Source: GrayScale; Compilation: Deng Tong, Bitchain Vision

Prior to the US presidential debate between Biden and Trump in June 2024, voters expressed concern about uncertainty: war raging in the world, political discourse continued to be severe differentiation, and the US economy continued to inflation.wait.In this uncertainty,The impact of encrypted assets on elections is getting greater and greaterAs Harris’s public opinion survey on behalf of Grayscale’s latest survey found.Key points include:

-

We believe,Due to the maturity of macro dynamics and Bitcoin itself, the correlation of Bitcoin is increasing. Nearly half of voters (47%) are now expected to include cryptocurrencies (higher than 40%higher than the end of last year).

-

Like the first stage of this year’s public opinion survey,The interviewees listed inflation as the primary problems (28%) in the election, and once again emphasized the potential value of assets such as Bitcoin with transparent and hard supply.

-

Trump strongly supports cryptocurrencies during the campaign, and the recent cryptocurrency bill FIT21 and SAB 121 have also been supported by Congress.The data surveyed by Harris supports such a view, that is,Cryptocurrencies are a topic of two parties. Republicans (18%) and Democrats (19%) are similar.

-

Headline news has begun to ferment: Will it become the “Bitcoin Election Month” in November?

Cryptive assets are increasingly concerned

GrayScale believes that due to the maturity of macro development and Bitcoin as a kind of asset, people’s attention to Bitcoin is increasing.在过去的六个月里,自本调查第一阶段以来,由于地缘政治紧张局势、通货膨胀和美元风险,选民们对比特币的关注度不断提高(现在的41% ,2023 年11 月仅有34%).It is worth noting,According to voters (28%), inflation is by far the primary problem in the election, which highlights the potential value of assets with transparent and hard supply upper limit like Bitcoin.

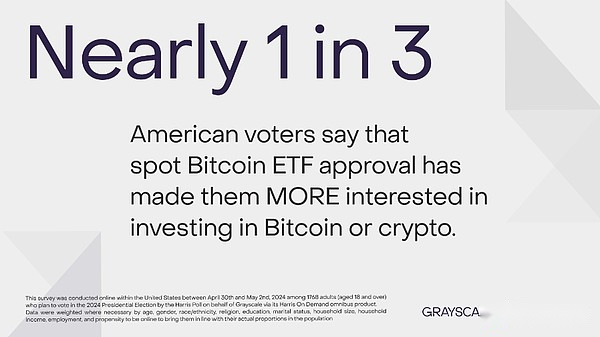

The important thing is that the GrayScale team added some new issues to consider in the survey. Harris polls found thatEvent related to Bitcoin, including the approval of the US spot Bitcoin ETF in January 2024 and halved in April 2024, making voters more interested in investing in Bitcoin and other crypto assets (18% and 20%, respectively).Especially the approval of the Bitcoin ETF, 9% of retirees are more interested in investing in Bitcoin or crypto assets.

Figure 1: Voters are more and more concerned about Bitcoin

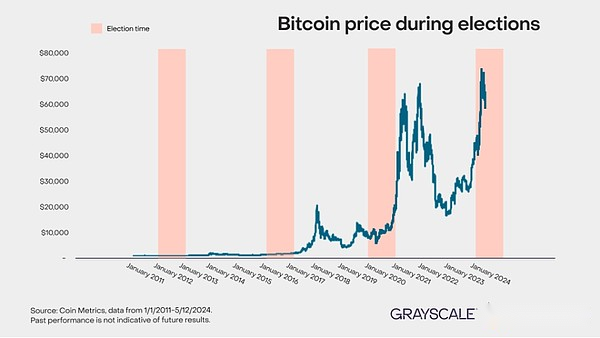

So far, 2024 is a glorious year for Bitcoin.The price of Bitcoin reached a record high on March 13, 2024. In addition, as far as 2024, the price of Bitcoin is higher than the price of previous elections.Headline news has been fermented: Will it become the “Bitcoin Election Month” in November?

