Author: Long Yue, Wall Street News

South Korean retail investors are withdrawing Tesla on a large scale, turning their funds into cryptocurrency-related fields.

On September 3, according to Bloomberg’s calculations, South Korean individual investors netted $657 million worth of Tesla shares in August, setting the largest single-month capital outflow record since at least early 2019.

Data shows that the total amount of funds withdrawn from Tesla has reached $1.8 billion in the past four months.TSLL, an exchange-traded fund that provides Tesla’s double leverage, also suffered a $554 million withdrawal in the same month, the largest single-month outflow since the beginning of 2024.

Meanwhile, these funds are pouring into more volatile assets.For example, Bitmine Immersion (BMNR) attracted a net inflow of $253 million in August, and the company is regarded as an “Ether proxy stock” by the market for its newly launched Ether treasury platform.

The narrative is lost, the momentum is no longer

South Korean retail investors’ confidence in Tesla is due to growing disappointment with the electric car maker.During the COVID-19 pandemic, they were attracted by high-profile American technology companies such as Tesla, but now, things are changing.

“Tesla used to provide a lot of inspiring narratives, but now it can’t win people’s hearts,” said a 33-year-old individual investor named Han Jungsu.He first bought Tesla in 2019, but cleared his position earlier this year and turned to stocks that he believes have more upside potential.

“It failed to take the lead in its AI narrative.” This sentiment spread among investors who believe that Tesla’s stock price lacked the strong momentum it once was and therefore chose to invest money elsewhere.

Turn to encryption and chase new hot spots

Withdrawing Tesla funds is looking for new, more dynamic speculative targets, and crypto-related stocks are becoming a hot choice.Among them, Bitmine Immersion (BMNR) is particularly prominent, and the company is regarded as an agent of Ethereum because of its newly launched Ethereum treasury platform.

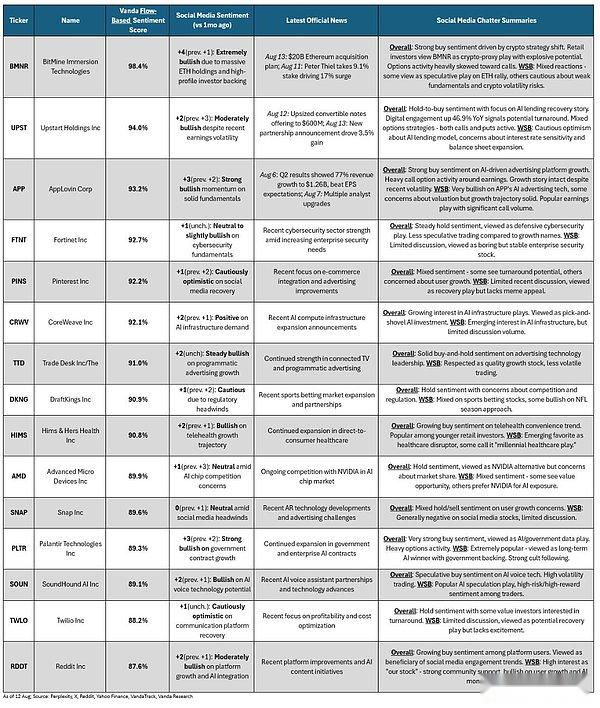

An analysis by research firm Vanda Research found that BMNR is not only sought after in South Korea, but also gained the highest attention among American investors.Its investor sentiment score is as high as 98.4%, surpassing all other stocks on the list.This shows that the preference for pursuing high volatility and high momentum assets has certain commonalities among retail investors around the world.

Loyalty is shaken, but status is not falling

Despite record capital outflows, Tesla’s position in the minds of Korean retail investors has not completely collapsed.Data shows that South Korean retail investors still hold about $21.9 billion in Tesla stock, making it firmly at the top of the most popular overseas stock list, ahead of Nvidia and Palantir, which ranked second and third.

However, the crack of loyalty has emerged.Vanda Research data also pointed out that in the US market, although retail investors are still very interested in Tesla, their net purchases are less than half of the leader Nvidia, and retail liquidity sentiment “remarkably worsened.”This further confirms that Tesla’s attractiveness among retail investors around the world is facing challenges.