Source: Glassnode; Compilation: Wuzhu, bitchain vision

summary

-

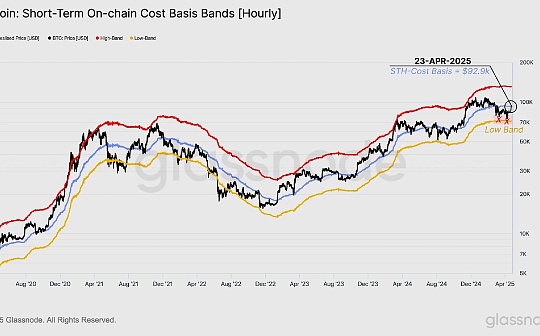

Bitcoin price surged to $94,700 due to optimism that tensions between the U.S. and China could ease.Price briefly restored the short-term holder cost base, which is a key midpoint to distinguish between bear and bull stages.

-

Profit supply percentage climbed to 87.3% from 82.7% when BTC last traded at similar price levels.This shows that nearly 5% of the supply has changed hands in recent adjustments.

-

The STH profit-to-loss ratio reaches 1.0, indicating that many buyers are break-even in recent times, a level that is usually associated with exit risk.Profits that have been realized have also increased significantly, driven mainly by short-term investors’ locked in returns.

-

Futures open contracts increased by 15.6%.However, despite higher market trading, financing rates turned negative, indicating a rise in short interest.

-

On April 22, the net inflow of spot Bitcoin ETFs in the United States hit a record high, reaching US$1.54 billion, indicating a large influx of institutional demand.Standardized traffic data show that through ETF, BTC demand far exceeds ETH demand, which helps explain Ethereum’s relative underperformance.

After weeks of sluggish activity and lower liquidity conditions, the market has finally responded positively to the wider macrocatalyst.Stocks and cryptocurrency markets rose after the U.S. government sent an optimistic signal about tariffs on Chinese imports.

As for Bitcoin, the rebound briefly broke the key on-chain threshold: the short-term holder (STH) cost base.This model reflects the average acquisition price of market participants who have recently purchased tokens and often serves as a critical pivot level.Historically, the continued breakthrough of this price model marks a transition between a bearish correction period and a resurgent sentiment during the recovery period.

However, very similar to the situation between July and September 2024, this move has so far resulted in only a temporary recovery of the STH cost base.This indicates that optimism has begun to emerge, but the market has not yet been confirmed to have turned completely bullish.As more investors return to meaningful unrealized investments, continued strength above this level may strengthen market confidence.

The market has recently risen to $94,300, while unrealized profits held by investors have also rebounded significantly.The profit supply percentage indicator has risen to 87.3%, a sharp rebound from the March low.

When Bitcoin last traded at about $94,000, only 82.7% of the supply was profitable.This means that nearly 5% of the circulation supply has changed hands at lower prices since early March as the market consolidates sideways and goes down.

Historically, typical excitement phases tend to follow this indicator to stabilize above 90% over a longer period of time, indicating general profitability and increased investor confidence.

Another indicator that Bitcoin has returned to important decision areas is the STH supply-profit-loss ratio, which has recently soared to a neutral level around 1.0.This shows that short-term supply is distributed more evenly between tokens in terms of profit and loss, which makes this group more balanced.

This structure is very important, and in previous bear markets, the STH-P/L ratio traded well below 1, and this level acted as the upper limit of resistance.Whenever the indicator retests 1.0 from below, it tends to be related to the formation of local tops as investors start to exit positions and suppress momentum.

If the market can convincingly recover this level and trade above 1.0, it will be a sign of a stronger recovery.Monitoring the trading of this ratio in the coming weeks, especially in combination with realized profit-taking behavior, can help determine whether the market is reestablishing a more constructive recovery from this adjustment.

Profit-taking stress test

Now that we have a market framework at the decision point, profit-taking behavior has become a key signal that needs to be monitored.At present, total realized profits for the hourly solution have soared to $139.9 million per hour, about 17% higher than its benchmark $120 million per hour.

