This closed-door gathering of crypto stock themesVDX Exchange, EBunker, Hashkey, 0xinfini, Zheng Di, Joy Lou, AlexonMany well-known Ethereum ecological projects, institutions and investors, etc..

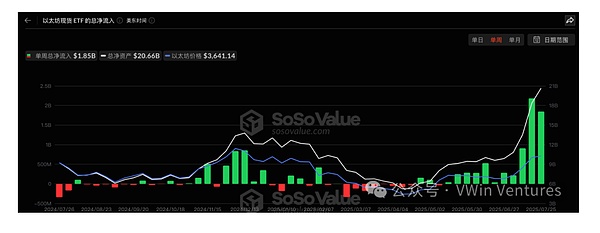

With the recent strong market trend and the accelerated allocation of ETFs and many listed companies, Ethereum once emerged from an “independent market trend”. The meeting conducted in-depth discussions on the core logic behind Ethereum’s strong rise, changes in the Ethereum-related industrial ecological pattern, and long-term development expectations of Ethereum.

The following is a summary of the key points of this discussion.

The core logic behind Ethereum’s strong rise

– Traditional institutional funds have become the core driving force for this round of Ethereum rise:

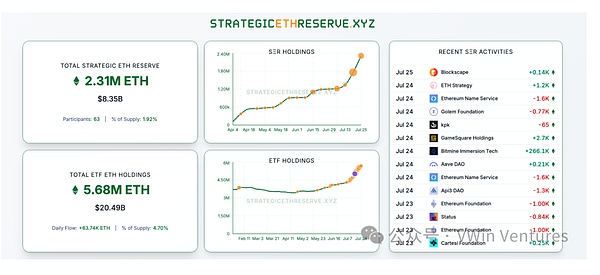

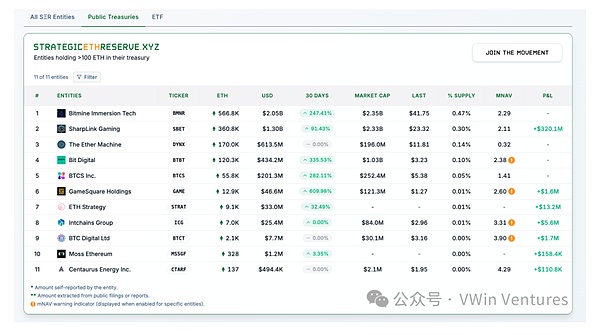

The treasury of listed companies led by Sharplink Gaming and Bitmine immersion accelerates the increase in allocation to Ethereum. The portrait of Ethereum holders has changed from early speculative retail investors to long-term holders, helping Ethereum break through multiple key positions in this round of rise;

– New applications, new assets, new narratives:

Stablecoins and RWA are the two largest incremental tracks for traditional institutions to enter, and Ethereum has become an inevitable choice for institutions because of its highest neutrality and security;

– Chip structure:

Ethereum has undergone a deep wash-up since 2025, and the chips have undergone in-depth turnover, which has become a necessary condition for the start of this wave of market.

Ethereum-related industrial ecological pattern changes

– Ethereum Treasury Company has become the focus of market capital attention:

-Layer2 has become the first choice for institutions to accelerate their layout of on-chain industries:

Ethereum’s long-term development expectations

– From improvement of capital to the ecological prosperity of application implementation: