Author: Dewhales Research Translation: Shan Oppa, Bitchain Vision

1. Introduction

Ethereum’s upgrade process has always followed a structured, thoughtful approach, with each upgrade designed to solve specific technical challenges while preparing for future needs.From the early Byzantium and Constantinople to the epoch-making The Merge, the Ethereum network has evolved to enhance its capabilities and meet the needs of the market.The upcoming Pectra upgrade (EIP-7600) is the latest step in this ongoing evolution, including 11 Ethereum Improvement Proposals (EIPs), covering multiple aspects of network efficiency and functionality.

Based on previous upgrades, such as The Merge, Shanghai-Capella (Shapella) and Dencun, Pectra aims to eliminate the remaining bottlenecks and pave the way for further technological advancements.In short, each previous upgrade has the following effect on Ethereum:

•The Merge (September 2022): Signifies Ethereum’s transformation from PoW to PoS, significantly reducing energy consumption, and introducing staking as a new consensus mechanism.

•Shanghai-Capella (April 2023): Also known as Shapella, this upgrade allows stakeholders to extract their locked ETH, enhancing liquidity in the Ethereum ecosystem.

•Dencun (March 2024): The introduction of proto-danksharding and blob transactions has driven the development of L2 solutions such as Optimism and Arbitrum, laying the foundation for better scalability and higher transaction throughput.

Now, Ethereum is preparing to welcome the Pectra hard fork, which is expected to be launched on the main network on May 7.Pectra’s focus is to improve validator efficiency, enhance data availability, improve user experience, while laying the foundation for future innovations such as Verkle Trees and stateless clients.

Pectra’s testing begins with the deployment of the Holesky testnet on February 24 to Ethereum’s Holesky testnet.However, the upgrade was not completed as expected and the developers began to investigate the problem.The second attempt at Sepolia testnet on March 5 also encountered problems, with an unknown attacker exploiting the edge situation, resulting in a large number of empty blocks being dug out.To ensure the upgrade is launched more smoothly, Ethereum core developers launched a new test network called Hoodi, which Pectra successfully deployed on March 26.As testing stabilizes, Ethereum is expected to launch the main network version in early May.

2. What exactly is a Pectra hard fork?What impact will it have?

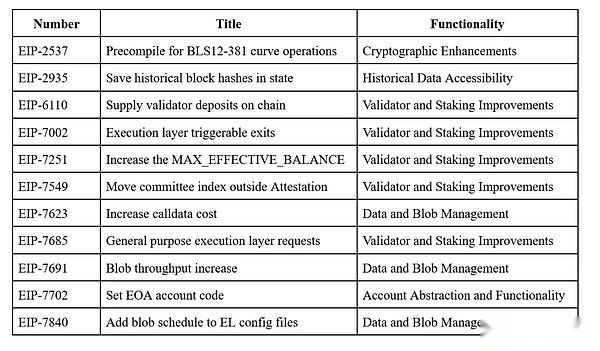

As mentioned earlier, this upgrade includes 11 EIPs, each serving the Ethereum network in a different way:

1. EIP-2537: Added precompilation for BLS12-381 curve operation

EIP-2537 is designed to add BLS12-381 curve operation to Ethereum, making cryptography operations more efficient and scalable.This proposal introduces a new precompiled contract (built-in Ethereum function) that allows smart contracts to operate directly using BLS12-381 without additional implementations.It can be compared to a built-in calculator instead of manually calculating complex math.Two key improvements to this EIP are:

•Batch Verification: Allow Ethereum to verify multiple signatures simultaneously, rather than checking one by one.

•Smaller signature: Reduce the signature volume, thus saving block space (cheaper and faster).

EIP-2537 helps Ethereum scale by improving the speed and cost efficiency of encryption verification.Furthermore, it is especially important for technologies that have zero knowledge proof and privacy-enhanced technologies.

