Source: Bai Lu Club Living Room

Hong Kong’s goal has always been stabilizing its own global financial center.In the past few years, the changes in policies and the world’s economic environment have made Hong Kong known as “financial ruins”. Therefore, the Hong Kong government has greatly relaxed the Hong Kong policy and strives to promote the development of Hong Kong from various aspects.

On January 24th, the Hong Kong Securities Regulatory Commission released the “Priority of the Strategy of 2024 to 2026”,It mainly includes 4 major aspects:

(I) Maintain market toughness and reduce serious damage to the market;

(Ii) Enhance the global competitiveness and attraction of market capital;

(III) lead the financial market transformation with technology and ESG (that is, environment, society and governance);

(IV) Improve the toughness and operating efficiency of the organization.

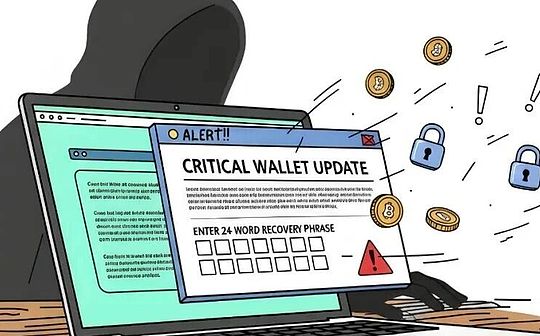

The file pointed out,The Securities and Futures Commission will take the technological innovation centered on virtual assets as one of the focus of development.Provide regulatory guidelines on new virtual asset activities to promote the development of the supervision system of virtual asset trading platforms; while supporting the tokenization of traditional products, protect the interests of investors; use blockchain and web3 basic technologies to promote the establishment of a responsible responsibilitySafety fintech ecosystems; at the same time establish a closer connection with local and international law enforcement agencies to crack down on crimes.

The following is the original text of the strategy.

introduction

The global market is complex and changeable, the geopolitical situation is tight, and the rapids of technology have brought unprecedented challenges and opportunities to Hong Kong’s financial markets.We understand the issues that are widely concerned about markets, and understand the importance of cooperation with the industry, and to deal with risks and seize opportunities together.At the same time, we will continue to strengthen the crime of cracking down on financial, so as not to cause damage to investors and markets.

The CSRC has always spared no effort to fulfill its statutory responsibilities and adhere to the principles of abide by the principles of regulating Hong Kong’s securities and futures markets and guaranteeing the majority of investors.Our legal goals include:

• Maintain and promote the fairness, efficiency, competitiveness, transparency and order of the securities period;

• Assist the public to understand the operation of the securities period;

• Guarantee the majority of investors;

• Try to reduce the crimes and missed behavior in the industry;

• Reduce the systemic risks of the securities and futures industry; and

• Assist the Hong Kong Special Administrative Region Government to maintain financial stability in Hong Kong.

In order to cope with the rapidly changing market conditions, we must set a strategy focus based on the above authority and responsibility, while leading the market development, so as to maintain Hong Kong’s reputation as a world -class financial center.

To this end, the Association has released a three -year strategy plan to openly explain the key tasks of the CSRC in the capital market supervision, as well as how we can improve market competitiveness and in order to consolidate Hong Kong’s international financial center position.In the annual report, we will explain the deployment and completion of the implementation strategy plan for the implementation strategy plan within the relevant financial year.

In the next three years, the four key strategies of the CSRC are:

The Association has confidence that the above four key tasks will strengthen the core advantages of the capital market in Hong Kong, help the sustainable development of the market, and enhance competitiveness.

We are waiting for the progress of the next few years.

Maintain market toughness and reduce serious damage to the market

In order to maintain the status of Hong Kong as an international financial center and risk management hub, the CSRC is committed to continuously enhance the toughness of Hong Kong’s financial markets and its infrastructure.This will stabilize the foundation of the market and promote the sustainable and secure market development.

Market toughness

In the face of challenging global market environment, tight geopolitical situations, and network security and scientific and technological risks, it maintains the toughness of the financial system.

In response to emerging risks, improving the risk management capabilities of market infrastructure and intermediary agencies, and laid a solid foundation for the sustainable market development.

Effective investigation and law enforcement

Use technology to improve the effectiveness of investigation and law enforcement.

Give full play to our supervisory capabilities to detect the market misconduct of listed companies and intermediary agencies.

Explore new supervision tools to monitor and investigate companies that crossed more than multiple judicial jurisdictions.

Step up cooperation

Continue to work closely with regulatory agencies in Hong Kong, Mainland and overseas to crack down on cross -border markets ‘misrepresentation behaviors and timely protect investors’ rights and interests.

Be wary and educate the public

Added resources to various publicity activities to ensure that simple, clear and effective messages are conveyed to the public.

Cooperate with the Hong Kong Police Department, investors and financial education committees to combat investment fraud and strengthen the education public.

Enhance the global competitiveness and attraction of Hong Kong’s capital market

Both the international or local macroeconomic and political environment have undergone tremendous changes.Hong Kong needs to maintain its competitiveness in many ways, especially to adhere to its status of its international assets and wealth management hubs and global fundraising centers, and fully play its advantages to support the development of local and mainland markets.

Through expanding and improving the market interconnection mechanism, we will deepen the connection with the Mainland capital market.Introduce more derivative products related to the Mainland into Hong Kong to enhance Hong Kong’s competitiveness in risk management.Strengthen the business landscape of mainland enterprises in Hong Kong and expand business activities in Hong Kong;

Expand overseas networks to expand the foundation of Hong Kong’s issuers and investors.Discuss the possibility of potential cooperation opportunities or connecting the market with overseas regulators.Actively participate in the formulation of international standards and organize the leadership role in the International Securities Affairs Supervision Committee to continue to consolidate Hong Kong’s international status;

Examine the positioning of Hong Kong to strengthen its ability to raise funds for the first time, while improving the quality and liquidity of the market.According to the report of the promotion of the stock market liquidity specialty group, the mid -to -long -term measures of its proposal are implemented.

Lead the financial market transformation with technology and ESG

In terms of science and technology, while holding the market clean and stable while hugging financial innovation:Provide regulatory guidelines on new virtual asset activities to promote the development of the supervision system of virtual asset trading platforms; while supporting the tokenization of traditional products, protect the interests of investors; use blockchain and web3 basic technologies to promote the establishment of a responsible responsibilitySafety fintech ecosystems; at the same time establish a closer connection with local and international law enforcement agencies to crack down on crimes.

In terms of ESG, consolidate Hong Kong’s position as a leading sustainable financial hub:Leading Hong Kong and the Asia -Pacific region in a pragmatic way to formulate sustainable disclosure standards; the role of leadership in the district and the world to shorten the distance between emerging markets and developed economies;; Expand local ESG products and markets, work together to build a stable and complete ESG ecosystem; curb greening behavior; cultivate sustainable financial talents; according to the carbon neutralization of the CSRC to reduce our carbon footprint.

Improve the toughness and operating efficiency of the organization

The CSRC is one of the key infrastructure in the financial market in Hong Kong. We will strive to improve the toughness and operating efficiency of the institution. Through strict budget preparation and internal monitoring measures, our fiscal resources are sufficient to support daily operations.

As a world -class regulatory agency, the CSRC is committed to connecting talents, functions, and technology to improve the effectiveness of governance, and always close to the development pace of the market and regulatory environment.