Data, 25%of the BTC supply has been idle for more than 5 years, and 67%have been idle for more than 1 year)

-

BTC’s native pledge on the Bitcoin network, and provides higher income opportunities

-

Reduce the security budget of the POS chain and reduce the tokens that attract pledges

-

Provide POW’s security supplement for POS chain -relieve “long -range attack”

-

Provide POW’s security supplement for POS chain -improve active attack threshold

Research report

Plan analysis

As the second market value of assets, Ethereum completed the first stage of mission to become the largest smart contract platform at present.Now through Eigenlayer’s “RESTAKING” concept goal, it has become a security layer of other networks.

In the POS consensus mechanism, one of the main sources of security of the blockchain is to attract a large amount of capital through pledged assets, and gradually establish economic security and larger networks.The more difficult to such a high consensus asset.At present, the two types of assets with strong consensus are BTC and ETH. In order to solve this problem, projects like Eigenlayer use ETH’s security to protect other blockchains or AVS instead of guiding it through high -cost tokens issuance to guide itEssence

As of now, Eigenlayer has achieved great success and has attracted more than $ 15 billion TVL. Then Bitcoin is the most consensus, the strongest security, and the only POW chain.This will also provide a good POW security supplement for the POS consensus mechanism. It is better not to argue that POW is better.

Babylon is committed to creating BTC pledge, allowing BTC holders to share more than $ 1.3 trillion in economic security with other networks without leaving the Bitcoin network in exchange for pledge income.In terms of plan, BABYLON has achieved the records and verification of key data submitted by the POS chain through remote pledge, customized pledge contract, timestamp, and EOTS (one -time signature).Computing logic and smart contracts, so there is still basic logical operations inside the POS chain, and the Bitcoin POW security provided by Babylon is a “extra security layer”, which is a supplement to POS security. It can also be said that it is also said that it is.Promote the integration of POS and POW at the safety level.At the same time, due to the different consensus mechanisms of Babylon and Eigenlayer, the two products are different in terms of service objects and protocol goals.This will be discussed after explaining the core principle of Babylon.

BABYLON architecture

Babylon is essentially a polymerization layer to build security between any POS blockchain and Bitcoin. If a BTC holder wants to pledge their assets, they can go to babylon to choose the qualified network they want to pledge,Then lock their BTC on the BTC main network, converge the key data of POS on the Babylon Chain aggregation layer, and send it to the Bitcoin network through IBC to establish a “checkpoint” through IBC. The end users can receive the benefits of the target POS network.

In this way, pledges can continue to hold their BTC and earn additional benefits, while POS networks pay some costs inherit the economic security of Bitcoin.

Source: Messari

Remote Staking

Remote pledge is a way to allow asset holders to provide pledge verification services for other networks without moving assets out of its native chain to obtain benefits.The key to Remote Staking is to maintain the autonomous control of assets and avoid being achieved through third -party agents (such as hosting services or bridge services).

In the Babylon project, Bitcoin holders can pledge the user’s BTC on the Bitcoin network through Remote Staking instead of the traditional transfer to other chains or through centralized services.This is a “customized pledge contract” achieved by the improved Bitcoin script and a specific transaction type.

Bitcoin customized pledge contract

Because Bitcoin does not support complex smart contracts, Babylon must implement pledge function within the existing script language range of Bitcoin.Bitcoin is different from Ethereum. It uses UTXO (without spending transaction output) model, that is, each transaction output can become another transaction input.

BABYLON uses the Bitcoin script and restrictions to customize UTXO operations. It is simply understanding the behavior of customizing Bitcoin through a tool and creating specific contract logic. It supports users to lock their Bitcoin for some time. OnlyAfter the lock -up period is over, users can use their private keys to redeem these assets.This “customized pledge contract” replaces the pledge contract implemented through smart contracts.

Submit data and verification

The use of timestamps helps to prevent some security issues, such as replay attacks (the old transactions are re -submitted to deceive the network) and long -range attacks (by creating an alternative chain from the old state).

Security and punishment mechanism

Although Babylon has achieved basic pledge functions through customized and special UTXO operations, there is still a certain gap in the smart contract itself. For example, the punishment cannot be performed through the logical operation of smart contracts. ThereforeReduce mechanism.

In the design of babylon

sign

To ensure the smooth operation of all mechanisms.

The Schnorr signature was introduced in the Taproot upgrade in Bitcoin 2021. It is mainly to solve some restrictions on traditional signatures to achieve a more efficient and concise signature method. The main feature is to allow multiple signatures into one.It is very useful for multi -signature transactions and complex script transactions, and it can also significantly reduce transaction size and costs.

In terms of security, due to the limited expression capacity of the Bitcoin script, it cannot directly implement a complex punishment mechanism (such as Slashing) similar to POS blockchain, so Babylon realizes the Slashing mechanism through a clever design.

