The market’s confidence in Ethereum seems to be shaken. Coupled with the hidden cost of the Layer2 war and the siphon effect of the Solana Meme economy, amid the controversy, Ethereum’s future path seems to be becoming increasingly blurred.

The “10,000-year-old second” Ethereum seems out of place in this bull market.Compared with the strength of currencies such as Bitcoin and SOL, ETH has been hovering around US$3,000.In addition, the frequent selling of coins by the Ethereum Foundation has aroused strong dissatisfaction among the community, and the market’s confidence in Ethereum seems to be shaken. Coupled with the hidden cost of the Layer2 war and the siphon effect of the Solana Meme economy, amidst many controversies, EthereumThe future path seems to be becoming increasingly blurred.

EF frequently sells coins and “lose your favor”

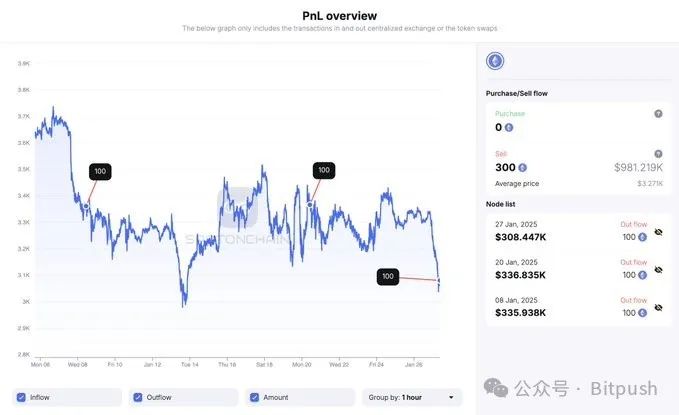

The Ethereum Foundation (EF) has been selling ETH intermittently and recently sold 100 more ETHs worth about $307,893.Data from blockchain analytics firm SpotOnChain shows that this is the foundation’s third ETH sell-off in 2025.

In January this year, EF sold a total of 300 ETH (data as of January 27), worth about $981,200.Market observers pointed out that the foundation’s selling has put pressure on Ethereum’s prices.As of press time, ETH trading price was slightly above $3,000, down more than 7% in 30 days.

However, the Ethereum Foundation still holds a large reserve of ETH.According to Arkham Intelligence, the foundation owns 269,175 ETHs, worth approximately US$817 million.

At the same time, Ethereum’s on-chain activities are also significantly behind other competitive chains.

