Author: Shane Neagle, Coingecko; Compilation: Baishui, Bitchain Vision

How many publicly listed blockchain companies are there?

There are 46 publicly listed blockchain companies worth paying attention to.As expected, most blockchain companies are listed on the Nasdaq, with a total of 24.The largest to date is the cryptocurrency exchange Coinbase (COIN), with a market cap of $74 billion.Bitcoin mining company Mara Holdings (MARA) is following behind, but with a market cap of $7 billion, 10 times lower than Coinbase.

The Nasdaq Stock Exchange has the most technology companies.Of the 100 most valuable companies in the Nasdaq 100 (NDX) index (excluding financial companies), 59.6% are from the IT industry.

The smallest blockchain company available for public transactions is the blockchain industry (BCII) for the metaverse, but is only used for off-market (OTC) transactions.In the decentralized OTC market, there are 18 blockchain companies.

On the New York Stock Exchange (NYSE), only two publicly traded companies are available for use in the cryptocurrency sector, namely Bit Mining (BTCM) and Hyperscale Data (GPUS).The latter is an example of a trend as it changed its name from Ault Alliance (AULT), which focuses on cryptocurrency mining, to GPUS, to become a provider of AI data center infrastructure.

Including Galaxy Digital (GLXY), led by Michael Novogratz, which is listed only on the Toronto Stock Exchange (TSX), with a total of 46 publicly traded blockchain companies.

It is worth noting that 47 blockchain companies are listed on Canadian exchanges, from TSX and TSX Venture to CSE and Cboe.However, the largest companies are also listed on the Nasdaq, while most other companies have micro-stocks that are under $10 million or may be ETFs.Therefore, Galaxy Digital, listed on the Toronto Stock Exchange, is the only notable exception to non-low priced stocks.

What are the listed blockchain giant companies?

Coinbase is the largest listed blockchain company with a market capitalization of US$71.2 billion.As of February 4, 2025, it far surpassed the No. 2 Galaxy Digital, which has a market cap of $6.7 billion.Coinbase has a market value of more than ten times that of Galaxy Digital.Coinbase’s market value is more than double the total value of the next nine largest blockchain companies, at $71.2 billion and $33.2 billion, respectively.

Which track do most blockchain listed companies belong to?

Foreseeable thatOf the 46 largest listed blockchain companies, most focus on cryptocurrency mining, accounting for 25 companies.Although some companies have expanded from mining operations to artificial intelligence and Web 3 solutions, such as Bluesky Digital Assets, they can be roughly divided into five industries.

Diversification trends have accelerated significantly after the fourth halving of Bitcoin (slashing Bitcoin mining rewards from 6.25 to 3.125).Bitcoin mining companies are diversifying into high-performance computing (HPC) and AI data centers using their existing expertise in server scaling and infrastructure maintenance.

The most notable examples of this trend are the previous bankrupt Core Scientific (CORZ), Hut 8 Mining (HUT), TeraWulf (WULF), HIVE Digital Technologies (HIVE) and CleanSpark (CLSK).However, when it comes to the total market value of listed companies in the cryptocurrency space, a few companies dominate.

Market value of blockchain companies and market value of the entire cryptocurrency market

Of the 46 listed blockchain companies, Coinbase (COIN) is the only company representing the exchange sector, accounting for 2.2%, as mentioned earlier.However, Coinbase has a market cap of $71.2 billion, dwarfing everything but the larger MicroStrategy (MSTR) $97.7 billion.

If MicroStrategy’s market cap is excluded, as the only company that uses a debt leverage strategy to accumulate BTC and leverage BTC price fluctuations, our market cap is $121.9 billion.

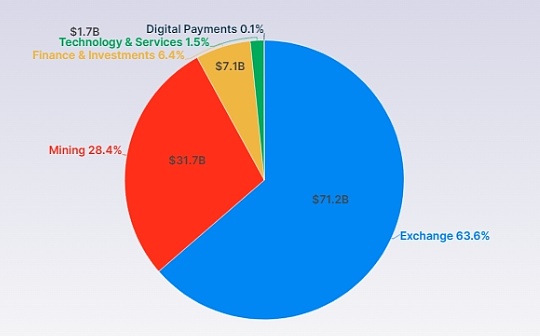

Although Coinbase is the only piece on the blue pie chart, with a market value of US$71.2 billion, accounting for about 63.6%, the mining industry’s stock is worth US$31.7 billion, mainly composed of MARA (US$7 billion), CORZ (US$4.2 billion), RIOT ($4.7 billion) and CLSK ($3.4 billion).Other mining companies have market capitalizations of less than $3 billion.

Similarly, Galaxy Digital accounts for the majority of this in the $7.1 billion financial and investment sector, at $6.7 billion.Overall, the total market value of publicly traded blockchain companies is $199.5 billion.This accounts for only 5.8% of the total market capitalization of the $3.45 trillion cryptocurrency.

Top 10 listed blockchain companies

The top ten listed blockchain companies are as follows: