Written by: AIMan@Bitchain Vision

Hong Kong compliant stablecoins are coming.

Sure enough, there is pressure only when there is competition.After the U.S. Senate accelerated the legislative process of the stablecoin GENIUS bill, Hong Kong’s stablecoin regulatory bill was ahead of the United States.

On May 21, 2025, the Hong Kong Legislative Council officially passed the “Stablecoin Bill” in its third reading.The bill will take effect as long as the Chief Executive of Hong Kong signs and publishes it in the Gazette.This means that Hong Kong will formally implement stablecoin regulation.Anyone who issues fiat currency stablecoins in Hong Kong or issues fiat currency stablecoins that claim to anchor the value of the Hong Kong dollar in or outside Hong Kong must apply for a license from the Hong Kong Financial Management Commissioner.

According to the current progress, the crypto industry may see the birth of a compliant Hong Kong stablecoin in the crypto industry before the end of 2025.

This article briefly reviews the important history and main content of the “Stablecoin Bill” in Hong Kong.

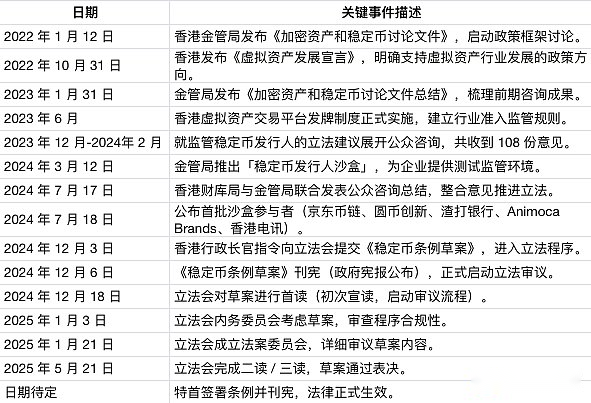

Important History of the Stablecoin Bill

On January 12, 2022, the Hong Kong Monetary Authority released discussion documents on crypto assets and stablecoins

October 31, 2022, Hong Kong Virtual Asset Development Declaration

On January 31, 2023, the Hong Kong Monetary Authority released a summary of the discussion documents on crypto assets and stablecoins.

In June 2023, the Hong Kong virtual asset trading platform license system was implemented

From December 2023 to February 2024, a public consultation document was issued to collect opinions on legislative suggestions on regulating stablecoin issuers, and a total of 108 opinions were obtained.

On March 12, 2024, the Hong Kong Monetary Authority launched a stablecoin issuer sandbox

On July 17, 2024, the Hong Kong Treasury Bureau and the Hong Kong Monetary Authority jointly issued a public consultation summary

On July 18, 2024, the Hong Kong Monetary Authority announced the stablecoin sandbox participants: JD.com Coin Chain Technology (Hong Kong) Co., Ltd., Yuanbi Innovation Technology Co., Ltd., Standard Chartered Bank (Hong Kong) Co., Ltd. and Animoca Brands, Hong Kong Telecommunications

On December 3, 2024, the Chief Executive of Hong Kong directed the submission of the “Stablecoin Bill” to the Legislative Council

On December 6, 2024, the “Stablecoin Bill” bill was published in the constitution

On December 18, 2024, the first reading of the Legislative Council

On January 3, 2025, the Interior Committee considers

January 21, 2025, the bill committee considers

May 21, 2025, second reading/third reading passed

The date is to be determined, and it will take effect after the signing of the Chief Executive and the law is published.

Main contents of the “Stablecoin Bill”

1. Regulatory agencies

Financial Management Specialist

2. Regulatory stablecoin

Focus on Hong Kong’s stablecoin issuance systemFiat currency stablecoin, a “specified stablecoin” regulated by the Monetary Authority is defined as a stablecoin that claims to anchor one or more official currencies to maintain stable value.

Stable coins refer to the value of other assets (such as commodities), in the future, the Financial Management Specialist can specify the value of a digital form as a specified stablecoin by publishing an announcement in the Gazette.

3. Regulated stablecoin activities

No person shall conduct regulated stablecoin activities in Hong Kong during the course of business, including issuing specified stablecoins without obtaining the license of the Financial Management Commissioner.