If the private key of a Bitcoin pledker is used to sign two different blocks within the same time, this behavior will be considered a trial of a double payment attack, and their private key will be made public. In this caseNow anyone can pretend to be a pledker, and send the reduction of the transaction to the Bitcoin chain and burn the BTC of the pledged state.

This is achieved through EOTS (one -time signature), which is compatible with Schnorr’s signature.This is a special form of encryption that ensures the integrity of the signature of the block and punished improper behavior.This process involves an additional consensus layer, called the “end wheel”, which plays a role after the basic consensus protocol function of the consumer chain.Only after collecting more than two -thirds of the EOTS signature involved in BTC pledge can the block reach the final determination.If any authenticator tries to attack the protocol by signing two different blocks at the same block, the EOTS system will ensure that its private key is leaked.

The system also solves challenges to execute punishment on blockchain that lacks smart contracts and complex trading types like Bitcoin.

BTC pledker’s journey

BTC pledker Alice journey:

Market space

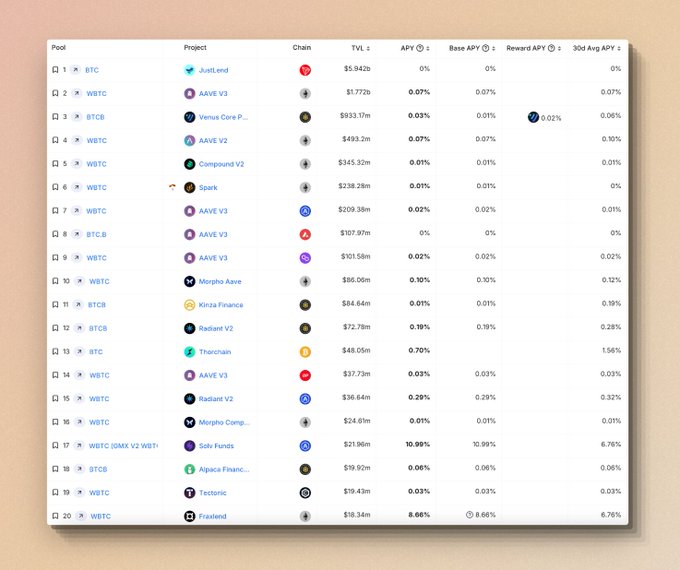

According to DEFILLAMA data, most of the current Bitcoin single currency income market is between 0.01%-1.5%, and the size of 5%-10%is very limited.

The market value of BTC currently reaches 1260B (1 BTC = $ 64000), and the market value of WBTC is 10B. At present, the BTC that is actively obtained in DEFI is less than 5B, which is related to several aspects:

A referenceable data, in 2021, Celsius attracted 43,000 BTC by providing a competitive 8%yield to BTC holders, currently worth nearly $ 3 billion.It can be speculated that idle BTC holders have demand to gain benefits in their assets, but the current main friction points are low income, centralized trust assumptions and risks.

So assuming that through Babylon’s pledge can capture nearly 8%of the income, then this may reach the scale of $ 3 billion, combined with Babylon’s decentralized characteristics, native BTC pledge does not need to leave the Bitcoin network, it may be possibleIntellectual.

What problems are solved

According to the current project information, Babylon solves 4 problems:

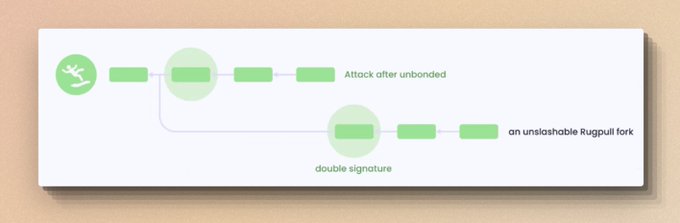

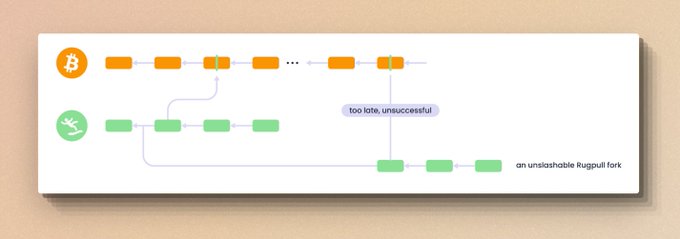

Long -range attack

Let’s take a look at what is “long-range attack”. It is also called Long-Range Attack, which is a specific security risk faced by the Blockchain of Equity (POS).This attack involves the pledgee’s use of their pledged token after unbundling (that is, the pledge funds) to create a bifurcation at a certain early point of the blockchain history.This attack attempts to use the past pledge status to rewrite the historical record of the blockchain.

Attack process 1. Attack starting point: The attacker selects a certain early point in the history of the blockchain, which is usually the time point where their pledge is still effective.Then, they started to secretly build a private split chain at this point.

2. Build a fork chain: The attacker builds a block on his own fork chain, which may include invalid or fraud transactions.Since they have enough pledge rights at this historical time, which blocks can they affect this fork chain.

