Source: Glassnode; Compilation: Wuzhu, bitchain vision

This week, we introduce another exploration of CBD use cases – analyzing the meta-universe tokens.Despite falling prices and hype fading, on-chain data suggests that major investors are still active, steadily accumulating and reducing the cost base.

Does this herald a long-term bet on the recovery of the metaverse?Let’s first review how CBD data can be analyzed and interpreted, and then apply this knowledge to the latest trends in the metaverse.

Understand the basic distribution of cost

Cost Base Distribution (CBD) tracks the location of the token supply concentration based on the average cost basis of the holder.By analyzing changes in supply distribution, we can identify investors’ behaviors—whether they are accumulating, selling or redistributing their holdings.

How to interpret CBD heat map:

-

Color intensity (supply distribution)

Warm colors (red/yellow) indicate high supply concentration in a given price range, while cool colors (blue/green) indicate low supply.

-

vertical axis (cost basis)

Each horizontal slice represents the price range of the last time the supply moves, showing how the holder adjusts its cost base over time.

Tracking these changes helps us find potential market turning points where accumulation or distribution trends may herald future price movements.

Metauniverse Tokens: What does the basic distribution data reveal?

In this analysis, we focus on the metacosmic tokens—The Sandbox (SAND), Decentraland (MANA), and Axie Infinity (AXS)—which are one of the most prominent assets during the 2021 Metauniverse boom.While the hype surrounding the virtual world has faded, our focus has shifted from user activity and instead uses cost-based distribution (CBD) data to examine investor behavior.

Rather than assessing adoption metrics or in-game activity, we analyze how token holders adjust their positions over time.Do they sell, stay stable or accumulate at a lower price?By tracking supply changes at different price levels, we can gain an in-depth look at how investor beliefs evolve in the post-hype phase and whether accumulation trends suggest long-term confidence in these projects.

The Sandbox (SAND): Steady Accumulation in Bear Market

Despite price fluctuations, on-chain data shows that it is still accumulating.Strong belief holders are steadily increasing their positions, strengthening their confidence in the long-term potential of the project.

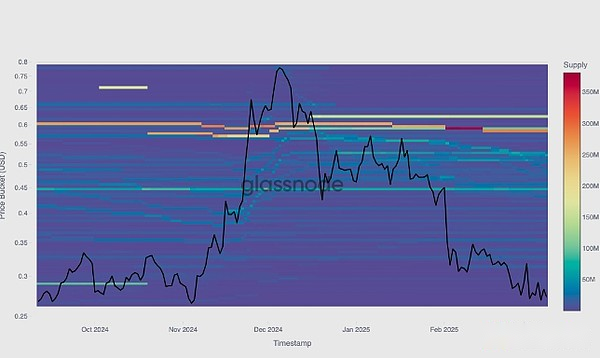

Decentraland (MANA): Buy on dips

Supply concentration increased significantly, reaching around USD 0.60, reflecting the increase in purchasing activity following the price decline.This suggests that investors see price declines as buying opportunities rather than signs of further declines.

Axie Infinity (AXS): Long-term confidence remains firm

Despite the continued downward trend, on-chain data shows that a large number of positions are gradually increasing.This model shows that some investors are still confident about the future of Axie Infinity.

Will the metaverse recover?

Speculation around the meta-universe may have faded, but on-chain activity suggests that is not the case.The continued accumulation of major meta-universe tokens suggests that many investors see these projects as an undervalued opportunity rather than failure.

Does this lay the foundation for future recovery?While the price trend is still uncertain, data show that confidence among major market participants remains strong – they are positioning accordingly.