Author: PAUL VERADITTAKIT, partner at Pantera Capital; compiled by AIMan@Bitchain Vision

Last week was a wonderful week in the cryptocurrency world!We saw Coinbase joining the S&P 500, Galaxy Digital moved to Nasdaq, and eToro completed its IPO.The market value of stablecoins has reached US$230 billion, and the price of Bitcoin has also exceeded US$100,000 again.

In addition, JPMorgan Chase used Pantera portfolio companies Ondo Finance and Chainlink to complete its first transaction on the public chain.I also want to share some of the great moments I attended Milken, Token2049, Medici and Consensus 2025 conferences.

We are at a turning point, and we are optimistic about the future – let’s work together.

Cryptocurrency IPO: A new era is unfolding

As I wrote before, cryptocurrency IPOs are leading the market to a new era of maturity.This week, eToro went public on Nasdaq on May 14, 2025, with an issue price of $52, and its market value soared to about $5.6 billion.Previously, Circle, FOLD and Amber Premium all filed IPO applications in the past two months.

Another growing trend is the publicly traded digital asset reserve companies.Pantera has been at the forefront, making large investments in two leading companies in the field.One of them is that we invested in DeFi Development Corp (DFDV, formerly JNVR), the first Solana financial company to be listed in the United States, and we are closely involved in guiding their strategies.DFDV shares have risen more than 22 times since our announcement of investment in April 2025.Another is our investment in Twenty One Capital (dba Cantor Equity Partners or CEP), a Bitcoin reserve company founded by Tether, SoftBank and Cantor.CEP is now the second largest digital asset reserve company after MSTR.CEP is one of our company’s largest investments and its share price has risen more than 3 times since our announcement.

During the conference, the focus of people’s hot discussion was on how these IPOs indicate that cryptocurrencies are integrating into mainstream finance.IPO channels are heating up, which not only provides liquidity, but also enhances consumer protection and attracts institutional capital.

Stablecoin: The next trillion dollar opportunity

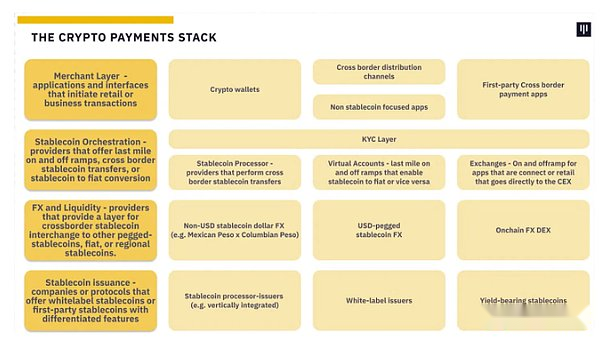

Stablecoins are currently the pioneering force in the cryptocurrency field.Its market capitalization is approximately $230 billion, mainly guaranteed by U.S. Treasury bonds 1:1.They represent the best way for blockchain technology to empower the global financial track, delivering US dollars to the hands of 5 billion smartphone users around the world.

At the end of last year, we published a comprehensive stablecoin article (see previous report by Bitchain Vision”Trillion dollar stablecoin market – stack and future opportunities”), highlighting the use cases, opportunities and payment stacks we are investing in and tracking.

Bitcoin breaks $100,000 again

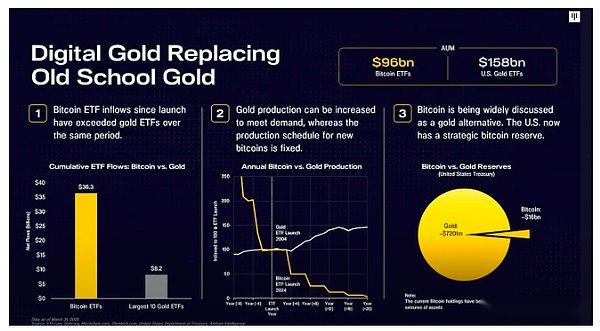

Bitcoin once again broke through the $100,000 mark.Digital gold remains strong as a store of value and is expected to surpass gold.At Token2049, Dan Morehead shared his views on Bitcoin’s decades of development and other opportunities in the market.

He believes that digital gold is replacing traditional gold, and the reasons include: 1. The inflow of funds from Bitcoin ETFs since its launch exceeded that of gold ETFs during the same period; 2. Gold production can be increased to meet demand, while Bitcoin’s new production plan is fixed; 3. Bitcoin is widely discussed as a gold alternative.The United States now has strategic Bitcoin reserves.