2. EIP-2935: Save historical block hash in state

You can think of Ethereum as a large notebook where everyone records transactions together.Full nodes retain complete records, but what if some nodes do not store all history, they can participate?This is what “stateless clients” mean – they do not save the entire blockchain state, but they can still be efficiently verified and interacted.This is achieved through cryptographic proof.

EIP-2935 proposes a new way to save and read the historical state of Ethereum (such as account balances, contract data, etc.).The purpose is as follows:

• Raise available past state roots (i.e., Ethereum data snapshots) from 256 blocks to 8192;

• Allow stateless clients to quickly verify transactions without the need for a full blockchain history.They can just request proof, rather than download all data.

The importance of this improvement is reflected in:

• Allow more light nodes to participate, which helps Ethereum scaling;

• Supports Verkle Trees and Stateless Ethereum (large upgrades in the future);

• Shorten the synchronization time of new nodes.

3. EIP-6110: Verifier deposit data is provided on the chain

EIP-6110 proposes to change the way new validators join Ethereum PoS system to make the staking process simpler.

Currently, if someone wants to become a validator, they need to send deposit transactions at the execution layer.The consensus layer relies on a voting mechanism between block makers to confirm these deposits.This approach is complex and slow (may take about 12 hours) and has security risks.

EIP-6110 recommends that the execution layer directly include a list of deposit operations in each block.This allows the consensus layer to immediately and automatically identify new deposits without waiting for a vote.

Simply put, this proposal aims to make joining the validator network faster and safer by simplifying data sharing between the execution layer and the consensus layer.

4. EIP-7002: The execution layer can trigger the exit operation

Currently, validators need to use their “verifier key” (a BLS key) to send an exit request to the beacon chain in order to stop staking and withdraw ETH.The withdrawal key can only receive funds and cannot initiate an exit operation.This can cause problems when the key is controlled by different users or when the key is lost.

EIP-7002 introduces a new execution layer smart contract that allows stakers to initiate exits with withdrawal keys.This means that simply interacting with the contract allows you to complete the exit operation without relying on the verification key or beacon chain access.

5. EIP-7251: Increase the MAX_EFFECTIVE_BALANCE upper limit

EIP-7251 increases the maximum valid staking amount of verifiers from 32 ETH to 2048 ETH, allowing verifiers to stake larger stakings without running multiple nodes.

This change allows small pledges to earn more rewards through additional pledges, while large pledges can centrally manage and improve efficiency.By reducing redundant validator nodes, the proposal helps reduce network load and may speed up proofing.

6. EIP-7549: Move the committee index out of signature content

EIP-7549 proposes to modify the way validator signing vote (i.e. proof).Currently each proof contains a “committee index” that identifies the group to which the verifier belongs.So even if the two validators vote consistently, their proofs are also different.

This proposal recommends moving the committee index out of the signature section.In this way, the same votes can be merged more easily, significantly reducing the number of separate proofs to be processed, thereby improving Ethereum’s consensus efficiency.

In addition, EIP-7549 is also a key step towards the “Based Rollups”.By optimizing consensus processes, Ethereum can act as a decentralized sorter, reducing dependence on third-party sorters, thus making Based Rollups more feasible.

7. EIP-7623: Increase calldata cost

Before the Dencun upgrade introduced the blob, the Layer 2 network relied on calldata in the EVM to store data permanently, although this was not the most efficient way.Although blobs are now the recommended way to store data, in some cases, the cost of using calldata is still lower.

EIP-7623 proposes to increase the cost of calldata to encourage the Layer 2 solution to switch to blobs in a comprehensive way, thereby controlling block size (especially data-intensive transactions) and promoting more efficient and stable development of the Ethereum network.

8. EIP-7685: General Execution Layer Request Interface

EIP-7685 introduces a standardized system for communication between Ethereum’s execution layer (EL) and consensus layer (CL) that allows smart contracts to directly contact and send requests within the network.This framework enhances the flexibility and efficiency of validator operations (such as withdrawals), because these operations can be initiated directly through smart contracts and no longer rely on the current more complex inter-chain message mechanism.