Figure 2: Bitcoin price is higher than the previous election period

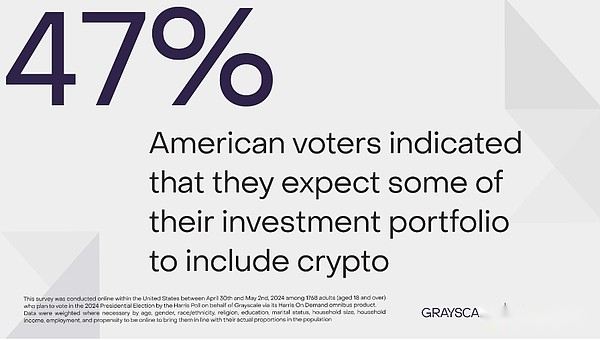

The increasing attention to cryptocurrencies is not limited to Bitcoin.Instead, it has expanded to a wider view of crypto assets, both from general interest or investment willingness.Nearly one -third of voters (32%) said that since the beginning of this year, they are more willing to understand cryptocurrency investment or actual investment cryptocurrencies.Compared with November 2023, voters are also more likely to treat cryptocurrencies as a good long -term investment opportunity (23% vs. 19%), and they are increasingly expected that their investment portfolio contains cryptocurrencies (47% VS VS. 40%).

Figure 3: Voters are increasingly expected that their investment portfolio contains cryptocurrencies

Cryptocurrency is a political issue for two parties

Although Trump supports cryptocurrencies more during the campaign, the data shows that the data shows thatCryptocurrencies are issues of two parties. The Republican (18%) and the Democratic Party (19%) have similar attention.

There are differences in the industry in which political parties support the industry, because voters of the same proportion (30%each) believe that the Democratic Party and Republican Party are the most favorable for cryptocurrency policy.These findings indicate,The support for cryptocurrencies is not completely biased towards a certain party, but indicates the balance of interests in the entire political field.This is consistent with the recent support of the two parties in Congress to the SAB 121 resolution. The resolution allows financial institutions to act as a custodian of digital assets, which may increase the accessibility of cryptocurrency investors.

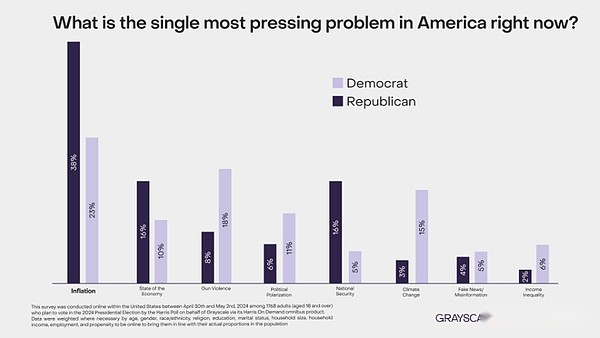

despite this,Republican voters tend to treat inflation and economic issues as the most urgent problems facing the United States (54%, Democratic Party is 33%).Although the ownership level of each party is similar,Republicans seem to pay more attention to issues related to Bitcoin and cryptocurrencies (inflation and economy)The data shows that Democrats are more concerned about the violence of guns, climate change, and income in unevenness than Republicans, as shown in Figure 4 below.This may explain why Trump has recently tended to support cryptocurrencies in campaign.

Figure 4: The most urgent issues faced by political parties

in conclusion

The United States is standing at the fork.The two candidates have different macro policies in government deficit and debt, inflation and Fed’s independence, and the United States’ role in the world; these positions have a direct impact on the US dollar and Bitcoin.

As voters are interested in cryptocurrencies,The next government’s attitude towards such emerging digital assets will be very important.This is particularly important for young people’s votes, because 62% of generations Z and millennial voters believe that cryptocurrency and blockchain technology are the future of finance.In any case, as November approaches, it is obvious that all policy makers and candidates who are preparing to participate in the 2024 election will become more and more considering cryptocurrencies.