Author: intoTheblock Translation: Shan Ouba, Bitchain Vision Realm

Although the assets of the real world can be traced back to the 1990s, it was not until 2023 that the industry has experienced a significant growth.In this article, we explore the current situation of RWA in Defi through the chain indicators.

Real World Assets (RWA) aims to use the income and assets of the real economy and introduce them into DEFI, and use its inherent interoperability.In 2023, it marked a major progress, and the project successfully included US Treasury yields into DEFI by creating stable coins.

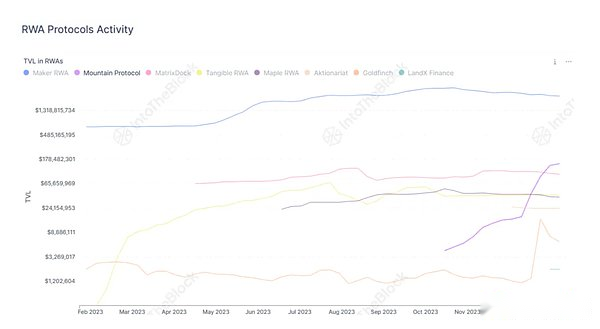

This type of innovation makes the total value of the RWA protocol locked more than $ 2.6B, which is almost the same as the total market value of the $ 2.87B of the top RWA protocol.At present, the RWA ecosystem is very successful and has more than 127,000 RWA protocol token holders.

MakerDao’s strategic diversification

MakerDao has achieved diversified income by incorporated US Treasury bonds into its investment portfolio.This not only enhances the stability of its income flow, generates an annualized income of more than $ 100 million, but also improves the risk of its mortgage assets.This strategy reflects MakerDao’s dedication to integrate traditional financial elements to strengthen the sustainability of DAI stabilization.

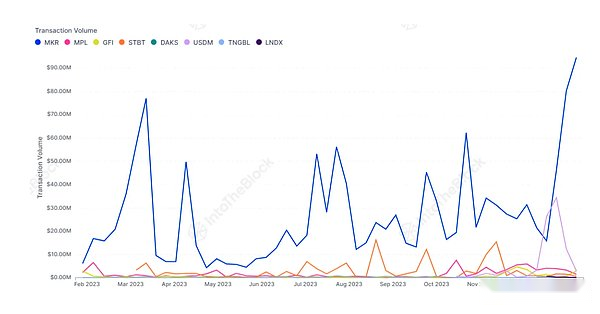

It is this strategy that has promoted the positive price trend of MKR and leads the annual return in the top RWA agreement.It is not surprising that MKR is among the best in terms of average transaction volume, and the daily average transaction volume in the second week of January reached 94.5 million US dollars.

>

Although other assets in this category cannot currently compete with MKR transactions, there are still a large amount of transaction volume, of which USDM reached a high of $ 34 million in December.

Mountain Protocol performed well in tvL growth

Mountain Protocol has become a well -known entity in the DEFI field with its unique income stabilized currency USDM (an ERC20 token supported by short -term US Treasury bonds).

Mountain Protocol has increased significantly, and its TVL reaches $ 150 million, an increase of 400%last month.This makes it the second largest RWA DEFI protocol second only to MakerDao.

>

Analyze the RWA protocol holder

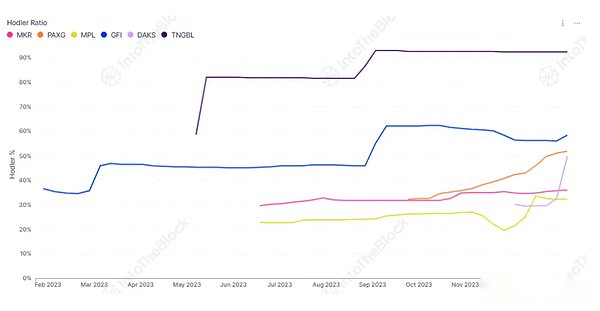

In -depth study of specific RWA protocol tokens, we can observe more significant tokens.Analysis of the profitability of the holders of various RWA tokens revealed the diverse situation.MKR stood out with a steady 75%address profit.

>

In contrast, the profit margin of tokens such as TNGBL and GFI is low, and the shareholders’ profit margins are 12.2% and 33%, respectively.

TNGBL has the most “diamond player”

The “HODLERS” ratio indicator represents the address ratio of specific tokens for at least one year, which is a key indicator for long -term investment confidence and potential market stability.A large number of holders show that the firm belief in the future value of the tokens also means that the market is more stable, because these people are unlikely to respond to the short -term market changes.In the RWA ecosystem, TNGBL stood out in a ratio of more than 90%of the HODLER.

>

The future of RWA in DEFI

The integration of RWA and DEFI brings incredible value to the cryptocurrency field.The data analyzed by various RWA protocols showed an exciting and continuous ecosystem.Pioneers such as MakerDao seamlessly integrated traditional financial tools such as US Treasury bonds into the DEFI protocol, and the rapid growth of protocols such as Mountain Protocol highlights the value and potential of the field.