Author: Brayden Lindrea, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

Ethereum is the world’s second largest blockchain network and is expected to be the focus of the next spot cryptocurrency exchange-traded fund, but it may have publicity issues.

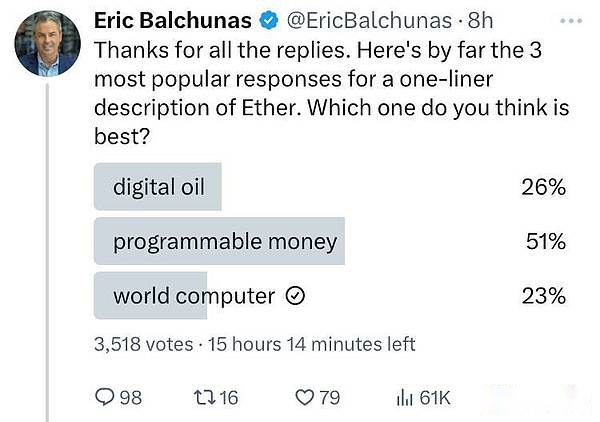

While Ethereum has been described as a “currency internet,” “world computers,” and “digital oil,” in the past, some people worry that Ethereum does not have good publicity, and its highly technical roadmap may be difficult to grasp by Wall Street, and maySuppress the demand for spot Ethereum ETFs.

Markus Thielen, research director at 10x Research, notes that the best investor recommendations should avoid technical terms.Here are the following: Thielen and several commentators believe that Ethereum can be recommended in this way.

The Future of Finance

Thielen said,As a “network that empowers the future of finance”, Ethereum is easier for Wall Street investors to understand.

Ethereum already has almost all the world’s largest decentralized financial protocols, tokenized real-world assets and stablecoins.

However, Thielen pointed out that Ethereum has lost many users and the recent network upgrades are progressing quite slowly, which may affect this claim.

“Although Ethereum’s staking yield is lower than Treasury yields, the fact that Ethereum generates insignificant revenue relative to its market capitalization does not make it a viable investment that generates cash flow.”

Integrated decentralized ecological platform

Henrik Andersson, chief investment officer of investment management firm Apollo Crypto, saidEthereum can also be called a “decentralized service platform” to support everything from finance, social networks to artificial intelligence.

Source: Eric Balchunas

In addition to decentralized financial applications, the Ethereum ecosystem also includes decentralized autonomous organizations, social networks and identity solutions.

Ethereum has more room for growth than Bitcoin

Andersson suggests that a simpler publicity is,Ethereum is a cryptocurrency with more room to rise than Bitcoin.

“Others may just see Ethereum as a smaller, faster-growing crypto asset,” he said.

Ethereum’s market capitalization is currently $453 billion, while Bitcoin’s $1.34 trillion is about three times the market capitalization.

Andersson saidOthers will be attracted by the potential price increase in Ethereum, and he firmly believes that Wall Street investors will not be troubled by Ethereum’s complex six-stage technology roadmap.

Regardless of technology, Ethereum’s price relative to Bitcoin (BTC) has steadily dropped from 0.085 in December 2021 to 0.055 today.

CK Zheng, investment director at cryptocurrency hedge fund ZX Squared Capital, explained that this will make it more difficult to convince investors to buy Ethereum ETFs that already have the same Bitcoin investment products on the market.

ETH/BTC charts for the last 12 months.Source: CoinGecko.

Zheng pointed out that the Ethereum Foundation was investigated by the US Securities and Exchange Commission and the rise of Solana to become an Ethereum competitor are two other factors that may hinder the performance of spot Ethereum ETFs.

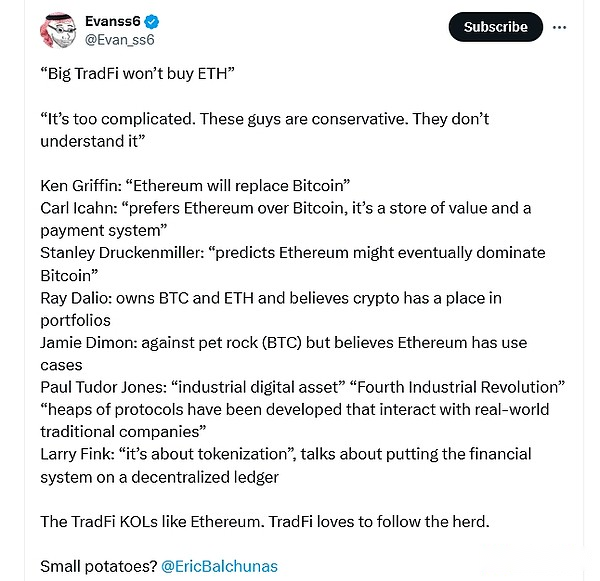

Larry Fink believes in this, so you should believe it too

That being said, some of the big Wall Street companies have begun exploring the use cases of Ethereum and have achieved considerable success.

BlackRock (one of the approved spot Ethereum issuers) used Ethereum tokenize its BlackRock dollar institution digital liquidity fund in March, which has accumulated $470 million in assets.

BlackRock CEO Larry Fink saidEvery stock and bond will eventually be tokenized on the blockchain.21Shares analysts say Ethereum may benefit if Fink’s predictions come true, as it already accounts for 71.9% of all tokenized financial assets on the chain.

Source: Evanss6

The SEC approved 19b-4 applications for VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy and Bitwise to issue spot Ethereum ETFs on May 23.

Approvers must wait until the SEC approves their S-1 form documents before the ETF can begin trading.

If that happens, Bloomberg ETF analyst James Seyffart expectsETFs will absorb 20% of the traffic seen by spot Bitcoin ETFs, Balchunas estimates are smaller, ranging from 10% to 15%.