Author: 0xTodd; Source: X, @0x_Todd

The core of Crypto is to disenchant finance.

At first, everyone thought that coins were rare, and then one-click coin issuance was born. Later, everyone felt that chains were rare, and then one-click chain wasting was born. Then, everyone thought that it would be awesome only if it was listed, and then DEX was born. Then, everyone thought that it was useless if you didn’t have a market maker, and then AMM was born. Then, everyone felt that contracts are the moat of CEX, and then on-chain perp was born.

Crypto has been arguing that finance is a tool, egalitarian and permissionless.

In the past, only financial giants could control the financial operations of those high-profile listing bells, equity pledges, and futures delivery seen on TV. Now, it is not difficult for ordinary people to achieve it even with a little effort on the chain.

Except for surging liquidity from retail investors, which remains the prerogative of top exchanges, there are basically cheap, permissionless alternatives.

For example, HyperLiquid starts with three HIPs:

-

HIP-1 defines what a token is;

-

HIP-2 defines how early tokens are traded;

-

HIP-3 defines how to issue perpetual contracts.

These three HIPs created an on-chain perp, causing CEX bosses to hold meetings every day to figure out how to deal with it.

It feels a bit like Go. It defines two rules: “a straight line adjacent to an empty point is qi” and “you will die when you run out of qi”. This game can be played for two thousand years.

Of course,Actually issuing a perpetual contract is not that simple. It relies heavily on a key infrastructure – oracles (like RedStone).

The biggest difference between perpetual and spot is that perpetual relies on spot to provide a benchmark price to exist.

For example,Many people don’t understand the arrangement of Binance Alpha + day1 perp on some coins. Why do they have to go to Alpha if they can get day1 perp?

Because the perpetual contract is essentially a bet on the future price of the spot.It’s like if you participate in betting on football, you can only bet after someone else has played.If people don’t play, it’s useless no matter how deep the handicap is.PS: The handicap in betting is actually the perpetual contract rate.

The oracles of traditional CEX are all run by themselves. For example, the contract of a certain token in Binance may be the weighted average of the prices from several other exchanges (binance, coinbase, okx, bybit kraken, etc.) after excluding abnormalities.

In the past, CEX was often criticized on the grounds of inserting pins.In fact, everyone’s real target of attack is CEX’s private internal oracle..Therefore, on-chain perp must be very cautious about oracles, after all, it is a challenger to CEX.

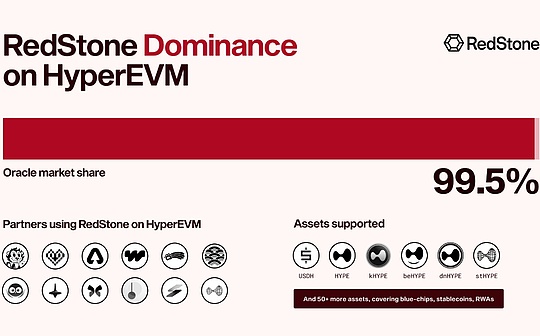

Therefore, RedStone has launched an oracle specifically for HyperLiquid that complies with the HIP-3 (Permissionless Perpetual Contract) standard.

For example, its price algorithm must withstand torture. After all, when people lose money, they will come to question the oracle machine.For another example, it needs to be fast enough. If it is too slow, it will not be able to provide a sustainable price feed.

According to RedStone, it currently occupies 99.5% of the market share of the entire HyperEVM ecosystem.

Later, if HIP-3 is really fully implemented, there will be no need to review the perpetual contract, and the era of two perpetual contracts per capita will come (this time may not be too late).

The oracle will undoubtedly earn a pretty good cash flow, after all, every price feed brings an income.Both the long and short parties win and lose from time to time, only on-chain perp and oracle machines are always pumping.