Golden Weekly is a weekly blockchain industry summary column launched by Bitchain Vision, covering weekly key news, market and contract data, mining information, project trends, technical progress and other industry trends.This article is a project weekly, which takes you a look at the progress of mainstream projects and celebrity projects this week.

Bitcoin

President of New York Stock Exchange Group: The liquidity brought by Bitcoin ETFs is undisputed

According to Bitcoin Vision, Lynn Martin, president of the New York Stock Exchange Group, said in an interview with CNBC that the success of Bitcoin ETFs and the liquidity it brings are undisputed.

Bitcoin chain NFT sales in May are less than $200 million, the lowest level in the past seven months

Bitcoin Chain Vision reported that according to cryptoslam data, NFT sales on Bitcoin chain in May were less than US$200 million, about US$190,067,268.88, the lowest level in the past seven months. The total number of NFT transactions on Bitcoin chain last month was about 15.There are tens of thousands of transactions, of which there are approximately 61,072 independent buyers and 45,414 independent sellers.As of now, the total sales of NFTs on the Bitcoin chain have exceeded US$3.95 billion.

Analysis: Ethereum price is strong and surpassing Bitcoin, driven by three major factors

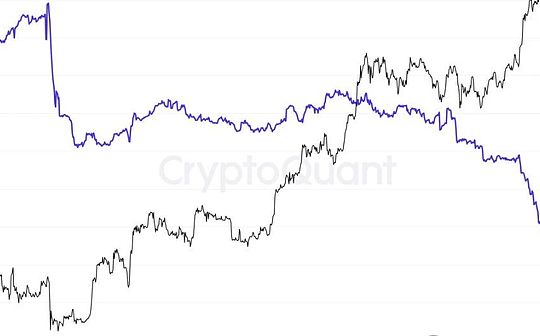

According to Bitchain Vision, cryptocurrency analyst Nancy Lubale posted a statement saying that Ethereum (ETH) prices strengthened in the ETH/BTC pair, and there are three main reasons:Spot Ethereum ETF expectations: ETH has risen about 30% relative to BTC since the U.S. Securities and Exchange Commission approved the spot Ethereum ETF on May 23, while BTC has only risen 9%.Growth of network activity: In the past week, transaction volume of Ethereum decentralized applications (DApps) has increased by 7.75%, and the number of smart contracts has also increased from 37,870 to 38,066.Technical indicators are bullish: The ETH/BTC ratio has continued to rise since May 17, reaching a two-week high of 0.05854 on May 23.Analysts predict that the ETH/BTC ratio will reach 0.1 in a few months.Experts believe that the launch of the spot Ethereum ETF may be at the end of June, which will further drive ETH prices, with the market expecting its price to reach $10,000 in the current cycle.

Bitcoin native DA layer Nubit has been integrated with Babylon Devnet

On May 31, Nubit, a Bitcoin native DA layer, announced that it has now integrated Babylon Devnet.As Babylon’s closest partner, Nubit is one of the first projects to carry out actual technology integration.Integration will make Bitcoin staking within Nubit trustless.This enables Bitcoin holders to participate and strengthen Nubit systems to create the most secure and scalable data availability layer.During this integration process, BabylonNode is responsible for managing the pledge operations and processing critical data.Meanwhile, IBC Relayer facilitates efficient communication between Nubit and Babylon.

Report: When Bitcoin hits a new high in this round, the selling pressure of “diamond hands” was only half of the previous bull market

Bitchain Vision reported that on-chain analysis company Glassnode said in a new research report on May 28 that the selling pressure from the “diamond hands” is only half of the previous bull market.Long-term Bitcoin holders (LTH) continue to resist the urge to make a profit—even if the BTC price moves close to $70,000 and the average profit of the LTH wallet is 3.5 times.So far, LTH wallets have not sold BTC at a rate that makes the current bull market unsustainable.