9. EIP-7691: Increase blob throughput

EIP-7691 proposes to increase the number of blobs that can be included in each Ethereum block to improve network scalability, especially L2 solutions that benefit from L1 data capacity.The proposal brings two key changes:

•Blob Targets and Caps: It is recommended to adjust the blob target value and maximum value of each block to 6 and 9 respectively, so as to provide higher data throughput without overwhelming the network.

•Basic cost adjustment: Optimize the response ability of the underlying cost to blob usage changes by modifying the ratio between the target value and the maximum value.The proposal introduces new parameters to ensure that the underlying costs respond reasonably based on the amount of blob usage.

10. EIP-7702: Setting up an account code for EOA

EIP-7702 is a step towards account abstraction, allowing standard user accounts (EOA) on Ethereum to temporarily execute smart contract logic.This delegate mechanism allows EOA to take advantage of advanced features that are usually limited to smart contract wallets, such as packaging multiple operations into a single transaction, paying gas fees for others, and enabling fine-grained permission control.In addition, users can choose to use other cryptocurrencies such as $USDC or $DAI to pay for transaction fees.

11. EIP-7840: Adding blob scheduling mechanism to the execution layer configuration file

This proposal allows developers and network participants to modify the parameters of the blob as needed, thereby optimizing network performance and scalability.EIP-7840 introduces configurable blob targets and maximums in client configuration files to make network tuning easier and creates a more predictable fee market for blob transactions.

To better present the overall context of Pectra upgrades, we divide its EIP into the following theme categories:

3. Challenges and concerns

Although the Pectra upgrade is only a small step in the optimization of Ethereum’s basic functions and developers are also pushing it out, there are still some potential risks:

•Complexity of the online process: The transition from the test network to the main network involves major technical and coordination challenges.

•Consistency with Ethereum’s overall development plan: Ensuring that Pectra upgrades can be smoothly integrated into Ethereum’s larger roadmap is a key challenge.Since Pectra lays the foundation for larger upgrades such as Fusaka, any mistakes or technical problems may cause a chain reaction, which will delay subsequent upgrades and slow down the implementation of Ethereum’s long-term scalability.

•Ecosystem adaptability: Verifiers, developers and dApp operators all need to update their systems to support new protocols.This not only takes time, but also consumes a lot of resources.The speed and efficiency of ecosystem adaptation will largely determine the success or failure of this upgrade.

It should be noted that the user’s account balance will not change, and the ETH (and other Ethereum ecosystem tokens) they currently hold can still be used as usual after the upgrade.

•Market Influence: Although this upgrade aims to enhance Ethereum’s core functionality, its impact on $ETH price in the short term is still unpredictable, mainly depending on investor sentiment and actual adoption rate.

•Regulatory concerns: If the upgrade affects the pledge economic model or triggers new centralized risks, it may attract the attention of regulators.

4. Potential Impact of Pectra on Ethereum Network and Ecosystem

Although Pectra is considered a relatively “small victory”, it will affect everything, namely the Ethereum network, ecosystem and players, and its impact cannot be ignored or even underestimated.Furthermore, it is the basis for future upgrades such as Fusaka.As we mentioned above, the technical implications of Pectra, we will now outline them:

1. Impact on the Ethereum network and ecosystem:

-

Enhanced scalability

-

User experience improvement

-

L2 solutions power by enhancing data availability and reducing costs

2. Impact on users:

-

Enhanced wallet (account) function

-

Reduce transaction costs

-

Improve transaction speed

3. Impact on developers:

-

Enhanced inter-layer communication

-

Provide developers with better opportunities as they gain enhanced encrypted precompiled and extended blob capabilities, thereby facilitating the creation of cost-effective and innovative dApps.

