Author: Jake Pahor, encrypted researcher; Translation: Bit Chain Vision Xiaozou

The Solana ecosystem is full of the hottest Defi development.Guess what?Solana may have just started a project that can be higher with Chainlink.This article is my latest research on Pyth.

The main contents of this article include 11 parts: 1. Overview; 2. Use cases; 3. Use; 4. Increase; 5. Virgin Economics; 6. Valley; 7. Governance; 8. Team and investors; 9. Competitive opponents10. Risk and audit; 11. Conclusion.

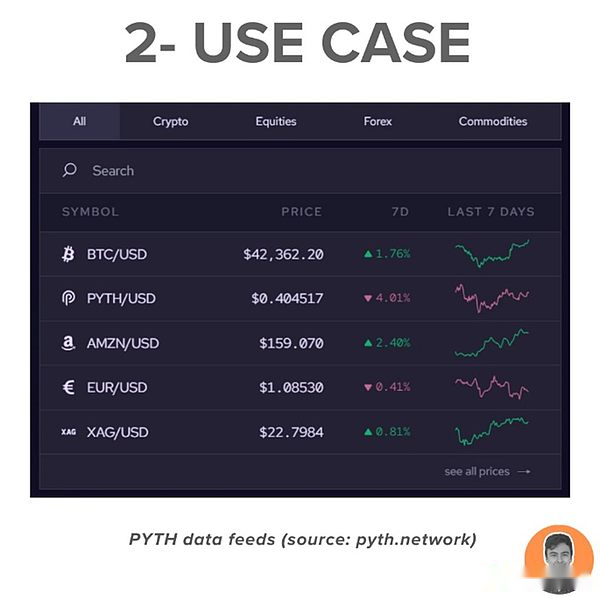

The Pyth network is currently the biggest and fastest -growing first -party Oracle (prophet) network. It provides real -time market data for more than 45 blockchain financial DAPP, and provides more than 400 low -delay price information for the following businesses:

-

Cryptocurrency

-

stock

-

Foreign exchange

-

Commodity

In the traditional market, price information is usually owned and controlled by several centralized entities.

The decentralized price prophet plays a vital role in the cryptocurrency field.They provide accurate price information that everyone can access.

But the Pyth network is not only the chainlink of Solana, it also has more characteristics.

-

Pyth Oracle price is updated once every 400 milliseconds

-

Update 200,000 times a day

-

449 price feeds

-

More than 250 apps

-

Super 45 blockchain

-

Daily update exceeds 80 million times

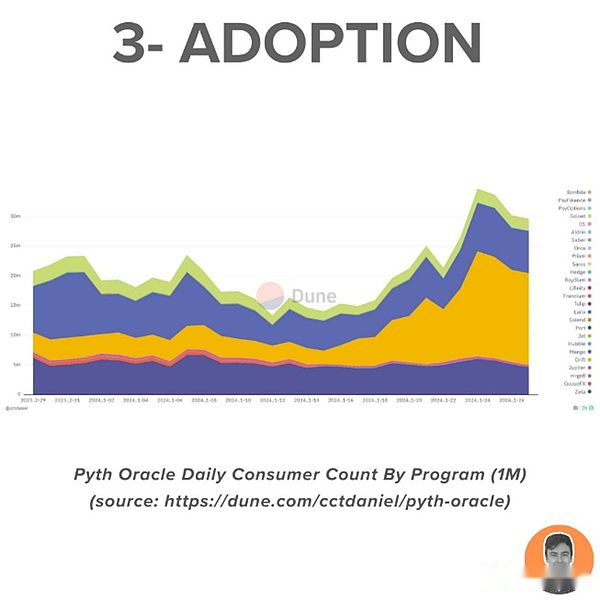

The Pyth network has been rapidly popular.The following are some amazing data of a certain 24 -hour recent:

-

40 million publisher prices update

-

5.5 million publishers price update transactions

-

118 daily living consumers

-

70,000 daily live users

-

26 million user interaction

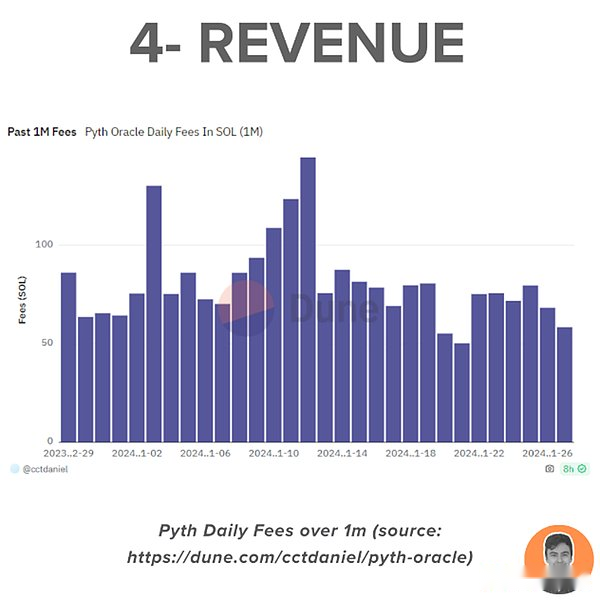

Consumers need to pay to access data through the agreement.These expenses charge a fixed rate at the price update cycle of each Pyth on the target chain.

In the past month, the agreement cost has been maintained at 50-80 SOL.

It is $ 4800-7,600 a day.

Pyth is a governance tokens for the Pyth network.Token holders can vote for the update proposal of the agreement.

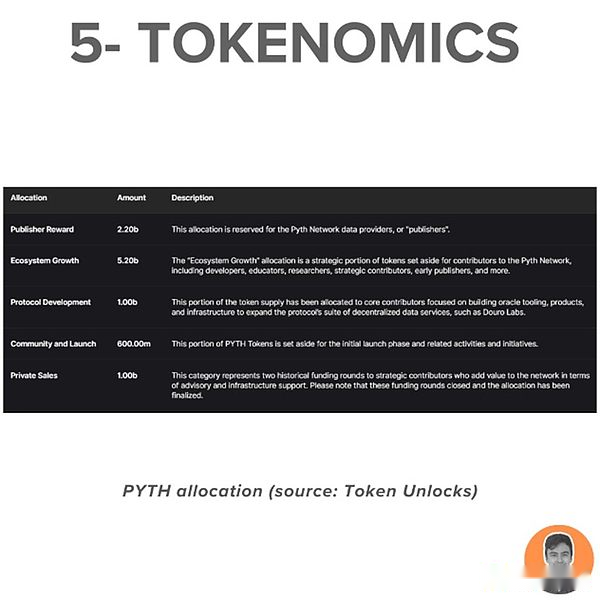

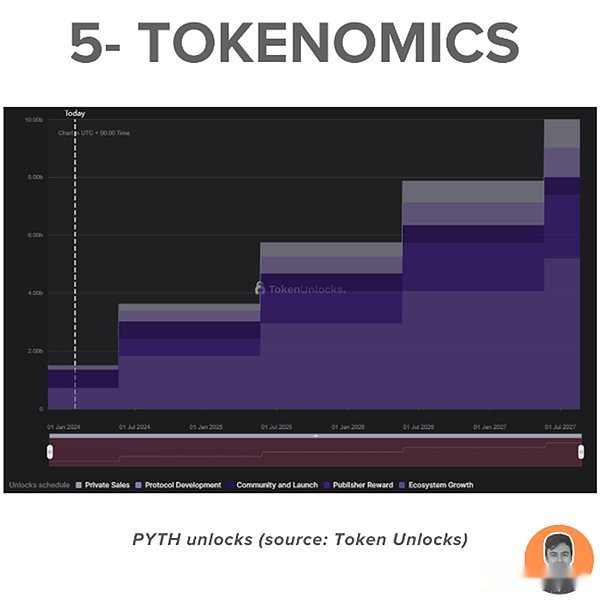

52%of the token supply will be used for “ecosystem development”, 22%are used for publisher rewards, and 10%are used for internal sales and agreement development.

