Source: Crypto Unfiltered, compiled by: Shaw bitchain vision

“You’re such an idiot…you should have taken the profits!”

If no one has ever shouted at you like this, believe me—it will happen sooner or later.Every cryptocurrency trader has heard this.And the worst thing?Sometimes they are right.

I only understood this through a tragic experience.When I first experienced a bull market, I watched my portfolio soar…and then plummet 90%, just because I foolishly thought I could go all the way to the top.There is no exit plan, no self-discipline, only blind greed.

Interestingly: Everyone will tell you when to buy it.But no one will tell you when to sell.Selling is the unknown secret of cryptocurrency – the part that no one wants to talk about because it is not attractive enough.But this is also the key to determining whether you return with a full load or suffer heavy losses.

I spent months researching how to sell when cryptocurrencies reach their all-time high (ATH).This is not a precise move at the highest point, nor is it a magical operation, but it is enough to lock in profits that can change life, while others are still waiting for “a further increase”.

This is the ultimate strategy I have summed up from that disaster.

Why everyone loses at a high position

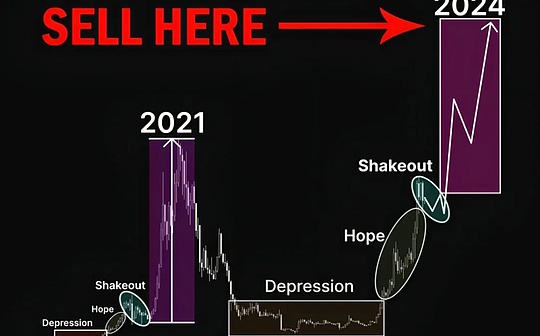

Every cryptocurrency bull market follows the same plot development.The script has never changed, it is just the characters that have changed.

-

99% of people either lose all their money or barely break even.

-

There are very few people who can truly make profits.

Why?Because cryptocurrencies are nothing more than amplified human emotions.Fear, greed, and FOMO are exactly the same as every bubble in history, except that the cryptocurrency bubble has formed within months, not decades.

If you don’t understand this, you’ll be deceived.You buy at the high point because you “don’t want to miss the opportunity”.You hold junk coins because you “trust this team”.You refuse to sell because you think “this is just the beginning.”

And then—puff, it’s gone.You spent a portion of your assets and learned another lesson in human psychology.

Introduction to the market cycle: Never cheat people

The price of Bitcoin—and the price of each crypto asset that extends therefrom—is not random, but periodic.

Bull market → ecstasy → collapse → despair → repeat.

This cycle is not mechanical.It is emotional.It’s like a crowd moving in groups, repeating itself.And no matter how many times people get burned, they will still line up to experience it again.

The secret is not to perfectly predict every step.That is impossible.The secret is to recognize the structure and use itGet profit systematically.

The best time to buy altcoins

If you really want a hundred times the gain, it’s not from Bitcoin, or even Ethereum, but from altcoins.

But the key is: you can’t buy when the altcoin price soars.And buy when they fall to the bottom.Buy when they are in a downturn.Buy it when no one cares about it, everyone mocks it, and there is a lot of scolding on Twitter.

That’s when you sow.That’s when you layout it.

Because when the cycle reversal and altcoins start to soar, they don’t just double or five times.They may rise a hundred times, five hundred times, sometimes even a thousand times.This is a good opportunity to change your life.But the premise is that you still have the courage to buy at a critical moment of life and death.

Remember the old saying: “When the blood flows like a river on the street, buy it, even if it is your own blood.”

Emotional Trap

The cruel fact is: Even if you know how the cycle works, you will still fail if you don’t control your emotions.

Cryptocurrencies have more severe punishments on greed and “fear of missing out” (FOMO) than anything else.If you don’t have a system, you will:

-

Refuse to sell when you make 10 times profit because you want 50 times profit;

-

Panic when you lose 60% because you think it will fall to zero;

-

Make excuses for holding junk tokens because you’ve “already invested”.

Knowledge alone is not enough, you also need rules.

ATH Selling Rules

This is the precise framework I built after almost losing money.These rules will keep me from being a laughing stock at the end of the next cycle.

Rule 1: Profit is your salary

Think of profit as salary, not lottery.

You won’t go to work, get your salary, and then squander all your money in the casino.Then why treat your cryptocurrency income as playing with money?

Cherish your money.Make profits regularly.Cash out when reasonable.Don’t deceive yourself and think you’re throwing chips in Las Vegas.

In the cryptocurrency world, the fastest way to lose all your money is to forget that the money in your portfolio is real.

Rule 2: Buy expected, sell news

This rule is old but never fails.

The market operates on expectations.The market had already hyped up the good news before it came.This means that by the time the news is released, the market fluctuations have actually ended.

-

News of the token coming soon?The price has been hyped up long ago.

-

Any news of cooperation?A smart investor bought it a few weeks ago.

-

New feature message?It’s time to sell, don’t buy it.

Don’t be someone who shows up after the party is over.Don’t be a high-level buyer.

Arrive early.Let’s go when there are too many people.

Rule 3: Will you buy it today?

This one is cruel but effective.Look at each token in your portfolio and ask yourself a simple question:

“If I hadn’t held this coin before, would I buy it today?”

If the answer is no, sell it.

Humans always tend to make excuses for bad decisions.We hold worthless junk coins just because we “don’t want to lock in losses.”We will also fabricate reasons such as “I have fallen so much, but I can only rise.”

Stop lying on yourself.If you won’t buy it now, you shouldn’t hold it now.

that’s all.

Rule 4: Must-check list for grand prize betting

If you want to catch the real “big killer”—the tokens that can double your wealth, here is a list of what I check every time:

-

Upward potential——Compare with other projects in the same industry, is the upper limit really high?

-

Major shareholder/VC——Is there anyone who supports it, or is it just retail investors hype?

-

Roadmap and team——Are they really building products, or are they just tweeting to create an atmosphere?

-

Will be available on CEX soon——Nothing can improve liquidity like a new listing, and news alone can significantly push up prices.

When a token meets these conditions, I double down on it.It is not blindly following the trend or chasing the rise of Memes that have been overheated, but investing in projects that truly have asymmetric advantages.

Profitable sale ≠ Missed opportunity

No one here tells you: Profitable selling does not mean you are “missing the opportunity”.

Every bull market, people are very upset because they sell too early.They made 5 times, but they didn’t make 20 times.They cashed out at $80, and the highest point was $120.

Who cares?You made money.You make a profit.You beat 99% of the market.

No one goes bankrupt by taking profits, but everyone goes bankrupt while waiting for the “perfect” top.

Why this matters more in 2025

The next bull market will not forgive any mistakes.Now the market space is larger, the participants are smarter, and the liquidity is deeper.Retail investors are still blind, but big players are smarter.

This means that your only real advantage lies in self-discipline.It is the rules you still stick to when greed whispers in your ear.

Because the fact is: cryptocurrencies won’t reward gamblers.It rewards people who stand still when the music stops.

The last words

I once lost 90% of my net assets because I did not make a profit in time.Never again.That mistake was costly, but it made me understand the principles I am following today.

If you treat cryptocurrency as a salary, if you respect cycles, if you sell when it’s reasonable rather than when it’s comfortable, you can get out of it with life-changing gains, and most retail investors will suffer heavy losses.

A bull market is not your reward.A bull market is a test for you.The profit you make is your reward.