4. Impact on the validator:

-

Improve equity flexibility

-

Simplify validator operations

-

Automatic compound reward

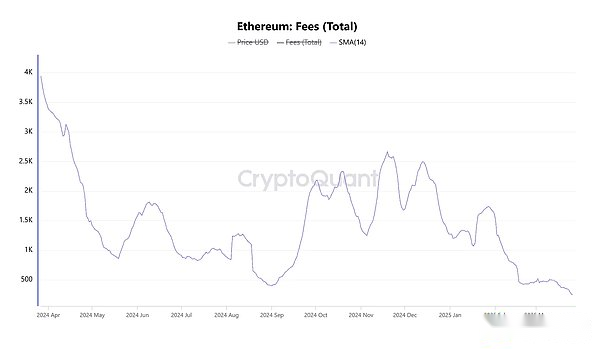

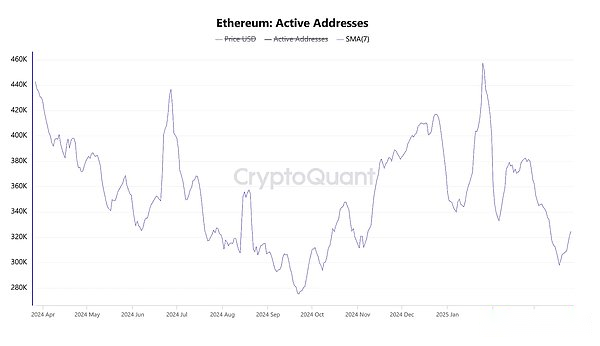

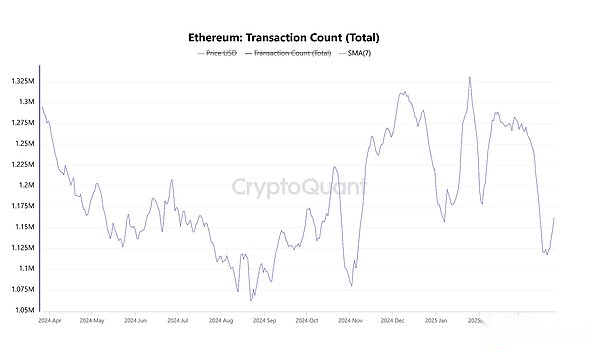

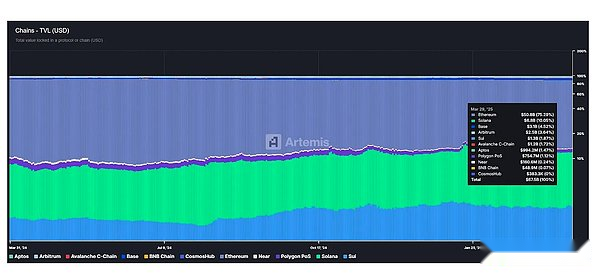

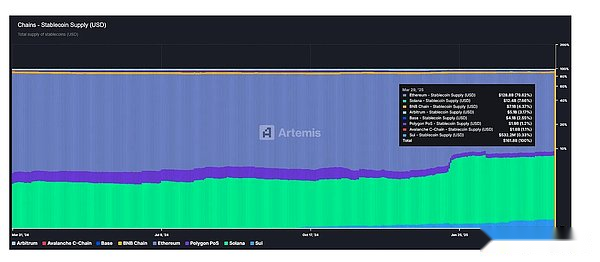

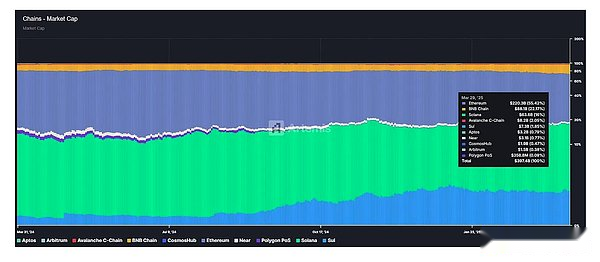

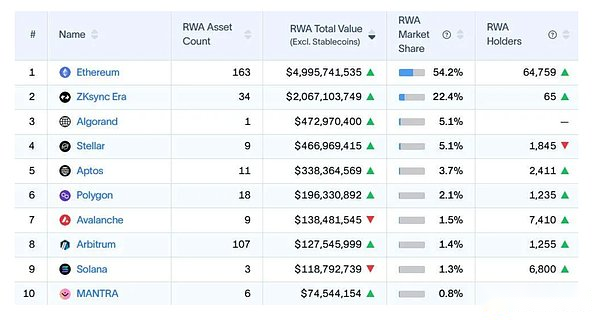

Last but not least is the discussion of liquidity and activity fragmentation in the Ethereum ecosystem, which has now become a hot topic as ETH prices continue to weaken.With the expansion of the Ethereum ecosystem, more and more activities are turning to the L2 blockchain driven by Ethereum’s high gas fees and rapid growth in the L2 network.This migration causes liquidity to be dispersed across multiple L2s, resulting in fragmentation.In contrast, Solana’s unified, monolithic model integrates liquidity within a single network.In other words, Ethereum has made significant progress in scaling with its L2 solution, at the expense of liquidity and fragmentation of user activity.

The decentralization of liquidity and activities will have negative impacts on the network and all participants:

-

Impact on users:Liquidity diversification limits access to depth and liquid asset pools, making it more difficult for traders to execute large orders without having a significant impact on prices.

-

Impact on developers:Developers face challenges when building applications that can seamlessly interact across different chains, which lead to repeated work and increased complexity.