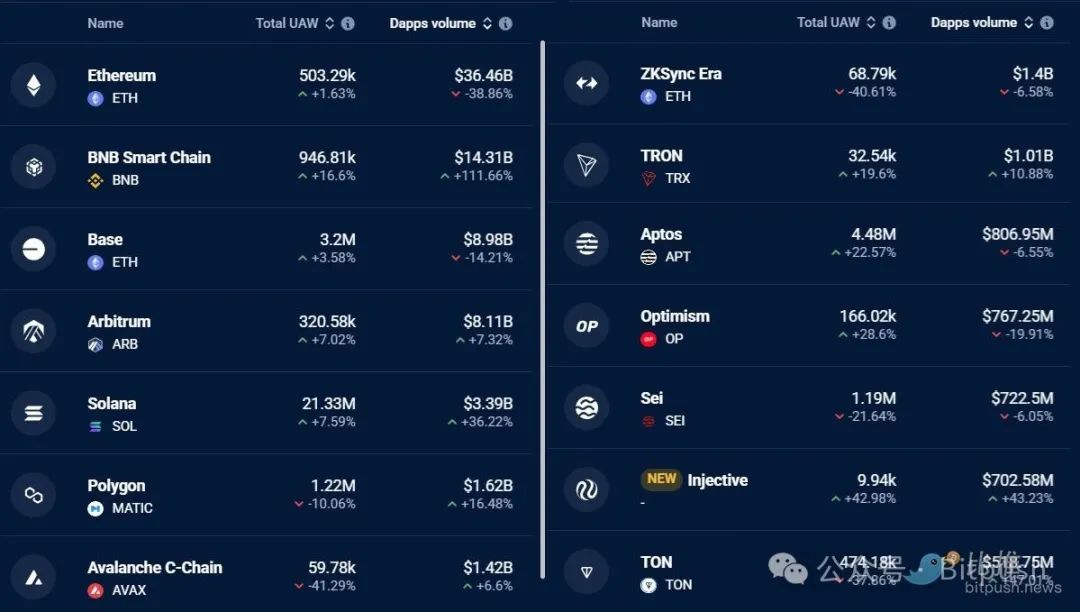

According to DappRadar data, on-chain transaction volume on Ethereum fell 38% to $36.5 billion in seven days.

By comparison, activity on BNB Chain surged 112%, while Solana grew 36%.

According to DefiLlama, Ethereum incurred only $46 million in fees between January 14 and January 21.By comparison, Solana charged $71 million, which combined with the contributions of Raydium, Jito and Meteora, totaled $309 million in the same period.

Ethereum L2 has been criticized as “Band-Aid”: the “division” behind the prosperity,

As ETH performs sluggishly, the Ethereum Foundation is facing severe challenges, and calls for innovation and internal restructuring are getting higher and higher.The rise of blockchains such as Solana has intensified the need for Ethereum to enhance its own strength and innovate within the ecosystem to maintain its competitive advantage.

The emergence of Layer 2 solutions such as Optimism, Arbitrum, etc. has alleviated the congestion and high gas fees on the Ethereum main network.However, the competition between these Layer 2s is becoming increasingly fierce, and the problem of ecosystem fragmentation is also highlighted.

Michael Egorov, founder of the decentralized exchange Curve Finance, criticized in a report that L2 “is more like a band-aid… and temporary solutions than building a foundation for a sustainable strategy.” He stressed that the Rollup roadmapIt hinders composability and “leaks” most of ETH’s value to L2 tokens and its operating companies.

In a post shared by Ethereum Foundation Justin Drake last weekend, he called for “Enable native Rollup technology to end the era of Layer2 separatism.”

Crypto research and investment firm Paradigm also called for reforms.The company believes that Ethereum’s current annual upgrade plan limits its ability to innovate and respond effectively to market trends.“Accelerating Ethereum will allow more people to enjoy the convenience of permissionless innovation and help pave the way to a truly globalized and minimal trust financial system,” Paradigm said.

Faced with increasing pressure, the Ethereum Foundation announced plans to allocate 50,000 ETH (about $165 million) to support its decentralized financial ecosystem.

Ethereum co-founder Vitalik Buterin said the foundation is indeed making “significant adjustments” to leadership to increase transparency and better support developers.

Technical Analysis: Key Support and Market Sentiment Game

If you want to find a sword in the boat, February and March have always been bullish for ETH.

Coinglass data shows that ETH has been on an upward trend in February for the past six consecutive years, with the biggest gain in 2024, when it rose from $2,280 to $3,380 at the end of the month, an increase of more than 46%.March is also a favorable period for ETH in history.Seven of the past nine years have risen in March and six in April.

Engineer and analyst Wolf posted on X on January 26: “With eight years of analyst experience, I can confidently say that I have never seen a chart as strong as ETH, and the potential here is unparalleled.This is the best asymmetric bet you can make”.

Technical analyst Rakesh believes ETH/USDT may fall to $2,850, which could become a strong support level.If the price rebounds from $2,850 but falls from the 20-day moving average ($3,308), it means the shorts are selling at highs.This increases the risk of falling below $2,850.If this happens, the pair could fall to $2,400.

There is not much time left for the bulls, and if they want to stop the decline, they have to push the price back above the 50-day moving average ($3,455) and then ETH/USDT may continue to rebound to $3,745.

In summary, when Solana uses Meme coins to reconstruct the traffic entrance, Layer2 becomes a value blood drawer, and Ethereum’s moat seems to be being seriously eroded.Technology advantages must be transformed into ecological dominance. The loss of every price support level may trigger the collapse of faith. Time will tell us the answer to where Ethereum will go.