Giant Whale took advantage of the callback to sweep the goods crazily, with a maximum position of nearly 80,000 ETH at a single address

In the past weekend, the market experienced a round of correction, but this became the best time for giant whales to enter the market.

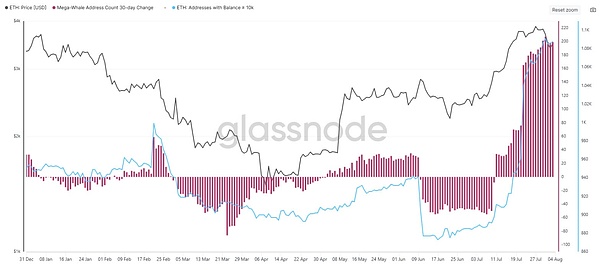

Data shows that the number of giant whale addresses in Ethereum (ETH) has increased significantly in the past 30 days.Since July, more than 200 new “mega whale” addresses have been added – each of which holds at least 10,000 ETH.The entities behind it include exchanges, large custodians, and exchange-traded products (ETPs).

Arkham also disclosed yesterday that a mysterious address transferred in through Galaxy Digital’s OTC channel in just three days and held up to 79,461 ETHs, with a market value of more than $280 million.These large buying shows strong confidence in the long-term value of ETH, while also injecting substantial liquidity and momentum into the market.

BlackRock leads the lead in grabbing, ETH spot ETF inflow continues to hit high

This wave of buying is not only a retail investor behavior, but also comes from traditional financial giants who are optimistic about the financial prospects on the chain.

Asset management institutions represented by BlackRock are rapidly increasing their holdings in ETH.Its launch of Ethereum Spot ETF (ETHA) has recorded consecutive net inflows of funds in the past ten trading days, with a total amount of up to US$1.7 billion.

According to the Dune data platform, the number of ETH held by all Ethereum ETFs has increased by more than 40% in the past 30 days.This shows that the speed of institutional buying has entered a stage of rapid growth.

Policy boosts, Wall Street embraces Ethereum

Behind this wave of ETH buying wave, not only is it driven by investment enthusiasm, but the policy changes also play a key role.

The “Crypto Policy Report” and “Project Crypto” plan recently released by the White House and the Securities and Exchange Commission (SEC) show that the US government is promoting the on-chainization of the traditional financial system, intending to remain ahead in the global digital finance competition.

It is worth noting that after several Wall Street banks conducted in-depth research on major public chains, the one that was finally selected as the underlying infrastructure is Ethereum, the largest and most stable smart contract platform at present.This means that ETH’s positioning is no longer a “cryptocurrency”, but may also be an indispensable “digital economy asset” in the global financial structure in the future.

The ETH turnover between retail investors and institutions is happening

Currently, about 12% of Bitcoin’s total supply has been held by listed companies, ETFs and institutions, while only about 5.2% of Ethereum is controlled by institutions (and ETH still has an inflation mechanism), which is still a huge gap from Wall Street’s expectations.

This also means that it is now a mid-term stage of capital structure transformation: retail investors continue to be shaken out, and institutions are accelerating their entry and layout.In the future, retail investors will hold less and less ETH, and the bargaining chips in institutions will continue to rise.Now, this script of “asset redistribution” is being staged quietly.

ETH will become part of global finance

From on-chain data to policy trends, all signs point to the same trend:

Ethereum is like Bitcoin, entering the mainstream system, but it is taking another path – becoming the core underlying structure of the new financial order of the United States and Wall Street.

And when ETH flows from decentralized communities to sovereign capital and institutions, it has also caused people to worry about the degree of decentralization of the network.But it is undeniable that Ethereum is being officially included in the world’s financial mainstream and has become a part of the future financial system.