In November 2023, Pyth Networks swapped 6%of tokens to online users and community members.About rumors about Pyth pledged airdrops are endless.

Current supply data:

-

Circulation supply: 1.5 billion pieces

-

Maximum supply: 10 billion pieces

-

Market value: $ 580 million

-

FDV: $ 3.87 billion

-

Market value/fdv: 15%

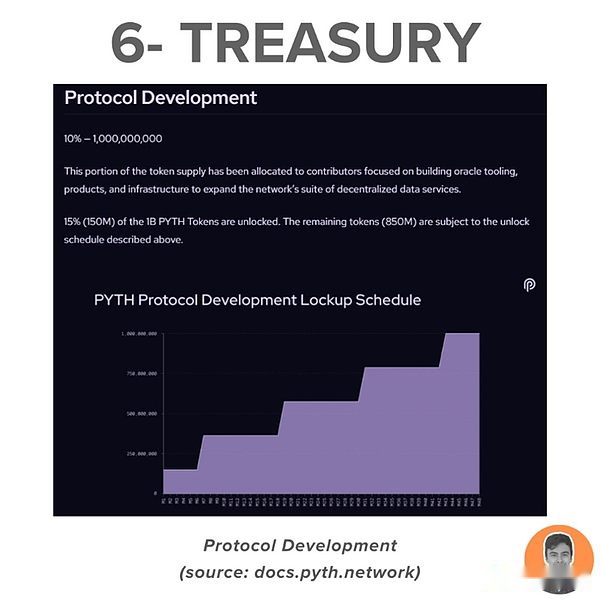

There is no vault in the Pyth network, but it distributes 1 billion Pyth tokens for “Agreement Development”.At present, 15%have not been unlocked, and the rest will be completely released by 2027.

The current value is $ 385 million.

For the newly released agreement, the performance is still amazing.

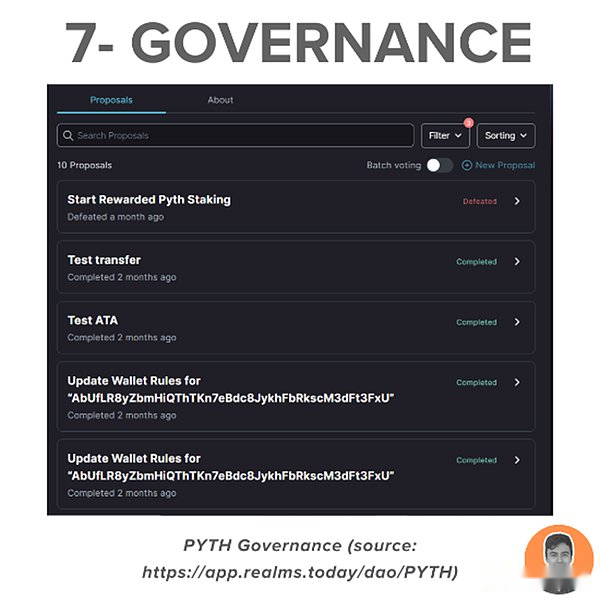

A decentralized governance process has been established and voted for 10 proposals.The proposal involves the following aspects:

-

Update the size of the cost

-

Reward distribution mechanism

-

Approval software update

-

Quotation information

-

Choose a publisher that provides data for each price information

Pyth was hatched by Jump Crypto in 2021.Later, the independent subject Duoro Labs, now focusing on the development of the Pyth protocol.

The core contributors are: Mike Cahill, Jayant Krishnamurthy and Ciarán Cronin.

Main investors: Multicoin Capital, Delphi Digital, and Wintermute.

