Author: Duo Nine, compiled by: Shaw bitchain vision

This week, gold prices hit a new high, with over $3,500 per ounce.Bitcoin price has hit an all-time high of $125,000 and is likely to rise further later this year.

Investing in scarce assets will be the first choice for the next decade.

Today, people’s trust in the central bank’s fiat currency has dropped to an all-time low.It can be said that when the issuance of currency (such as USD) is unlimited, the price of Bitcoin or gold may also tend to be unlimited.

It’s just a matter of time.That’s why I’m mainly holding gold and Bitcoin today.

In this environment, scarce assets will continue to set new records.That’s why you want to hold them.

what happened

The world is about to enter a high inflation and low interest rate environment. If the Federal Reserve cuts interest rates in mid-September and continues to cut interest rates in the future, there will be only one result.

Prices for everything are rising, especially scarce assets like gold or Bitcoin.It seems to me that these assets are already pricing for such a future.

In fact, central banks cannot curb inflation by raising interest rates, because doing so will lead to market collapse.The Ponzi scheme bubble of fiat currency is too big to be solved in this way.It is impossible to pay high interest rates for such a huge bubble.

In order to avoid the economic crisis, central banks of various countries have chosen to balance the two evils and choose the least.Reduce debt through inflation.This means that they will print a large amount of fiat currency, making past debts controllable and easy to repay.

In this process, anyone holding or saving cash will suffer from currency devaluation and dilution, and ultimately a significant decline in purchasing power.Given this, it becomes crucial to protect wealth with gold and Bitcoin.

Interestingly, central banks around the world are also buying large quantities of gold while reducing their holdings of U.S. Treasury bonds (or fiat currencies).They are very aware of what is going on and are hedging this future risk.

Golden decade

Looking back at the gold price trends over the past 30 years, we found a very interesting phenomenon.Its price seems to go through a cycle every 10 years:

-

2001-2011, the price has risen by nearly 7 times;

-

2012-2022, correct and stabilize the trend (long-term stagnation);

-

2023-2033, after a major breakthrough, it rose sharply.

We cannot be sure whether this will trigger another decade-long bull market, but the conditions are already in place.I have accumulated gold since 2021, and this investment has always performed better than the US stock market.

I’ve also sold most of the altcoins over the past two years, with the goal of simplifying my investments and focusing on what really matters: Bitcoin.

In addition, U.S. stocks remain negative so far this year after gold or inflation adjustments.See the figure below.On the left is gold adjusted data, and on the right is the same S&P 500 index denominated in euros.

Obviously, the denominator is important.Simply put, with the US dollar as a reference, everything has risen because the value of 1 US dollar plummeted in 2025, depreciating gold by 25% and depreciating euro by 13%.

That’s why when mass media reports that U.S. stocks hit a new high this year, it’s just in dollar terms.Priced in gold, the U.S. stock market has been in a bear market since 2000.

In this environment, investing in the U.S. stock market is very risky.Many Europeans are regretting that they have invested in US stocks. In the euro, their “returns” are still negative.

Solution

Some people call it escape from the matrix, get rid of the debt system, or simply withdraw from the fiat currency Ponzi scheme.You can do this by buying scarce assets and selling fiat currency.Michael Saylor’s strategy is exactly the same: shorting fiat currency.

As mentioned earlier, our global financial system is a huge bubble supported by unlimited legal debt.This foam can be stabilized in two ways:

-

If the economy grows sharply, inflation will be lower

-

If you can pass on inflation to others (let them continue to be poor)

After the COVID-19 pandemic, all this no longer exists.What’s different this time is that its impact has actually affected the “golden billion people”.The so-called “golden billion people” refer to people living in the green countries below.

Inflation has swept the country and cannot be alleviated through exports.It’s really a dilemma.

It happens that other countries are growing faster and faster.Worse, they knew that the global financial system, which was denominated in US dollars, had collapsed, so they bought a large amount of gold from their growth proceeds.Other countries are also hedging, which will only accelerate the bursting of the bubble.

No matter your position on the above map, the fundamentals of gold and Bitcoin will not change, and they will protect you from future risks.They are the best choice we have.If you want to protect your wealth, there is nothing better than them.

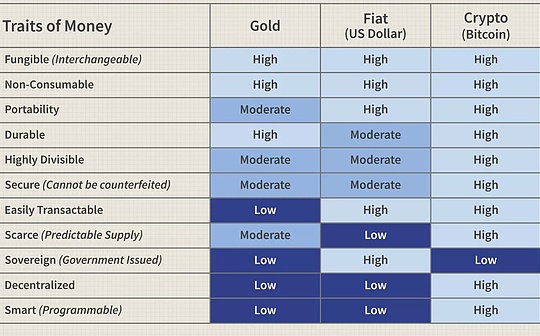

This will bring instability, conflict and currency collapse.In uncertain times, traditional safe-haven assets are gold.Thanks to the digital age, we now have Bitcoin, which is even better than gold in several ways, the reasons are shown in the following table.

What is unique about gold and Bitcoin is that they are neither politically influenced and are highly favored in any country, regardless of the country’s politics, governance or financial system.

This is the most ideal hedging method in an uncertain world.