Author: CapitalismLab Source: @Nintendodoomed

Magpie’s Subdao @eigenpiexyz_io has opened the integration activity today. This is by far the largest cake for TVL providers in the LRT project. In addition to the projects, the previous Magpie’s Subdao has a lot of benefits, and the configuration value is Heng Olympic.

This Thread will analyze EIGENPIE’s airdrop gameplay, mechanism, prospects, and revenue expectations to help you obtain maximum returns.

>

A. Air investment gameplay

Currently, STETH and other LST can get triple returns:

1. EIGENPIE points, the corresponding 10% airdrop with a total amount of 10%

2. EIGENLAYER Points (after EIGENLAYER opens the deposit on February 5)

3. EIGENPIE corresponds to total 24% IDO share, 3M FDV low valuation

3. The basic income of LST (for example, the Meth APR is 7%, then you can continue to enjoy 7%)

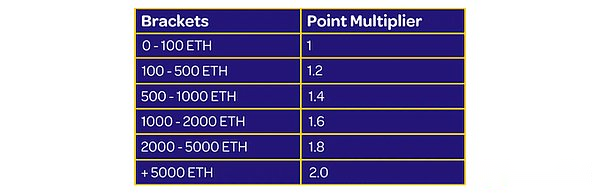

Points will provide gain based on the total size of the team. The larger the team, the larger the maximum, so it is best to hold the group to warm it. Welcome to join: https://eigenlayer.magpiexyz.io/? Ref = 0x307225BC52EF0FEDAA6726996CEA924EEE

After use, you continue to invite newcomers, and they will also join this team.

>

B. Mechanism

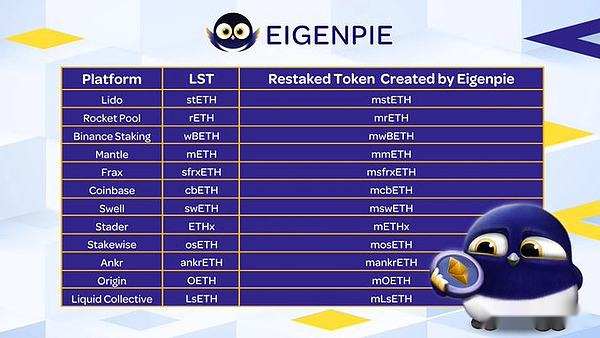

EIGENPIE is doing it for the ISOLATE LRT (ILRT). Send a corresponding token isolation risk for each LST. See the following table:

At present, Eigenlayer has so many LST. If a LRT project is accepted in general, then this project must bear the risk of all underlying LST. Once a certain LST has a security problem, it may cause a devastating blow to it.

>

So there is an EIGENPIE’s ILRT that can be isolated, and the risk is isolated and the liquidity is isolated. Is there a problem?In fact, it is not dyed. Compared with LRT supporting LRT, one of the advantages is that one of the advantages is that one of the advantages can make full use of the liquidity of the underlying LST.The separate PAIRs of mreth/ends, MMETH/METH are actually more conducive to cooperating with LST projectists to motivate liquidity.

C. Prospect

What are the advantages of this project?After all, it is a bit late, but there is indeed a vacancies that have not been filled in: LST LS that entered Eigenlayer is urgent to participate in the LRT narrative, and EIGENPIE is currently the best solution. Each LST has independent independence.Don’t worry about making wedding dresses for others.LST, a higher interest rate like METH, can also continue to play its advantages.

When can Mint’s MSTETH trading in DEX?Will you give PENDLE?

It is obvious that the project party has great willingness and ability to advance these. Without him, these can bring Cakepie, Penpie’s rich bribery income.

If you don’t know about Magpie’s architecture, you can refer to our previous tweet:

https://twitter.com/nintendodoomed/status/168045767576255489

D. Revenue expectations

Income here, let’s look at the next token economy:

• IDO: 40%

• airdrop: 10%

• Incentive 35%

• MAGPIE TREASURY: 15%(without sale according to the convention, Staking dividends to VLMGP)

Basically, it is a Fairlaunch operation. The difference is that most of the current Fairlaunch whitelists are set in more. Most of this IDO white list is given to TVL provider to TVL providers

The right to the TVL provider is:

1. A total of 10% airdrops

2. 60% IDO share, IDO accounts for 40% of the total, $ 3M FDV valuation

That is to say, 10%+60%*40% = 34% of the total amount will be given to TVL provider, which accounts for 34%/ 50% = ~ 70% of the initial circulation. There will be no VC throwing these in the future.

>

At present, the LRT narrative is very hot, only $ 7m TVL $ RSTK has $ 35M McAP and $ 180M FDV. At present, the valuation of several other projects has been released.

EIGENPIE’s final tvl will be much higher than RSTK. If according to the $ RSTK FDV benchmark, the total profit of the TVL provider can also reach: 10%*180+60%*40%*(180-3) = $ 60M

Assuming that the coin is issued two months later, if the average TVL is $ 200M, it can also reach (60/2)/200*12 = 180% APR.Participants have 2 times the number of points increase

Let’s take a look at the increase of the Subdao IDo of Magpie to this day:

-

Penpie, IDO 3M FDV, 14 times

-

RADPIE, two -wheeled IDO average 7.5m FDV, 1.4 times

-

Cakepie, IDO 20M FDV, 2.4 times

This time the larger LRT track in the market has not only taken out 3M FDV, but also to the TVL provider’s airdrops and IDO shares several times the PNP of the year. I wonder if the benefits will be engraved or even surpassed.

Summarize:

1. The airdrop needs to hold the group heating to get a larger increase.

2. The risk of the special mechanism is ILRT isolate each LST

3. Advantages also have PENDLE/PANCAKE resources accumulated by Magpie to accelerate development

4. Most of the rights and interests are given to TVL provider, the IDO quota is transparent Fairlaunch

>