-

Impact on validators:The lower the number and fees of transactions, the lower the demand for block space.Therefore, when the expenses drop, not only will the ETH consumption rate drop, but the validator’s revenue will also decrease.

-

Impact on the price of $ETH:According to Ultrasound.money, the $ETH consumption rate is expected to drop to $28,000 per year, while the supply growth rate has climbed to 0.76 per year.This makes the current issuance rate approximately $950,000 per year.So in fact, $ETH is now an inflation token.

While Pectra will pave the way for a higher level of L2 adoption and expansion, developers and researchers are still working on a variety of projects and solutions to address this “parasitic” effect of L2 on the Ethereum network.Some of these solutions and methods are mentioned below:

-

Interoperability and cross-chain communication:Solutions are being explored to enable seamless communication and asset transfer between different chains, addressing the lack of inherent interoperability.

-

Aggregation protocol:These protocols are designed to integrate liquidity from a variety of sources to provide users with a unified DeFi experience.

-

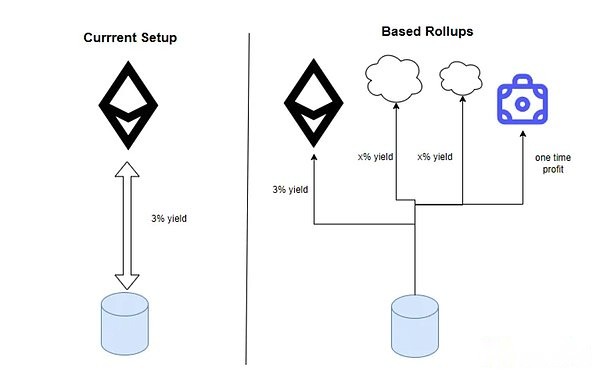

Rollup based on Rollup:They are a new type of L2 Rollup designed to deeply integrate with Ethereum’s infrastructure.Unlike traditional Rollup, Rollup based is directly managed by Ethereum’s consensus layer.In other words, Rollup no longer has its own independent sorter, but Ethereum itself takes over the role.This also reduces dependence on centralized participants.