Forbes: Bitcoin inflation after halving is 75% lower than the current U.S. inflation rate

On May 29, the Bitcoin inflation rate after the halving is now 75% lower than the current U.S. inflation rate and 72% lower than the annual issuance of gold.After the Bitcoin halving in April, the block reward dropped from 6.25 bitcoins to 3.125 bitcoins, which had a significant impact on the issuance rate of cryptocurrencies.Each halving event reduces the supply of new Bitcoins, tightens market supply, and may increase asset value over time.At present, about 450 bitcoins are mined every day, and Bitcoin’s current inflation rate is about 0.84%, while the latest U.S. inflation data in May is 3.4%.The decline in Bitcoin’s inflation rate is an important milestone as it is now even below the lower limit of annual inflation in gold, which is between 1% and 3% per year.Gold mining issuance results in an increase of supply by 1%, and recycling of gold is also included in its inflation rate, with an inflation rate of 9% in 2023 resulting in a net increase in gold circulation supply by 3%.

Ethereum

CNBC Host: Ethereum is an excellent means of store of value

Bitchain Vision reports that CNBC Mad Money host Jim Cramer shared his views on Ethereum and Spot ETH Exchange Trading Funds (ETFs), saying: “I hold ETH because I think, in today’s world, the dollar will face difficulties due to the severe US federal budget deficit, and Ethereum is a good means of store of value. “In addition, Jim Cramer clarifies that ETH is not a stock, “but thinks it is worth owning.”Jim Cramer, a former supporter of Bitcoin, sold all of his holdings due to ransomware concerns after initially proposing to allocate 5% of his portfolio to BTC in March 2021.

Bloomberg ETF analyst: US spot Ethereum ETF may launch by the end of June

Bitchain Vision reported that Bloomberg ETF analyst Eric Balchunas said that the possibility of U.S. spot Ethereum ETF may be launched by the end of June after BlackRock and Grayscale updates files.The possibility of launch in mid-June is very small, and the latest product launch date is expected to be July 4.Balchunas’ expectations are affected by the time the issuer S-1 declares.He commented on BlackRock’s May 29 S-1 amendment, which he noted that the amendment did not include fees and other important data, making it a close to the final version.Grayscale submitted an S-3 amendment for its fund on May 30, updating the fund and explicitly prohibiting pledges.These two statements mark one of the last necessary steps before these funds begin trading.

Grayscale submits the revised S-3 registration statement of spot Ethereum ETF

Bitchain Vision reported that on Thursday the day after BlackRock submitted its revised S-1 statement for spot Ethereum ETF, Grayscale submitted its revised S-3 registration statement on Thursday, with more revisions expected in the futureRegistration statement afterward.Grayscale discusses regulatory handling of Ether in its latest document.

Vitalik reveals some regrets about the initial design of Ethereum

May 30th news, at this year’s ETHBerlin event, Ethereum co-founder Vitalik Buterin described some of his regrets in the initial design of Ethereum.Vitalik said he had a series of things he could have done differently.These things range from the development of Ethereum virtual machines to smart contracts to proof-of-stake consensus mechanisms.He also said that even if Ethereum becomes more mainstream, it is still misunderstood.”Based on everything you know and learn in the past 10 years, if you could start from scratch today, how would you build Ethereum differently?” Vitalik said Ethereum’s initial EVM design choice256-bit processing, rather than 64-bit or 32-bit, the original design was too complex for 256-bit, which is very inefficient and can generate a large number of on-chain even when performing simple tasks.Redundant data.In addition, Vitalik said that Ethereum switches from a proof of work consensus mechanism to a proof of stake in 2022 should be done earlier.Vitalik also mentioned: “The automatic log of Ethereum transfer should exist from the beginning. We only need to take 30 minutes to complete the encoding, but it has become an EIP.” Vitalik submitted an EIP on May 17-7708 will make this exact change.Vitalik also said that if he re-selected, he would use SHA-2 to encrypt Ethereum instead of the encryption algorithm called Keccak currently used.

TD Cowen: Ethereum ETF paves the way for more cryptocurrency funds

According to Bitcoin Vision, the research team of investment bank TD Cowen believes that it is inevitable that the Ethereum ETF will be approved after Bitcoin is approved.That’s six months faster than we expected, but the decision is inevitable once the SEC approves crypto futures ETFs, Jaret Seiberg of TD Cowen, Washington Research Group, wrote in a note.The next product launched in a year could be a basket of cryptocurrencies, maybe just Bitcoin and Ether, but there may be more.However, this approval does not mean that the SEC’s overall attitude toward cryptocurrencies has changed overall, as Gary Gensler, chairman of the committee, who is critical of cryptocurrencies, issued a highly critical statement against the passage of potentially weakening the agency’s powersCryptocurrency legislation.

Other projects

WalletConnect launches AppKit and WalletKit

WalletConnect has released AppKit and WalletKit, its latest development kit for connecting wallets to dapps.AppKit enables developers to integrate features such as email and social login, Safe-powered smart contract wallet login, fiat to cryptocurrency bridge, and exchange capabilities into their applications.WalletKit simplifies the process of developers integrating “Connect with WalletConnect” and enables users to connect to desktop applications from their mobile wallets.WalletKit also includes one-click connection and verification capabilities.Both toolkits support notifications triggered by on-chain operations.The new development kit is scheduled to be released on June 12.

Safe launches ERC-7579 adapter

Safe introduces the ERC-7579 adapter that integrates modules from external platforms into Safe smart accounts.The ERC-7579 standard establishes a module interface to ensure interoperability between different wallet implementations.The ERC-7579 adapter enhances wallet function and supports modules such as pass keys and session keys.Developers can now implement the adapter on their existing Safe accounts.

Conduit supports Arbitrum Stylus on test networks

Conduit supports Arbitrum Stylus on the test network. Users can write contracts in Rust or any language that can be compiled into WASM. The computing power is expanded by more than 10 times and the memory is expanded by 100 times. EVM contracts can interact seamlessly with the Stylus contract.

Python Entropy and price feeding services have been deployed to Sei V2

Decentralized oracle service Python Network posted on the X platform that its Python Entropy and price feed services have been deployed to Sei v2.

Solana Community Votes to Pass Proposal for “Assigning 100% Priority Fees to Validators”

According to the official governance page, the Solana community has voted to pass a proposal to allocate 100% priority fees to validators to replace the current structure of 50% destruction and 50% rewards.The vote ended at the end of 620 epoch, with 51.17% stake participating and finally passed with a 77.77% approval rate.

Previously, tao-stones released the “Proposal for Enable Full Priority Fee Rewards for Verifiers on Solana Mainnet-beta” on the Solana Developer Forum. It is recommended to adjust the priority fee structure and reward 100% of the priority fee to the Verifier,Ensure that validators have the appropriate incentives to prioritize network security and efficiency.

Tao-stones, the initiator of the discussion, said that the implementation of this proposal requires the use of featuregate.While the payment structure for transaction submitters will not change, the software containing this proposal will allocate a larger proportion of fees to validators than previous versions.Therefore, functional gating is essential to ensure that all validators have smooth transitions to new features at the epoch boundary, thus maintaining consensus.

Bitcoin’s OP_CAT proposal may change Bitcoin blockchain

The Bitcoin blockchain may undergo significant changes in 2026 due to the launch of the Runes protocol and OP_CAT proposal.On April 19, the Runes protocol was launched at the fourth halving of Bitcoin, aiming to generate Bitcoin native tokens more efficiently.Within two days of launch, more than 7,000 Runes tokens were minted, and now there are more than 91,000, with a transaction fee of US$4.5 million.

The Runes protocol not only promotes token generation, but also promotes liquid staking, investment activities, second layer expansion and DeFi innovation.However, Runes is only part of BTCFi.It is expected that the OP_CAT proposal passed in 2025 will re-enable the Bitcoin smart contract function, allowing the creation of conditions and rules to open up the possibility of development of layer 2, smart contracts, etc.

Galxe is building L1 smart contract platform Gravity, planning to move all its products to the new blockchain

Galxe (GAL), a web3 infrastructure and digital certificate network, said Wednesday that it is building its own L1 smart contract platform, Gravity, and migrating all its products to the new blockchain.The first version of the network is built on the Arbitrum Nitro technology stack and will be launched in June to test cross-chain settlement in an open and transparent manner. The Gravity main network has native staking and re-staking functions and is scheduled to be launched in the second quarter of 2025.

The Galaxy team said the reason for creating Gravity is because the platform’s user base has grown significantly over the past three years, with 20 million users and 100 million transactions per month, so a more efficient and scalable solution is needed to manage Galaxy.Cross-chain interactions between 34 blockchains supported.

SmartLayer announces integration with multi-chain self-hosted wallet TokenPocket

SmartLayer integrates with the multi-chain self-hosted wallet TokenPocket.Users can view and interact with ERC-5169 NFT through the Smart Token Viewer on the TokenPocket wallet.