This rise shows that many market participants are using the rebound to lock in earnings.If the market can absorb this selling pressure without collapse, the road ahead will be brighter.

Conversely, if you fail to hold these levels while achieving huge profits, this move may be marked as another dead cat rebound, consistent with the relief rebound that has faded under similar conditions.

Who is making a profit?

In addition to the amount of realized returns, understanding which groups are realizing profits gives you a deeper insight into market sentiment.To this end, we adopt the Used Output Profit Margin (SOPR), an indicator that compares the selling price of a token to its original cost basis, providing a perspective on the average profit or loss multiple that investors lock in.

The SOPR (STH-SOPR) of short-term holders shows that recent buyers are the main group that locks in profits during the recent surge.

This is the first time STH-SOPR has significantly exceeded the breakeven level of 1.0 since the end of February, and it is another relatively positive signal for investors to return to their profitable positions.Overall, STH-SOPR continues to trade above 1.0 is a characteristic of a bullish uptrend.

Short Perpetual Options

While some spot holders appear to be locking in profits, perpetual swap traders tend to short in the rebound.Opens in perpetual swaps have climbed sharply to 281k BTC, up about 15.6% since the low of 243k BTC hit in early March.

This reflects the rise in the derivatives market leverage ratio, which tends to exacerbate market volatility if the price starts to touch the trader’s stop loss or clearing area.

Interestingly, the surge in open contracts was consistent with the decline in average financing rates, which plummeted to -0.023%.This showsThe growing tendency to short positions suggests that many traders are betting on a rebound and may think that the recent trend is too much.

If the upward momentum continues, this divergence between rising open contract volumes and negative capital inflows will lay the foundation for possible short squeezes.

However, things become more cautious when narrowing down to assess the long-term sentiment of perpetual swap traders.The 7-day moving average of long financing paid per hour has steadily declined, currently at $88,000 per hour and is still on a downward trend.

As an indicator of sustained long-term exposure willingness, the indicator reflects the dollar value paid by traders on the market “consensus” side.The current downward trend in premiums shows that most positions are indeed moving to short positions, creating momentum for market makers to take long positions to collect interest on financing rates.

Institutional interests

ETF traffic has become an important indicator to measure institutional investor sentiment and demand this cycle.Tracking the inflows and outflows of ETF products allows you to understand the beliefs and engagement of large capital allocators from a unique perspective.

During the recent rise to $94,000, the U.S. spot Bitcoin ETF net inflows reached an astonishing $1.54 billion, one of the highest single-day net inflows since its inception.This influx sends a strong signal that demand for Bitcoin may begin to recover.

Is it still the Bitcoin season now?

Despite the strong rebound in Bitcoin prices, many people question why Ethereum did not rebound at the same level.One answer lies in the comparison of ETF traffic, which we standardize and adjust based on the relative spot trading volume of each asset.

In the past two weeks, there have been two obvious inflows on Bitcoin ETFs, each exceeding 10% of BTC spot trading volume, highlighting a relatively strong institutional demand situation.

By comparison,Inflows of Ethereum ETFs are still quite sluggish, with inflows less than 1% of the ETH spot trading volume.This stark difference in institutional demand between the two assets, which may be one reason why ETH’s recent performance continues to lag behind BTC.

in conclusion

Bitcoin’s price rebounded to more than $94,000, reflecting a shift in macro optimism and investor sentiment.Positive signals surrounding U.S.-China tariffs triggered a rebound, recouping the short-term holder cost base and increasing the percentage of profit supply to 87.3%.Several indicators suggest Bitcoin is experiencing a positive recovery, while futures markets are also showing signs of short squeeze.

Institutional demand for Bitcoin may be returning, with the net inflow of Bitcoin ETFs reaching US$1.54 billion in a single-day.The market is at a decision point, and the key level to focus on is the cost basis for short-term holders, which can often outline bullish and bearish market structures.The bulls need to push the market to break through this price model and stay at that level.