5. Potential Impact of Pectra on Ethereum Price

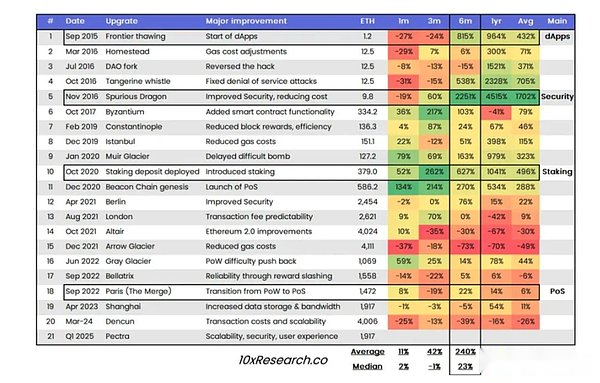

Generally speaking, technology upgrades will push up the price of tokens, and Ethereum is no exception.According to 10xResearch, the average and median changes in the $ETH price in the short to medium term are almost always positive.However, there is a problem: in recent years, especially after The Merge, the upgraded data seems to have been disappointing.This can be attributed to a well-known event, namely, “buy rumors, sell news.”So, who knows?Maybe this will happen again to Pectra.

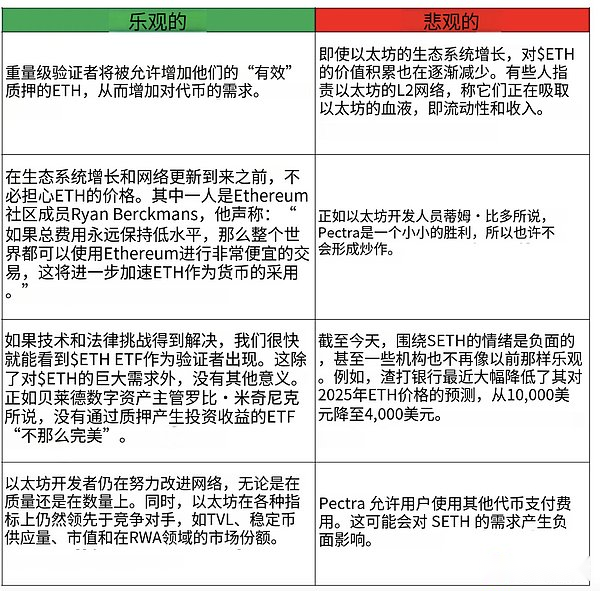

Putting aside history, people have both optimistic and pessimistic views on the direction of $ETH after Pectra.Here we divide these ideas into two parts:

To sum up, no one can be 100% sure what will happen to the ETH price, whether in the short term or in the long term after Pectra.In addition to what we discussed earlier, there are some macro factors worth noting:

-

A broader crypto market atmosphere,

-

Around Pectra’s sentiment and the market’s perception of it,

-

Ethereum’s competitors, most importantly, are Solana, how will they play chess.

6. What is the next step for Ethereum?

Pectra not only can immediately improve Ethereum, but it can also lay the foundation for a deeper transformation of network infrastructure.While Pectra introduces various code updates, its bigger role is to lay the foundation for the upcoming Fusaka (Fulu + Osaka) hard fork, which will implement the Verkle tree.

The Verkle tree is a data structure designed to enable Ethereum nodes to store and access data more efficiently.By providing smaller, more efficient proof of data verification, they help reduce storage requirements and increase scalability, making the network more efficient overall.

Compared to Pectra, Fusaka’s upgrade is larger and more complex, and will handle a large part of Ethereum’s long-term evolution.While Fusaka’s specific timeline is still under discussion, it is expected to be launched in 2025 or 2026, depending on the progress of previous upgrades and testing.

Key improvements that Fusaka may include:

-

Peer-to-peer data availability sampling (PeerDAS):This is a core element designed to improve data availability sampling, resulting in higher scalability.

-

Ethereum Object Format (EOF):Designed to modernize Ethereum Virtual Machines (EVMs) and improve security, developer tools and overall developer experience.

Finally, to answer the questions in the title of this article, we should wait and see how successful Pectra will be, and how the ecosystem and the broader market view it.