3. Publish fork: Once the fork chain is long enough, it covers the same period of the same period on the main chain, and the attacker can publish it.Because the POS protocol usually accepts the heaviest chain (that is, the most accumulated pledge right or the longest chain) as the valid chain, the bistan of the attacker may be accepted by the network as an orthodox history.

In the POS system, it is relatively easy to reorganize old blocks (that is, blockchain reorganization) because it does not need to be calculated like POW.The attacker only needs to show a long chain that is longer than the main chain or has a “weight” chain longer than the main chain, and it may persuade the network to accept its chain as a valid chain.

This attack usually involves emerging or smaller POS chains with fewer network nodes, weaker monitoring and security measures, because such a network is more likely to be affected by a small number of pledges.

In order to alleviate long -range attacks, the general POS chain will set a minimum unbinding period, usually 7 days, 14 days, and 21 days.You can get the pledge assets.Settling period means that once the verifications decide to unbink their funds, these funds will not be available immediately.During this period, their pledge is still regarded as part of the network security, but they cannot use these pledge to verify new blocks or participate in consensus decisions, which will greatly increase their costs and complexity of launching attacks.

How does babylon alleviate the “long -range attack”?

BABYLON sets up the “unbinding” operation of the POS chain by setting a checkpoint on the Bitcoin blockchain. The advantage of this is to use the strong consensus characteristics of Bitcoin to provide an external security verification point for the POS chain.Reduce the possibility of time required for unbinding, from a few weeks to a few hours, which can significantly improve the liquidity and efficiency of funds.

Active attack

Secondly, understand what an active attack is. It refers to a minority verification person (such as one -third) trying to review or block certain transactions or operations to affect the normal operation of the chain.For example, the verifications do not include certain transactions, which may be due to their own interests or external incentives.

How does babylon improve the active attack threshold?

Babylon uses the security of the Bitcoin blockchain to create a checkpoint.These checkpoints are snapshots of the POS chain status, which are regularly anchored to the Bitcoin blockchain.This method enhances the security of the POS chain through the non -tampering of Bitcoin blockchain, and provides a credible and external verification record for important decisions or status on the POS chain.

In addition, Babylon has improved the economic and technical costs of active attack on POS by creating an additional security layer on the Bitcoin blockchain.(It may include destroying the strong consensus of Bitcoin)

Comprehensive analysis of comparison with Eigenlayer

Restrictions: No smart contracts cannot achieve more advanced security support

In the industry, BABYLON is compared with Eigenlayer. EIGENLAYER is to coordinate the needs between AVS and RESTAKER again by writing smart contracts. Theoretically, as long as smart contracts can be written, Eigenlayer can be competent for the task, such as supporting ETH RESTAKING and Agreement.The dual pledge demand for tokens is set up, and the proportional parameters can be adjusted. It provides an extra layer of Ethereum -level security protection for existing middleware. It can also directly build a consensus layer of new middleware.Although the risk of smart contracts has also been introduced, its business can be more widely supported.

Babylon is currently implemented by setting up a “checkpoint” through the status of regular snapshot POS chains on the Bitcoin chain, so as to provide a strong and credible, external verification record based on the protected POS chain.Although it realizes the native pledge lock of BTC through the customized UTXO, it still does not have the function of smart contract -level, and cannot handle and coordinate complex needs and logic.

Restriction: Limited to IBC

Babylon uses IBC to aggregate data and communicate between Bitcoin and any POS blockchain.This is a necessary prerequisite for BTC pledge and set up a checkpoint through time stamp.The reason for using IBC is that it has the ability to seamlessly transmits any data between different chains and the ability to verify the information.At present, Babylon’s current addressable market is 91 cosmos chains that support IBC.However, the IBC -based expansion protocol is gradually constructing, such as Composable is establishing IBC support for other networks such as Ethereum, Polkadot, Solana, NEAR, and TRON.

Advantages: The market space of idle BTC is very large

Compared with Eigenlayer, the underlying assets aimed at Babylon are BTC, and according to the discussion in the [Market Space] part, the number of idle BTCs is very huge. At the same timeMore partners access Babylon to provide considerable benefits for BTC pledge, so the market growth will be very rapid.

Same points: economic security support

The same place as EIGENLAYER is that Babylon also provides economic security support for some small -scale POS chains, increasing the economic and technical costs of attackers on small -scale POS chains.

Different points: service objects and goals

BABYLON may be more effective in alleviating long -range attacks and shortening POS asset pledge. For example, if OSMOSIS cooperates with Babylon, it may only take 1 day or even shorter when lifting the pledged OSMO (for 14 days). This is relatively clear.need.Of course, Babylon brings BTC’s POW POW consensus to POS, and it may be more likely to unlock as the protocol matures.

Eigenlayer relies on the huge ecology of Ethereum to radiate the security of Ethereum to all corners and middleware through smart contract+pledge.Therefore, EIGENLAYER has completely obtained the natural advantage of smart contracts in terms of scalability, and has more diversified service objects and functions.