In the third quarter of 2025,Decentralized exchange (DEX) spot trading volume reaches $1.43 trillion, recording strongest quarterly performance in history,Signaling a structural shift in the way cryptocurrency markets are priced.

This data increased 43.6% from US$1 trillion in the second quarter and surpassed the historical record of nearly US$1.2 trillion set in January-March 2025.

The transaction volume in August and September ranked second and third highest in history with US$510.5 billion and US$499.1 billion respectively, second only to US$560.3 billion in January 2025.

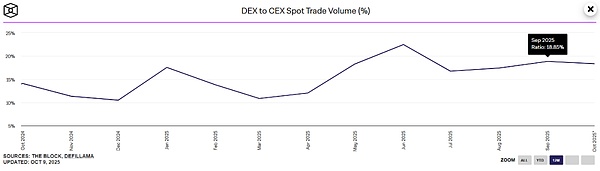

According to The Block data,DEX trading volume accounts for 17.7% of the total spot volume on centralized exchanges,An increase of 0.1 percentage points from the second quarter and the previous high.

This milestone shows that decentralized platforms have been able to keep pace with centralized exchanges during active trading periods, reflecting increased infrastructure maturity and liquidity depth.

The surge in trading volume is accompanied by fundamental changes in market mechanisms.Analyst Ignas pointed out that the recent performance of cryptocurrencies listed on Binance has generally been weaker than the market, indicating that the price discovery link has been transferred to decentralized exchanges, while centralized platforms have gradually become exit liquidity channels.

Simon’s Cat (CAT) and Magic Eden’s ME both fell by 70% after going online. Velodrome (VELO) plummeted by nearly 70% to $0.1154 after going online on Binance, confirming the trend of centralized exchanges increasingly becoming exiting liquidity tools rather than pricing venues.

Ignas concluded:“Previously, price discovery occurred in the VC private equity market, and CEX served as an exit channel; now DEX assumes the price discovery function, and CEX focuses on exiting liquidity..”

This shift is led by professional traders known as “smart money” on decentralized platforms.

Platforms such as Uniswap have continuously achieved monthly trading volumes exceeding 100 billion US dollars, which means that more prices are formed from the AMM curve and RFQ auction mechanism rather than custodial order books.

Despite Ignas’s observations at the beginning of the year, decentralized exchanges continue to attract investors.This growth has reshaped how markets work,Changed the ownership of pricing power, risk taking and liquidity orientation.

When DEX continues to achieve monthly trading volumes exceeding 100 billion US dollars, index construction, market making models and oracle machine designs will all tilt towards DEX liquidity sources, eventually forming a transparent and programmable market that integrates custody and execution into a wallet.

Liquidity, pricing and risk management are moving to smart contracts and solver networks, regulators, index compilers and market makersAre treating on-chain venues as core information sources rather than supplementary channels.

Maintaining exit liquidity channels through centralized exchanges remains critical to the health of the market, providing an outlet for position liquidation and fund rotation.

This two-tier structure allows prices to form on a decentralized track while retaining deep exit channels for large-scale instant liquidity demanders.