Any person who actively promotes the issuance of its specified stablecoins to the Hong Kong public is deemed to show that he or she is engaged in regulated stablecoin activities and must be licensed by the Financial Management Specialist.

Stablecoins anchoring the value of Hong Kong dollar (whether in whole or in part) should be covered as regulated stablecoin activities even if issued outside Hong Kong, regardless of where it is issued.

4. License Regulations

The Hong Kong stablecoin issuance guidelines include the following main elements:

(a) Management and stabilization mechanism of reserve assets:It indicates that the market value of the reserve assets of the stablecoin must at least be equal to its circulating face value at all times.Licensed persons must have a robust and stable mechanism, properly separate and manage reserve assets arrangements, and have sufficient disclosure policies;

(b) Redemption: To ensure that the holder of the specified stablecoin (holder) is properly protected, the licensee must pay the face value of the specified stablecoin to the holder who makes a valid redemption requirement, and shall not attach excessively cumbersome conditions and unreasonable fees.The redemption procedure, time limit, any conditions or fees involved and rights shall also be clearly disclosed for reference by the holder.;

(c) Have a physical company in Hong Kong: To ensure that the Financial Management Specialist can conduct effective supervision and law enforcement,Licensors must have a physical company in Hong Kong;

(d) Financial resources:Licensors must have sufficient financial resources to operate their business.Including the minimum paid-up share capital requirement of HK$25 million;

(e) Appropriate candidates:The controller, CEO and director of the licensee must be appropriate candidates, and the person responsible for managing and operating regulated stablecoin activities must have the required knowledge and experience;

(f) Prudent and risk management:Licensors must have appropriate risk management policies and procedures to manage risks arising from their business operations, and the relevant policies and procedures must be commensurate with their business scale and complexity.Licensed persons should also have sound and appropriate control systems to prevent and combat possible money laundering and terrorist fundraising activities.

5. License term

Grant the licensee’s open license,As long as the licensee has not been revoked by the Financial Management Specialist, his license will remain valid.Licensed persons are subject to ongoing supervision by the Financial Management Specialist.

6. Who can sell stablecoins to the public

Only the following institutions regulated by the Monetary Authority or the Hong Kong Securities and Exchange Commission can sell designated stablecoins to the public:

(a) Licensors under the fiat stablecoin issuer system;

(b) A virtual asset trading platform licensed by the China Securities Regulatory Commission;

(c) a corporation licensed by the SFC to conduct category 1 regulated activities under Section 116 of the Securities and Futures Ordinance (Cap. 571);

(d) Accredited institutions defined in the Banking Ordinance (Chapter 155).

7. What are the penalties for issuing stablecoins without license or are licensed but violated

(a) Unlicensed stablecoin activities: a fine of HK$5 million and imprisonment for seven years;

(b) Sales of stablecoins by non-designated licensed institutions: they can be fined HK$5 million and imprisoned for seven years;

(c) Fraud or deceptive behavior involving specified stablecoin transactions: liable to a fine of HK$10 million and imprisonment for ten years;

(d) Misrepresentation that induces others to obtain specified stablecoins and make fraud or disregard the truth: they can be fined HK$1 million and imprisoned for seven years.

8. What powers does the financial management specialist have?

In order to effectively implement the system, the Hong Kong Legislative Council grants the Monetary Authority the authority to conduct continuous supervision.Its powers include requesting the submission of documents and records, issuing instructions, making regulations, issuing guidance, etc., such as: specifying that an activity is a regulated stablecoin activity; designating an entity providing services to a stablecoin payment system is a designated stablecoin entity with regulated regulations; designating a stablecoin issuer without applying for a license is a designated stablecoin entity; instructing an investigator to conduct an investigation, requesting evidence related to suspected violations, requiring assistance to relevant persons in the investigation, and applying for a search warrant and seizure from the magistrate if necessary; andThe power of regulatory penalties, including temporary revocation or revocation of the license, and imposing a fine of no more than HK$10 million or three times the amount of profits or losses avoided due to violations, whichever is higher.