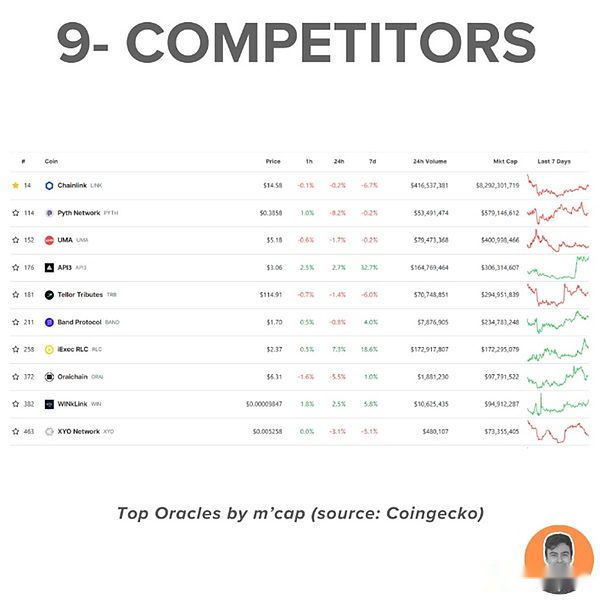

ChainLink is the main competitor of the Pyth network.It is the initial Oracle solution, and has gone through many bear markets in more than 6 years.

Although I love Chainlink, there are other competitors in the Oracle market, and Pyth is ready to capture market share.

Pyth Software has passed multiple rounds of audits from different companies, and has also launched a BUG bounty plan of up to $ 500,000.

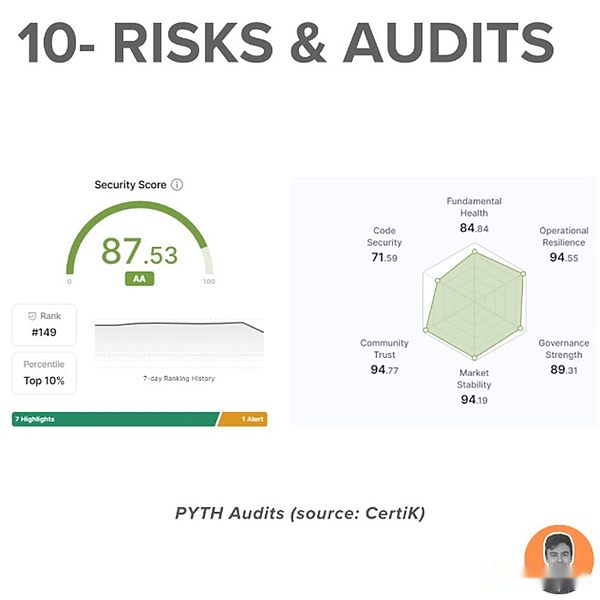

The safety score of Certik gave Pyth 87.53 points, ranking among the top 10%of their survey agreements.

Basic health and code safety scores are the lowest.

I still think that Chainlink is the number one Oracle solution, but I think Pyth has great potential.Absolutely worthy of attention.

The upcoming catalysts are:

-

Rumor of pyth pledge space investment

-

Tokens of more assets

-

Solana ecosystem growth

-

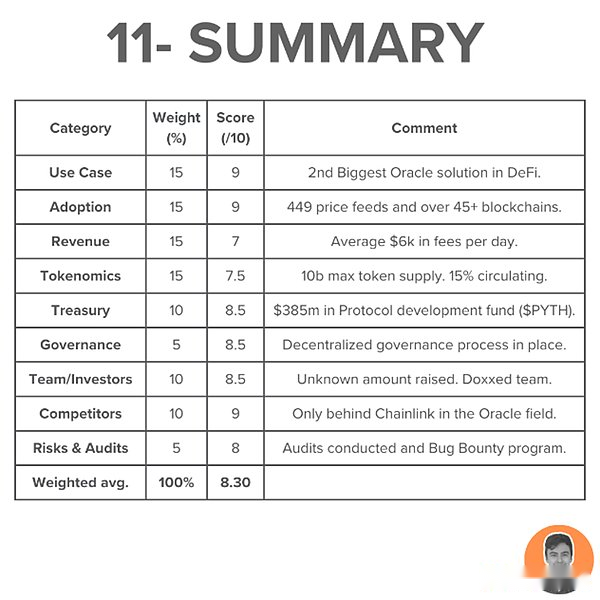

Total weighted score: 8.30