Author: ARNDXT, encrypted researcher; compile: 0xjs@作 作 作 作 作

MOVE is moving towards EVM, and the Movement’s test network has completed more than 30 million transactions in less than 2 weeks.

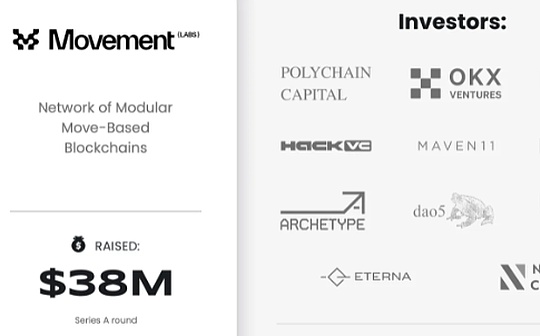

Movement raised 38 million US dollars, and the Rollup M2 based on ZKMOVE’s Ethereum will be launched later this year.

I chatted with the co -founder of Movement @coopsmoves, and he revealed some inside information.

This is Alpha you need to know.

Movement overview

In essence, Movement Labs did not introduce a new one or two layers.Instead, they are integrated into the existing blockchain without users to leave their ecosystems, bridges, or download new infrastructure without users.

They are cooperative, not competition.

Their recent test network indicators are very good, and they have achieved it in less than two weeks:

-

The total transaction volume is 30 million strokes

-

14 million active address

-

38 dapp

Overall, Movement is very useful for AI use cases.The reason is as follows:

-

Movevm’s powerful features + efficiency

-

Seamless processing massive transactions

-

MOVE’s unparalleled security

-

BLOCKSTM parallelization ultra -high throughput

-

United EVM and Move Ecosystem

What is M1?

M1 is the “core” of the Movement network, which aims to be the peak of modularity.

M1 is a decentralized sorter that expands Snowman consensus into any blockchain, application chain or network in any blockchain, application chain or network in the motion framework.

Thanks to the Snowman consensus, M1 provides the fastest and most scalable processing mechanism.

What is M2?

M2 is the main network of Movement. It is a zero -knowledge (ZK) Move Ethereum Rollup.

It is the place where the application is deployed, using distributed infrastructure provided by M1 to achieve rapid endability, scalability and best consensus mechanism.

Why do you move?

Move is faster, safer, and more scalability than existing language such as Solidity.

It supports native parallel processing (up to 140,000 TPS) and contains enhanced security functions to prevent heavy -duty attacks and other common vulnerabilities.

From solidity to Move

Movement Labs has developed tools such as Fractal as part of the MOVE stack, allowing the existing Solidity applications to be seamlessly upgraded without leaving its network or spending a lot of engineering energy to learn MOVE.

Attract application

The exciting announcement is about to be released, including the team can apply for a plan to ensure the TVL on the first day of the main network -even before any potential token release!

Movement verification

Movement Labs is making verification easier by eliminating high thresholds (such as expensive hardware or a large amount of financial investment).They are researching innovative methods so that more people become verificationrs.

Projects in the Movement ecosystem

The following are some of the existing projects in the Movement ecosystem:

• @neterest_dinero

•@Desig

•@xebratrad

•@Razordao

•@nightly_app